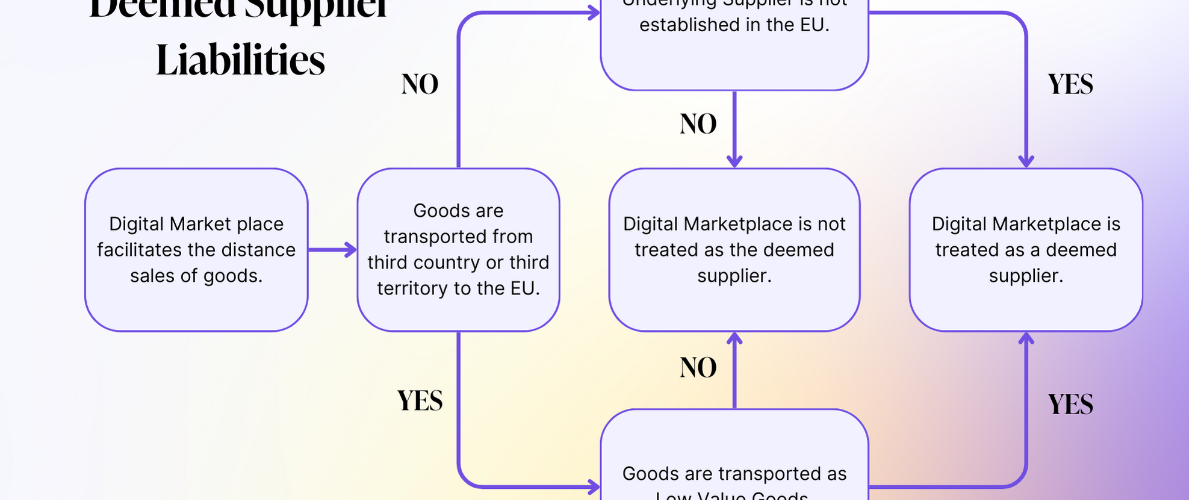

The EU E-Commerce package brought significant changes to electronic commerce transactions, including the introduction of the deemed supplier provision. This provision transfers the VAT liability from the supplier to the taxable person, who acts as the facilitator in the digital marketplace. The amendment to the EU VAT Directive requires the digital marketplace to be treated as the deemed supplier for certain types of goods, such as low-value goods imported from third countries or distance supplies of goods where the supplier is non-EU established. The E-commerce package is effective from July 1, 2021.

Source 1stopvat

Join the Linkedin Group on VAT/GST and E-Commerce HERE