On December 7, 2022, it is expected that the EU Commission will publish its proposals on ”VAT in the Digital Age”. This will include proposals on

- Digital Reporting Requirements (DRRs);

- The VAT Treatment of the Platform Economy; and

- The Single VAT Registration and Import One Stop Shop (IOSS).

In a countdown towards November 16, we will publish a number of interesting facts around ”VAT in the Digital Age”. This one is on the ”Platform Economy”

Some facts

- The analysis of firm-level databases led to the identification of 1 831 digital platforms with a non-minor market presence in the EU27 or the UK, regardless of where they have their headquarters.

- A cluster of digital platforms stands out: a small group of platforms with substantial operations in all or nearly all Member States and with an annual turnover significantly above the average. The group of digital platforms with an EU27 turnover above EUR 1 billion consists of 11 operators. These platforms account for ca. 81 percent of the total revenue generated by digital platforms

in the EU27 in 2019. - The remaining market share mostly belongs to platforms with their EU27 revenue ranging from EUR 100 million to EUR 1 billion. Finally, the most numerous group (ca. 70 percent of platforms) have an annual revenue of less than EUR 1 million and account for only for ca. 0.5 percent of total revenue of the platform economy.

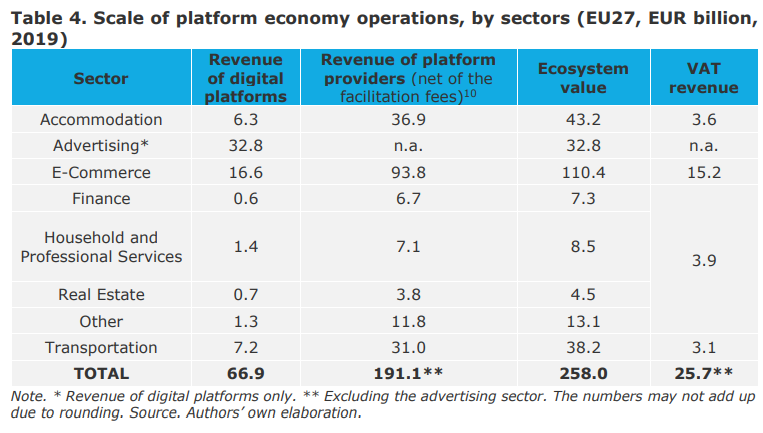

- In 2019, the turnover of digital platforms in the EU27 is estimated at EUR 67 billion. The revenue of the underlying supplies of goods and services net of the facilitation fees and excluding the advertising sector is worth about three times the platforms’ revenues, at EUR 191 billion. The sum of both platforms and providers’ revenue, that is the ecosystem value, reach EUR 258 billion. The estimated EU27 VAT revenue on the platform economy ecosystem amounts to approximately EUR 25.7 billion (2019).

- Out of the sectors analysed, the largest contribution to VAT revenue – ca. EUR 15.2 billion – comes from the e-commerce sector. This represents nearly 60 percent of VAT revenue in the platform economy excluding the advertising sector.

- The revenue from accommodation services accounts for EUR 3.6 billion, and nearly the same revenue comes from the transportation sector (ca. EUR 3.2 billion).

- The remaining VAT revenue was charged mostly to platforms and companies in the real estate and household and professional services sectors. Overall, sectors other than ecommerce, accommodation and transportation brought ca. 15 percent of VAT revenue from the platform economy.

See also in this serie

Digital Reporting Requirements

- Part 1: 13 Member States require all B2G invoices to be issued and transmitted as structured e-invoices over a specific platform

- Part 2: Implementation of DRR lead to net annual benefits of about EUR 8 billion

- Part 3: Digital Reporting Requirements – What is the problem?

- Part 4: DRR Policy options – Will it be Option 4a? Partial harmonisation. An EU DRR is introduced for intra-EU transactions

- Part 5: Types and features of the EU Digital Reporting Requirement

Platform Economy

- Part 6: Platform Economy – Types of Platforms

- Part 7: Platform Economy – Scale of the platform economy – Estimated VAT revenue from digital platforms is EUR 26 billion

- Part 8: Platform Economy – Legal issues

- Part 9: Platform Economy – What is the problem?

- Part 10: Platform Economy – Policy Options

- Part 11: Platform Economy – Comparison of Policy Options

Single VAT Registration and Import One Stop Shop (IOSS)