See WP 1046 – Case C-235-18 Vega International – Fuel cards – Follow-up

On October 21, 2022, the EU Commission Services continued the discussion on the on issues arising from the ruling ofthe Court of Justice of the European Union (CJEU) in case C-235/18 Vega International. This follows on discussions in and a document issued by the VAT Expert Group. The latter presented the document to and discussed by the VAT Committee.

Conclusion of the EU Commission Services as regards the VAT treatment of the supplies of fuel cards:

- As decided by the CJEU, in order to determine the character of a supply in the case of transactions relating to supply of fuel through the use of fuel cards, it is necessary to consider to whom the right to dispose of the fuel as owner is transferred.

- If it can be established that the said right to dispose of the fuel as owner is transferred to the issuer or supplier of a fuel card, the latter may be considered as supplying the goods concerned (fuel).

- Such a transfer of the right to dispose of the fuel as owner does not seem to take place under the buy/sell model for the supply of fuel cards, as described by the VAT Expert Group in its presentation made to the VAT Committee at its 120th meeting.

- Where fuel cards constitute a mere instrument to structure the fuel supply under a purchase or sales commissionaire contract, whereby the commissionaire acts in its own name but on behalf of a principal, supplies received and delivered by the commissionaire, in principle, should qualify as a supply of goods (fuel).

What is the problem?

LEGAL CERTAINTY – Commercial Practice vs Agreed Legal Set-up

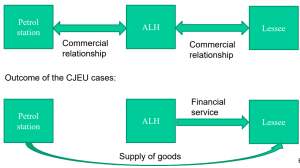

(Example from the Auto Lease Holland (ALH) Case – C-185/01)

Discussion in the document on buy/sell vs. commissionaie model

- Buy/sell model:

- The fuel card issuer does not seem to dispose of the fuel as if it were the owner at any time. The fuel seems rather to be purchased by the fuel card users at their discretion directly from the mineral oil companies. The contractual arrangements between the mineral oil companies, fuel card issuers and the fuel card users, do not change this assessment. As pointed out by the CJEU, the concept of a “supply of goods” is objective in nature and applies without regard to the purpose or results of the transactions concerned. If the fuel is not delivered to the fuel card issuer,v the latter cannot transfer it further to the fuel card user. What the fuel card issuer therefore does is to finance the purchase of fuel by the fuel card users.

- Conclusion Commission Services: the supply of fuel cards under the buy/sell model in principle constitutes a supply of financial services consisting in financing of the purchase of fuel.

- Commissionaire model:

- The transfer of goods pursuant to a contract under which commission is payable on purchase or sale, Article 14(2)(c) of the VAT Directive introduces a fiction that such transfers constitute supplies of goods. This provision implies that when a sale or purchase is effected through an intermediary acting in his own name but on behalf of the principal (his client), there will be two taxable supplies, even if the good, which is the object of the transactions is handed over directly by the first supplier to the last buyer.

- In the case of a sales commissionaire contract, from the VAT point of view, therefore the principal makes a taxable supply of fuel to the commissionaire and the commissionaire in turn makes a taxable supply of fuel to the buyer (fuel card user).

- In the case of a purchase commissionaire contract, the fuel supplier effects a taxable supply of fuel to the commissionaire and the latter makes a taxable supply of fuel to the principal (who in this case is the fuel card user).

- Therefore, under the sales and purchase commissionere contracts, whereby:

- the commissionaire acts in its own name, but on behalf of a principal and

- the commission is payable on purchase or sale,

the supplies to and from the commissionaire, who is a fuel card supplier, qualify as supplies of goods (fuel) and not services.

Link to the ECJ Case

VAT Expert Group

- On November 30, 2020, the VAT Expert Group issued a document ”Selected CJEU Cases with impacts on businesses operating in the EU Single Market”, which discusses amongst other the ECJ Case C-235/18 (Vega International)

EU VAT Committee – Working Paper 1020 discussed during the VAT Committee on November 22, 2021

- The document that the VAT Expert Group presented on November 30, 2020 was presented to the EU VAT Committee on April 19, 2021

- During its meeting on November 22, 2021, the EU VAT Committee discussed Working Paper 1020 which is related to the ECJ Case C-235/18 (Vega International)

EU VAT Committee – Working Paper 1046 discussed during the VAT Committee on October 21, 2022

- On October 21, 2022, the EU VAT Commiteee dicussed WP 1046 – Case C-235-18 Vega International – Fuel cards – Follow-up

See also