On December 7, 2022, it is expected that the EU Commission will publish its proposals on ”VAT in the Digital Age”. This will include proposals on

- Digital Reporting Requirements (DRRs);

- The VAT Treatment of the Platform Economy; and

- The Single VAT Registration and Import One Stop Shop (IOSS).

In a countdown towards November 16, we will publish a number of interesting facts around ”VAT in the Digital Age”. This one is on the ”Platform Economy”

Part 2 of the study on ”VAT in the Digital Age” Study focuses on the VAT treatment of the platform economy, which is the term used to describe a multi-sided model of transactions, where there are three or more parties involved.

In these transactions, the role of the online/digital platform is to facilitate the connection between two or more distinct but interdependent sets of users (whether firms or individuals, whether carrying out an economic activity or not) who interact via electronic means.

In these interactions, one of the parties to the platform offers access to or transfers assets, resources, time and/or skills, goods and/or services to the other party, in return for monetary consideration or, in certain cases, by barter/non-monetary exchanges. In most cases, these users could be named as ‘providers’ and ‘consumers’, respectively. Providers and consumers can be bothbusinesses and private individuals; platforms usually link different types of users. A platform usually charges a fee for the facilitation of the transaction.

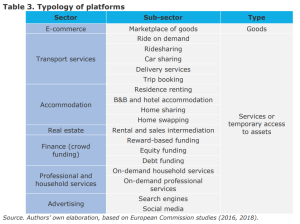

Seven sectors and 18 sub-sectors have been identified as those with a significant presence of platform-based activities. These are e-commerce, transport, accommodation, real estate, finance, professional and household services, and advertising, as shown in below Table

See also in this serie

Digital Reporting Requirements

- Part 1: 13 Member States require all B2G invoices to be issued and transmitted as structured e-invoices over a specific platform

- Part 2: Implementation of DRR lead to net annual benefits of about EUR 8 billion

- Part 3: Digital Reporting Requirements – What is the problem?

- Part 4: DRR Policy options – Will it be Option 4a? Partial harmonisation. An EU DRR is introduced for intra-EU transactions

- Part 5: Types and features of the EU Digital Reporting Requirement

Platform Economy

- Part 6: Platform Economy – Types of Platforms

- Part 7: Platform Economy – Scale of the platform economy – Estimated VAT revenue from digital platforms is EUR 26 billion

- Part 8: Platform Economy – Legal issues

- Part 9: Platform Economy – What is the problem?

- Part 10: Platform Economy – Policy Options

- Part 11: Platform Economy – Comparison of Policy Options

Single VAT Registration and Import One Stop Shop (IOSS)