On December 7, 2022, it is expected that the EU Commission will publish its proposals on ”VAT in the Digital Age”. This will include proposals on

- Digital Reporting Requirements (DRRs);

- The VAT Treatment of the Platform Economy; and

- The Single VAT Registration and Import One Stop Shop (IOSS).

In a countdown towards November 16, we will publish a number of interesting facts around ”VAT in the Digital Age”. This one is on the ”Platform Economy”

For more info see Link– Page 23 – 26

See also in this serie

Digital Reporting Requirements

- Part 1: 13 Member States require all B2G invoices to be issued and transmitted as structured e-invoices over a specific platform

- Part 2: Implementation of DRR lead to net annual benefits of about EUR 8 billion

- Part 3: Digital Reporting Requirements – What is the problem?

- Part 4: DRR Policy options – Will it be Option 4a? Partial harmonisation. An EU DRR is introduced for intra-EU transactions

- Part 5: Types and features of the EU Digital Reporting Requirement

Platform Economy

- Part 6: Platform Economy – Types of Platforms

- Part 7: Platform Economy – Scale of the platform economy – Estimated VAT revenue from digital platforms is EUR 26 billion

- Part 8: Platform Economy – Legal issues

- Part 9: Platform Economy – What is the problem?

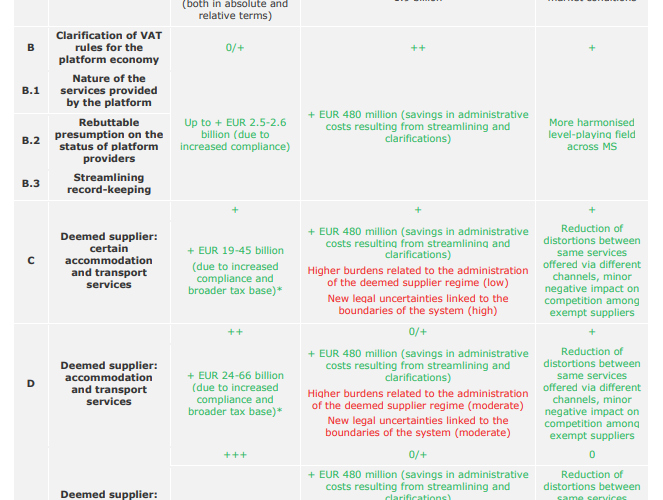

- Part 10: Platform Economy – Policy Options

- Part 11: Platform Economy – Comparison of Policy Options

Single VAT Registration and Import One Stop Shop (IOSS)

- Part 12: Single EU VAT registration & IOSS – Current situation

- Part 13: Single EU VAT registration & IOSS – Problem definition

- Part 14: Single EU VAT registration & IOSS – Policy options

Latest Posts in "European Union"

- ECG T-96/26 (TellusTax Advisory) – Questions – VAT deductions in the event of different VAT treatment between Member States

- VIDA Measures applicable from 1 January 2027

- Agenda of the ECJ/General Court VAT cases – 7 Judgments and 2 Hearings till March 25, 2026

- Comments on T-638/24: Double dip alert – an incorrect invoice can create multiple VAT liabilities

- VAT IOSS Scheme: Intermediary Registration Available from April 2026 for Non-EU Businesses