What is DAC7 about?

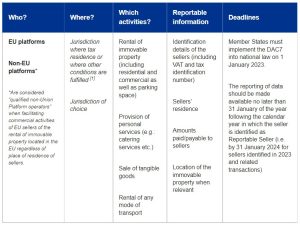

On 22 March 2021, Council Directive (EU) 2021/514 amending Directive 2011/16/EU on administrative cooperation in the field of taxation (so-called DAC7) was adopted.

This document lays down rules and procedures that digital platforms must follow and share with the tax authorities of the Member State concerned. The aim is to address “the lack of tax compliance and the under-declaration of income earned from commercial activities carried out with the intermediation of such digital platforms”.

Status of the implementation in the Member States

AUSTRIA

BELGIUM

- DAC7: FAQ regarding the obligations of operators of a digital collaboration platform

- Belgian reporting (tax) obligations for platform operators in anticipation of DAC 7 seem safe from an EU perspective

- FAQ and reporting forms published by the tax authorities to implement and clarify the DAC 7 “light” reporting obligation(s)

- DAC 7 light reporting obligation(s) introduced for digital platforms in the sharing and gig economy

- Belgium anticipates DAC 7: New Belgian reporting obligations for digital platforms facilitating the provision of services

CZECH REPUBLIC

- DAC 7: Implications of new obligations for digital platform operators

- Czech Government Approves Draft Law for Implementing DAC7

FRANCE

- Electronic platforms: The DAC 7 Directive is transposed with an effective date of 1 January 2024 for transactions carried out in 2023

- Transposition of the DAC Directive 7

GERMANY

- Which reporting obligations will be introduced for online platforms?

- MOF publishes DAC 7 draft implementation bill

- DAC7 Reporting Obligations

- Government Releases the obligations for EU Digital Platform Operators

- German Federal Ministry of Finance publishes draft DAC7 implementation bill

- Draft law on due diligence and reporting obligations for digital platform operators (DAC7)

- German Draft Law to Implement DAC7

HUNGARY

- Hungary VAT marketplace DAC 7 for Jan 2024

- Draft law: Implementation DAC 7 as of Jan 1, 2024, reciprocity with the UK on VAT refunds

IRELAND

LUXEMBOURG

- Luxembourg publishes draft tax transparency rules for digital platforms

- Automatic exchange of information for digital platform operators (DAC 7) – Luxembourg draft bill released by the Council of Ministers

- Parliament considers bill to implement EU directive on AEOI for digital platform operators

- Luxembourg Council of Ministers Approves Draft Law for DAC7

NETHERLANDS

- Note of amendment DAC7: exchange of data non-EU member states

- DAC7 tax transparency guidelines for income generated by digital platforms

- Draft Bill: Implementation Directive on Exchange of Information on Income Generated through Digital Platforms (DAC7)

- DAC7: bill on transparency about income from digital platforms has been presented to the House of Representatives

- Public consultation on on bill implementing reporting obligations for digital platforms (DAC7)

POLAND

- Reporting obligations of digital platform operators in the European Union (DAC7)

- Pre-consultation on assumptions for digital platform owners (DAC7)

- New requirements for the e-commerce market (DAC7 directive)

SLOVAKIA

SLOVENIA

SPAIN

- Improving administrative cooperation and exchange of tax information with the EU on Digital Platform Operators (DAC7)

- Council of Ministers has begun the procedures for the approval of a Draft Bill for DAC7 implementation

EUROPEAN UNION

- EU DAC 7 marketplaces’ seller transaction reporting Jan 2023 update

- Information obligation for online platforms (DAC7)

- Ready for DAC7?

- Italy Consulting on Legislative Decree for Implementing DAC7

- Platforms in the spotlight – DAC7

- DAC 7: New obligation for digital platforms to bring better overview of online trading

- European Commission Consulting on Draft Implementing Regulation for DAC7

- DAC7 adds reporting obligations for EU digital platform operators

- The DAC 7 directive and actions you should take

- DAC 7 will allow better tax control of business on digital platforms (approved)

- The DAC7 Directive and the information obligations of digital platforms from 2023

- Implementation test DAC7 data exchange between EU tax authorities

- DAC7: Tax reporting obligation for digital platforms

- EU Member States will have to implement DAC7 regulations per Jan 1, 2023

- OECD aligns more closely with the EU on reporting obligations for digital platform operators

- DAC7 & record-keeping obligations for digital platforms

- DAC7 – Reporting obligations for digital platform operators

- Amendment to the Mutual Assistance Directive (DAC7) published

- European Union Adopts Mandatory Exchange of Information for Digital Platform Operators (DAC7)

- DAC7 approved: New reporting obligations for digital platforms

- EU expands automatic exchange of information for digital platforms (DAC7)

- EU adopts tax transparency rules for digital platforms (DAC7)

- EU expands reporting obligations under DAC7 and DAC8 for the digital economy and crypto assets

- DAC7 approved: New reporting obligations for digital platforms

- Joint audits under the new DAC 7

- Council adopts new rules to strengthen administrative cooperation and include sales through digital platforms (DAC7)

- The EU Proposal for Tax Information Reporting by Sharing and Gig Economy Platforms (DAC7)

- Member States agree on new tax transparency rules on digital platforms (DAC7)

- Fair Taxation: Member States agree on new tax transparency rules on digital platforms (DAC7 & DAC8)

- DAC7 – New tax reporting obligations for digital platforms proposed from 2022

- DAC 7: online platforms, key players-to-be inthe European tax transparency framework?

WORLD

- OECD releases IT-format to support exchange of tax information on digital platforms

- Global reporting obligations for gig and sharing economy marketplaces

See also

- New VAT obligations for electronic marketplaces

- DAC7 & record-keeping obligations for digital platforms

- All other newsitems relatedto DAC7, click HERE