Follow the latest updates on E-Invoicing and Real Time Reporting on www.vatupdate.com and the LinkedIn pages on E-Invoicing/Real Time Reporting and ViDA.

Highlights of week 13 & 14/2024

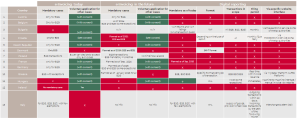

- EU e-invoicing and e-reporting overview

- The implementation of mandatory e-invoicing for B2B transactions is increasingly gaining relevance in different jurisdictions around the world, especially in Europe. For this reason, an overview of the current developments around e-invoicing and e-reporting obligations in the European Union and other European countries has been prepared. This overview is useful to both tax advisors and companies dealing with e-invoicing requirements and upcoming implementations across different jurisdictions.

- France implemented Decree No. 2024-266: Electronic Invoicing and Transaction Data Transmission for VAT Taxpayers

- Decree No. 2024-266 aims to implement electronic invoicing in transactions between VAT taxpayers and the transmission of transaction data.

- The decree applies to VAT taxpayers, public entities, dematerialization platform operators, the Agency for Financial IT, and the Directorate General of Public Finance.

- It amends Annex II to the General Tax Code and Decree No. 2022-1299 of October 7, 2022, related to electronic invoicing between VAT taxpayers.

- The decree introduces a transitional regime for the registration of dematerialization platform operators, allowing registration before the testing environment of the public invoicing portal becomes available.

- The decree adjusts the timeline and provisions regarding electronic invoicing and transmission of transaction data based on changes in relevant legislation and extends the use f electronic identification guarantee levels for partner dematerialization platform operators.

- Germany – E-Invoicing Law published

- On March 27, 2024, the Act to Strengthen Growth Opportunities, Investment and Innovation as well as Tax Simplification and Tax Fairness (Growth Opportunities Act) which includes the implementation of the B2B E-Invoicing Law has been published.

- Norway – New Financial SAF-T schema (version 1.3)

- The schemas for the Norwegian Financial SAF-T have been updated to version 1.30 and are accessible here. Effective January 2025, compliance with the new schema version will be mandatory. Until then, entities are permitted to continue using the previous version, 1.2.

- Poland

- KSeF Update: New Implementation Date Announcement Expected Soon: New date for implementation of national e-invoicing system (KSeF) in Poland will be announced in late April or early May. Four draft regulations to be presented at the end of April.

- Consultations open for the draft amendment to the KSeF obligation: The Polish government has released a draft amendment to the mandatory National e-invoicing system, with a public consultation open until April 19, 2024. The proposed changes include the postponement of the second stage of electronic handling of cases regarding binding rate information, excise information, information on origin, and tariff information. Additionally, the obligation to integrate cash registers with payment terminals may be eliminated. Interested parties are encouraged to submit comments and opinions to the MoF by the specified deadline.

- Saudi Arabia announces 10th wave of Phase 2 e-invoicing integration

- Saudi Arabia’s Zakat, Tax and Customs Authority has announced the criteria for taxpayers to be included in the 10th wave of Phase 2 e-invoicing integration.

- Taxpayers resident in Saudi Arabia with a taxable turnover exceeding SAR25m during calendar year 2022 or 2023 should comply with the Phase 2 e-invoicing requirements that are effective from 1 October 2024.

- Slovakia

- Draft 2024 National Reform Programme: Advancing Towards E-faktúra and Digital VAT Implementation

Upcoming events

- ecosio webinar – E-invoicing is becoming mandatory in Germany – What you need to know (April 11)

- Webinar European Commission – Impact of the EU eInvoicing Directive and the future of electronic invoicing (April 17)

- RTC Webinar – Exploring Malaysia e-Invoicing: Compliance, Implementation, and Technical Aspects (April 17)

- Event: E-Invoicing Exchange Summit in Miami – April 22-24, 2024

BELGIUM

- 5 essential actions for navigating Belgium’s e-invoicing mandate

- 2026: Mandatory Structured e-Invoicing for B2B Transactions in Belgium

BULGARIA

COLOMBIA

- Clarification on Obligation to Issue Electronic Invoices in Colombian Pesos by DIAN Concept 1509

- Colombia Cracks Down on VAT Non-Compliance Using Invoice Data – International Update

EUROPEAN UNION

- Future of eInvoicing: European Commission Webinar on 17 April 2024

- EN 16931 Standards & Country-Specific Mandates for Digital Cross-Border Transactions

- Streamlining Cross-Border Trade: EU Directive EN 16931 for Standardised E-Invoicing Compliance

- Demystifying EU E-Invoicing: A Complete Guide to Compliance and Implementation

- Timeline of B2B E-Invoicing & E-Reporting mandates in the European Union

- EU e-invoicing and e-reporting overview

EUROPEAN UNIONWEBINARS / EVENTS

FRANCE

- French E-invoicing Decree Enacted

- Extended timeline for medium-sized taxpayers and updates for Partner Dematerialization Platforms (PDPs)

- France Delays Compliance Date for Micro and Medium Taxpayers

- France’s New Decree: Changes to e-Invoicing Provider Registration Timeline and Mandate Implementation

- Decree No. 2024-266: Implementation of Electronic Invoicing and Transaction Data Transmission for VAT Taxpayers

- France Delays Implementation of E-Invoicing Regime to 2026, Small Businesses Get Extra Year

- France e-invoicing & e-reporting Sept 2026: new technical decree

GERMANY

- E-Invoicing Law published

- Germany to Implement E-Invoicing Requirement from 1 January 2025: What You Need to Know

- German “Growth Opportunities Act” approved, paving the way for e-invoicing in Germany

- New Rules Mandate E-Invoices for B2B Transactions in Germany from 2025

- Germany adopts e-invoicing mandate

- German B2B Status and Recent Updates

- Demystifying ZUGFeRD: A Guide to Germany’s Revolutionary E-Invoicing System

- Germany’s Mandatory E-Invoicing: Implementation Timeline and Buyer Consent Changes

- The Bundesrat Specifies Its Requirements for the Introduction of a Mandatory E-Invoice In Germany

- E-invoicing in Germany: B2B mandate timeline for implementation

- Germany: Current Status of B2B E-Invoicing

- How e-invoicing becomes a digital driver

- E-Invoicing in Germany: Complete Guide

- Parliament Approves E-Invoicing Mandate for Businesses by 2028

- Bundesrat approves the Mediation Committee compromise on the text of the Growth Opportunities Act

- E-invoicing Obligation in Germany from 2025: Federal Council Approves Legislation

GERMANY/ WEBINARS / EVENTS

INDIA

ISRAEL

KENYA

LATVIA

LITHUANIA

MALAYSIA

- Why is Malaysia’s Integration with Global E-Invoicing Networks a Game Changer?

- Proposed Tax Changes in 2024 Bills: E-Invoicing and Labuan Business Activity Tax Amendments

- The Future of Financial Transactions: Adopting e-Invoicing in Malaysia

- E-Invoicing in Malaysia: What Are the Compliance Standards and Tax Implications?

MALAYSIA/ WEBINARS / EVENTS

NAMIBIA

NETHERLANDS

NORWAY

PAKISTAN

- Pakistan embarks on a journey to revolutionize its tax system

- e-Invoicing Changes in Pakistan: Compliance Urgency and Extension Requests

PARAGUAY

POLAND

- Consultations open for the draft amendment to the KSeF obligation

- Draft Amendments on KSeF Regulation Published

- Poland – Recent Updates and Changes in the KSeF System

- Simplified Implementation of KSeF for Taxpayers: Ministry Incorporates Feedback

- Consultation of KSeF Interface Software Specification Project

- Consultation on Mandatory e-Invoicing Law Changes in KSeF Project Begins 03.04.2024

- Proposed Changes to KSeF: Details and Timeline for Implementation by Polish Ministry of Finance

- Poland 2025 KSeF e-invoicing; April legal & interface consultations

- VAT can be deducted if Invoice are issued outside KSeF

- VAT Deduction Allowed for Invoices Outside KSeF System: Recent Tax Interpretation

- Poland Delays E-Invoicing Requirements to 2025, Introduces New Implementation Plan

- Updated Questions and Answers on KSEF after the Consultation

- KSeF more business-friendly. Changes in the system after consultation meetings

- Proposed changes to KSeF system after the consultation meetings

- Summary of Consultations and Upcoming Changes in KSeF: March 25, 2024 Meeting Highlights

- Poland’s KSeF: Proposed Changes in E-Invoicing Mandate and Public Consultation Results

- Revolutionizing B2B E-Invoicing in Poland: The 2025 Launch Timeline and Key Enhancements

- KSeF Update: New Implementation Date Announcement Expected Soon

ROMANIA

- Romania Extends E-Reporting Grace Period: New Penalties for Non-Compliance Clarified

- The E-invoicing Revolution in Romania: From Grace Period to Obligation

- E-Invoicing in Romania: Complete Guide

- Romanian e-invoicing / e-reporting – grace period extended

- Romania’s E-Invoicing Mandate: Extended Grace Period Eases Compliance Pressure

- Romania Extends E-Invoicing Fines Deadline to June 2024: Impact and Timeline

- Romania e-Invoicing Grace Period Extended

- Romania E-Invoice Generator: Mobile App for Compliance with RO e-Factura Platform

- Romania publishes a draft law extending penalty grace period for not complying with e-invoicing

- Romania B2B RO e-invoicing eFactură 2024 penalty foregiveness

- Romania Delays e-Reporting Penalties Deadline to May 31, 2024: Draft Legislation Update

- RO e-Invoice System: No non-compliance penalties until May 31, 2024

SAUDI ARABIA

- The Evolution of e-Invoicing in the Saudi Arabia (KSA): Entering Wave 10 of the Integration Phase

- KSA Determines the 10th Group Implementation

- Saudi Arabia announces 10th wave of Phase 2 e-invoicing integration

- Saudi Arabia: New Taxpayer Group Included in Phase 2 of e-Invoicing Implementation

- ZATCA publishes criteria for the upcoming tenth wave of the Integration Phase

- Saudi Arabia: Criteria for 10th Group of Taxpayers for E-Invoicing Integration Phase from October 2024

- Saudi Arabia Tax Agency Criteria for Tenth Wave E-Invoicing Integration Announcement

- Saudi Arabia announces tenth wave of Phase 2 e-invoicing implementation

- ZATCA Criteria for Selecting Taxpayers in 10th Wave of E-Invoicing Integration Phase

SLOVAKIA

SPAIN

- Spain B2B e-Invoicing and VERI FACTU

- Revolutionizing Business Transactions: A Deep Dive into Spain’s Mandatory Electronic Invoicing System

- Spain’s Mandatory Electronic Invoicing

- Spain’s Draft E-Invoicing Rules: Impact on Businesses and Deadlines for Compliance

UKRAINE

- Penalties for Non-Compliance with E-Invoicing Regulations in Ukraine

- What Are the e-Invoice Requirements in Ukraine (Full Guide)

WEBINARS / EVENTS

WORLD

- Worldwide updates on E-Invoicing/Real Time Reporting/SAF-T in March 2024

- What’s Happening in the World of e-Invoicing?

- Exploring different models for Continuous Transactions Control

- Demystifying Indirect Tax Controls: E-invoicing and Digital Reporting Terminology Explained

- The Peppol 4-corner model and the 5-corner Peppol CTC

- Updated KPMG Guide to E-Invoicing and Real-Time Reporting Trends

- E-Invoicing & E-Reporting developments in the news in week 12/2024

See also

- E-Invoicing & E-Reporting developments in the news in week 12/2024

- E-Invoicing & E-Reporting developments in the news in week 11/2024

- E-Invoicing & E-Reporting developments in the news in week 10/2024

- E-Invoicing & E-Reporting developments in the news in week 9/2024

- E-Invoicing & E-Reporting developments in the news in week 8/2024

- E-Invoicing & E-Reporting developments in the news in week 7/2024

- E-Invoicing & E-Reporting developments in the news in week 6/2024

- Worldwide Upcoming E-Invoicing mandates, implementations and changes – Chronological

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

- Join the LinkedIn Group on ”VAT in the Digital Age” (VIDA), click HERE