Updated September 12, 2023

Highlights

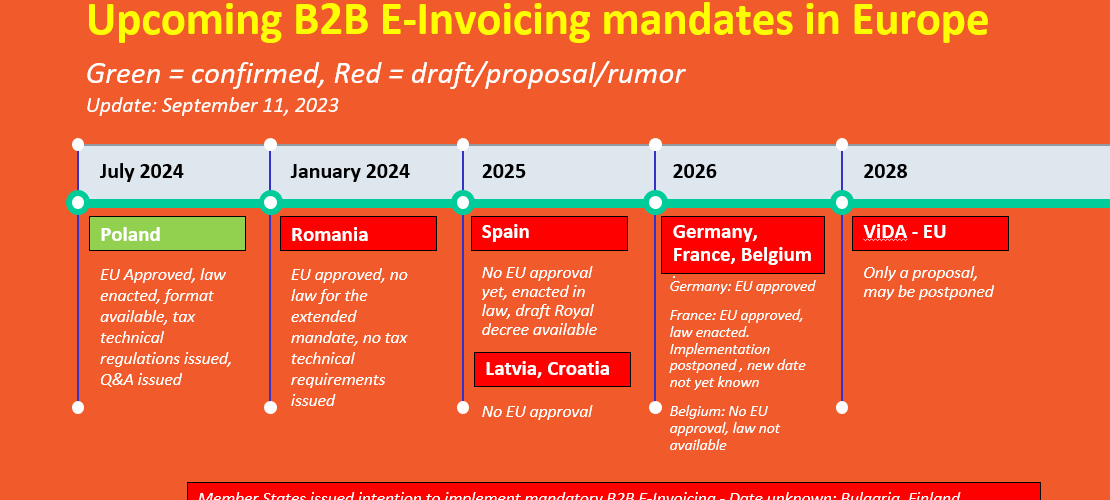

- Poland will implement mandatory E-Invoicing and Real Time Reporting per July 1, 2024

- France has postponed the mandate from July 1, 2024 to a new date still to be announced

- Romania: The regulation required to implement mandatory B2B E-Invoicing per Jan 1, 2024 has not yet been published.

- Spain was targetting to implement madatory B2B E-Invoicing as of July 1, 2024. The implementation will be delayed as the final version of the Royal Decree has not yet been published. Spain does not have the approval yet from the European Commission t implement mandatory B2B E-Invoicing.

- Germany: Implementation of B2B E-Invoicing mandate delayed till most probably Jan 1. 2026 (EDI not longer accepted as 2028)

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

- Join the LinkedIn Group on ”VAT in the Digital Age” (VIDA), click HERE

Country updates

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

See also

- Worldwide Upcoming E-Invoicing mandates, implementations and changes – Chronological

- Upcoming E-Invoicing & E-Reporting mandates in the European Union (incl. ViDA)

Latest Posts in "European Union"

- ECJ VAT C-409/24 to C-411/24 – Judgment – Reduced VAT Rate Excludes Non-Accommodation Ancillary Services

- ECJ C-436/24 (Lyko Operations) – Judgment – Loyalty Points in Customer Reward Schemes Are Not VAT Vouchers

- ECJ C-472/24 (Žaidimų valiuta) – Judgment – VAT Exemption Denied for Virtual Money Transactions

- ECG T-96/26 (TellusTax Advisory) – Questions – VAT deductions in the event of different VAT treatment between Member States

- VIDA Measures applicable from 1 January 2027