Podcast on Spotify

Follow the latest updates on E-Invoicing and Real Time Reporting on www.vatupdate.com and the LinkedIn pages on E-Invoicing/Real Time Reporting and ViDA.

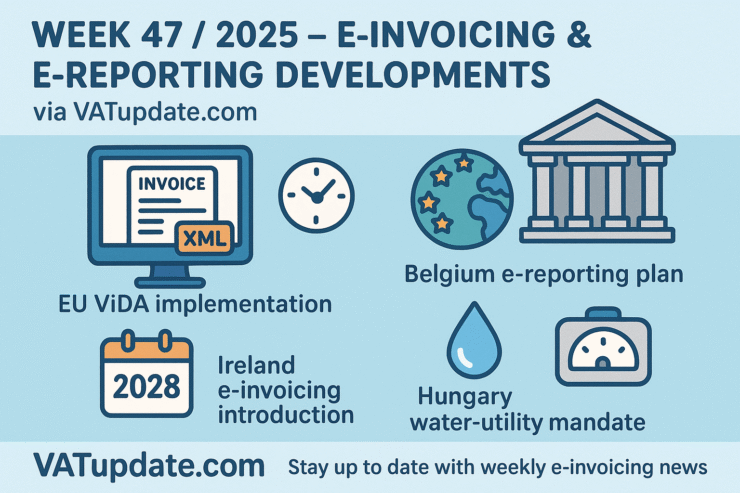

HIGHLIGHTS OF WEEKS 47/2025

NEW COLLECTION – Briefing documents & Podcasts – Country Profiles on E-Invoicing, E-Reporting, E-Transport, SAF-T Mandates, and ViDA Initiatives

- Global Shift to Digitalization: Countries are increasingly implementing electronic solutions such as e-invoicing, e-reporting, e-transport, and SAF-T mandates to enhance financial and logistical efficiency, reflecting a broader trend towards digitalization in commerce and tax compliance.

- Country-Specific Profiles: The analysis includes detailed profiles of various countries, outlining their regulatory frameworks and measures related to e-invoicing and e-reporting. The profiles are regularly updated and include insights on the implications for businesses and compliance.

- Engagement and Resources: Accompanying the country profiles is an engaging podcast available on Spotify, inviting listeners to delve deeper into the topics discussed. The initiative encourages feedback and discussions on the impact of these digital mandates on global trade and tax compliance.

- Bosnia and Herzegovina is introducing electronic invoicing (e-invoicing) to modernize business and public administration, integrating digital tools like e-signatures and certification authorities.

- A new Law on Fiscalization will establish a legal framework and a central platform for real-time transaction monitoring, though implementation deadlines are not yet set.

- E-invoicing will align with European standards, enabling automated invoice processing, reducing errors, and facilitating cross-border trade.

- Local IT companies are developing solutions to support the transition, making invoicing faster, more secure, and easier for businesses.

- The system aims to save time, reduce administrative burdens, improve transparency, and help Bosnia and Herzegovina meet EU standards, benefiting both businesses and the broader economy.

EU VAT Expert Group – Minutes of the 41th meeting – Explanatory Notes DRR discussed

- Draft Explanatory Notes on Digital Reporting Requirements: The Commission services presented the first draft of explanatory notes concerning Digital Reporting Requirements (DRR), emphasizing that it is a preliminary document requiring further refinement, including missing graphics and tables. Members of the VAT Expert Group were invited to submit comments by November 28, 2025.

- Key Areas for Discussion: Members raised several points for further discussion, including the need for clear definitions of invoicing processes, the distinction between compliant and conformant practices, guidelines for correcting invoice errors, and the need for executive summaries and visual aids in the notes. Additionally, concerns about data security, the implications of a five-day reporting requirement, and various transmission methods were addressed.

- Clarifications from the Commission: The Commission clarified that certain Member States can maintain specific practices until 2035, the EDIFACT syntax is not permitted for cross-border transactions, and there is no obligation to structure all invoice data. They assured members of the security measures in place for the central VIES database and encouraged detailed feedback to inform the ongoing development of the explanatory notes.

The EU Commission proposes new collaborative measures in view of ViDA

- The European Commission has proposed an amendment to enhance cooperation between the European Public Prosecutor’s Office (EPPO), the European Anti-Fraud Office (OLAF), and Member States, facilitating the exchange of information and access to VAT data to combat fraud against the EU’s financial interests.

- The introduction of real-time digital reporting for cross-border trade aims to provide Member States with crucial information to address VAT fraud, particularly carousel fraud, which costs EU taxpayers an estimated €12.5 billion to €32.8 billion annually.

- The proposal aims to improve communication and coordination among EPPO, OLAF, and Eurofisc, enabling efficient cross-border investigations and rapid identification of fraudulent activities, and will undergo consultation with the Council, European Parliament, and Economic and Social Committee before implementation.

France Proposes Two-Year Grace Period for E-Invoicing Penalties Starting September 2026

- Proposed Grace Period: France is considering a two-year grace period (Sept 1, 2026 – Aug 31, 2028) for businesses subject to the e-invoicing and e-reporting mandate, shielding “good faith” companies from fines.

- Scope of Exemptions: The grace period would apply to penalties under Articles 1737 and 1788D of the General Tax Code, covering e-invoice issuance, e-reporting, and obligations for dematerialization platforms.

- Pending Approval & Criteria: The amendment (No. I-1028) is part of the 2026 finance bill and awaits discussion; detailed criteria for “good faith” will be defined by a decree of the Council of State.

Polish Ministry of Finance Launches KSeF 2.0 Taxpayer App Demo for Public Testing

- On November 15, 2025, the Polish Ministry of Finance launched a demo of the KSeF 2.0 Taxpayer Application for testing before its official release on February 1, 2026.

- The demo allows users to issue, receive, and manage invoices in a simulated environment with no legal or tax consequences.

- Features include issuing and correcting invoices, searching and downloading invoices in various formats, QR code access, managing permissions, and generating tokens.

- The demo operates independently from the production environment, and real credentials are used with dummy data.

- User feedback from the demo will be used to optimize the system before the full launch.

Turkey’s E-Invoicing System: Mandatory Digital Compliance and Real-Time Reporting by 2026

- Turkey’s e-invoicing system is mandatory for most businesses, covering B2B, B2G, and many B2C transactions, with near-universal adoption expected by 2026.

- Sector-specific rules and thresholds apply, with lower limits for high-risk sectors like e-commerce, fuel, and real estate.

- Two main invoice types: e-Fatura (B2B/B2G, real-time clearance) and e-Arşiv (mainly B2C, next-day reporting), both requiring QR codes since 2023.

- Strict compliance is enforced with significant penalties for non-compliance, affecting both issuers and buyers.

- The system is fully digital, integrated with the tax authority (GİB), and includes digitalized ledgers, delivery notes, and receipts, but VAT returns must still be filed manually.

See also

Australia

- Australia’s Phased E-Invoicing via Peppol: B2G Mandate, B2B Voluntary, ATO Oversight

- Briefing document & Podcast: Australia E-Invoicing and E-Reporting

Austria

Belgium

Bosnia and Herzegovina

Chile

- Chile Clarifies VAT on Renewable Energy Accreditation Charges and Penalties for Electricity Companies

- Tax Authority Clarifies VAT Withholding Exemption for E-Invoice Issuers Not on Withholding List

- VAT Withholding Not Applicable to Electronic Invoice Issuers Outside Withholding List, SII Clarifies

Colombia

Croatia

European Union

- EU VAT Expert Group – Minutes of the 41th meeting – Explanatory Notes DRR discussed

- Group of the Future of VAT – Minutes 50th meeting – October 20, 2025

- EU Commission plans to revise rules on B2G e-invoicing

- ViDA Digital Reporting Requirements (DRR): First draft Explanatory Notes raise key technical questions

- EU E-Invoicing: Corner Models, Mandates, and the 2026 Regulatory Convergence Explained

- EU Proposes New Measures to Tackle Cross-Border VAT Fraud Ahead of ViDA Implementation

- The EU Commission proposes new collaborative measures in view of ViDA

- Timeline of Major Milestones for DRR Implementation (ViDA, 2025–2030)

France

- France Proposes Two-Year Grace Period for E-Invoicing Penalties Starting September 2026

- France’s E-Invoicing Mandate: Gwenaëlle Bernier on Digital Transformation and Tax Compliance Challenges

- France’s Mandatory E-Invoicing: 2026-2027 Deadlines, Key Requirements, and Common Misconceptions

- France Updates E-Invoicing Rules: New Specs, API, Grace Period, and Central Directory Testing

- France Proposes Two-Year Grace Period for E-Invoicing Penalties Starting September 2026

- 6 common misconceptions about e-invoicing

- Electronic invoicing – Publication of new versions of external specifications and three AFNOR standards

Germany

- Germany Updates B2B E-Invoicing Rules: Exemptions, Error Types, Validation, and Rollout Timeline

- E-Invoicing in B2B: Key Changes and Clarifications in the Latest BMF Guidance 2025

Ireland

Latvia

Macedonia

Malta

Oman

Poland

- Polish Ministry of Finance issues draft act on KSeF exemptions

- Polish Tax Office Warns Against Invoicing Outside KSeF – VAT Deduction Still Allowed

- Poland KSeF e-Invoicing: Your Essential Guide to Real-Time VAT Compliance and Automation

- Poland Mandates B2B eInvoicing and Updates VAT Returns Starting February 2026

- How Much Will Implementing Mandatory KSeF Cost for Accounting Offices?

- Poland Releases Draft Act Detailing QR Code Rules for National e-Invoicing System

- Polish Ministry of Finance published draft act on the use of KSeF

- KSeF Redefines Invoice Receipt Date: New Rules for Payment and Interest Deadlines

- Poland Launches KSeF 2.0 Pre-Production Taxpayer App for Realistic E-Invoice Testing

- New E-Invoicing System in Poland Complicates VAT Deduction Rules for Buyers

- How Are the National e-Invoicing System and JPK_CIT Related for Polish Taxpayers?

- Switching to Quarterly VAT Delays JPK_Books Submission Requirement by One Year

- Taxpayers Can Now Test the National e-Invoice System Before Its 2026 Launch

- When Must Taxpayers Submit JPK_Księgi After Losing VAT Exemption During the Year?

- Entrepreneurs and Lawmakers Raise Concerns Over Unprepared KSeF, Call for Implementation Delay

- KSeF: From Obligation to Opportunity—How Data and Technology Help Accountants Regain Work-Life Balance

- Poland Announces Major JPK_VAT Changes: E-Invoicing, Deposit Refunds, and Faster VAT Refunds

- Polish Ministry of Finance Launches KSeF 2.0 Taxpayer App Demo for Public Testing

- Payment Demands Can Be Included in the e-Invoice Footer Under KSeF Regulations

- KSeF 2026: Can Tax Regulations Change the Content of Contracts?

- What do National e-Invoicing System (KSeF) and JPK_CIT have in common

Portugal

Serbia

- Serbia Releases SEF E-Invoice System Version 3.15.0 on Demo Environment

- Serbia Mandates eConsignment and e-Delivery: New Digital Era for Goods Movement Begins 2026

Slovakia

- Slovakia Issues FAQs on Mandatory VAT E-Invoicing Effective January 2027 for B2B and B2G

- Slovakia Issues Guide on Mandatory B2B/B2G VAT E-Invoicing Effective January 2027

Slovenia

- Slovenia to Mandate E-Invoicing for All Domestic B2B Transactions from January 2028

- Slovenia to Mandate B2B e-Invoicing by January 2028 for All Domestic Businesses

- Slovenia to Require B2B E-Invoicing for All Businesses Starting January 2028

Turkey

Webinars / EventsWorld

- MDDP Seminar: Get ready for KSEeF (Nov 27)

- VAT IT eezi webinar – European E-Invoicing Spotlight: Greece, Poland, Croatia & Spain (Nov 27)

World

- How E-Invoicing Is Redefining VAT Compliance: From Sampling to Real-Time Full Visibility

- E–invoicing Developments Tracker

- E-Invoicing & E-Reporting developments in the news in week 45 & 46/2025

- E-Invoicing & E-Reporting developments in the news in week 45 & 46/2025

- NEW COLLECTION – Briefing documents & Podcasts – Country Profiles on E-Invoicing, E-Reporting, E-Transport, SAF-T Mandates, and ViDA Initiatives

- France – DGFiP e-invoicing guide: Overview of the French project on E-Invoicing and E-Reporting

- Germany – Federal Ministry of Finance updates e-invoicing FAQ

- Hungary is making e-invoicing mandatory for water supplies

- Ireland Sets Timeline for Mandatory eInvoicing and Real-Time B2B Digital Reporting from November 2028

- Malta’s 2025 ViDA Roadmap: Peppol e-Invoicing, Digital Reporting, and VAT Compliance Transformation

- Slovakia – Frequently Asked Questions About eInvoicing Obligations Effective from January 2027

- Tunisia Expands E-Invoicing to Services: New Mandate Proposed for January 2026 Implementation

- E-Invoicing & E-Reporting developments in the news in week 44/2025

- CEN Approves Revised EN 16931: A Milestone for ViDA Implementation (updated with Timeline)

- ViDA Public Debate: Summary of Implementation Dialogue with Commissioner Hoekstra (European Commission Website)

- France Proposes 2026 Budget Law Amendments to E-Invoicing and E-Reporting Mandate

- Greece – Digital Delivery Notes – Extension of Phase B Implementation and New Exemptions

- Malta’s Phased B2B E-Invoicing Strategy Ahead of EU ViDA Mandate

- Slovenia to Mandate E-Invoicing for B2B Transactions Starting January 2028

- Tunisia Proposes 2026 Finance Bill to Expand Mandatory E-Invoicing to All Goods and Services

- E-Invoicing & E-Reporting developments in the news in week 42 & 43/2025

- Denmark advances e-invoicing strategy and digital bookkeeping requirements

- Germany Issues Second Guidance on B2B E-Invoicing: Key Clarifications for Compliance and Operations

- Philippines Extends E-Invoicing Compliance Deadline to December 31, 2026 for Large Taxpayers

- Portugal Delays QES and SAF-T: 2026 Budget Impact on E-Invoicing and VAT Compliance

- Madagascar Moves to Implement Comprehensive E-Invoicing Mandate

- New Zealand mandates B2G e-invoicing for large suppliers from 2027

- E-Invoicing & E-Reporting developments in the news in week 41/2025

- Ireland’s ViDA Roadmap: Phased Rollout of E-Invoicing & Real-Time VAT Reporting

- Belgium – FAQ on E-Invoicing implementation in Belgium – UPDATED

- Angola Pushes E-Invoicing Rollout to New Year

- Madagascar Progresses Toward Implementing Mandatory Electronic Invoicing

- Portugal Adapts E-Invoicing System for VIDA 2030 Timeline

- Serbia Launches Updated E-Invoicing System with SEF 3.14.0

- Briefing document & Podcast: South Africa’s E-Invoicing and Real-Time Reporting Overhaul

- E-Invoicing & E-Reporting developments in the news in week 40/2025

- Australia Establishes E-Invoicing as Default in Federal Procurement

- Oman Tax Authority moves forward with e-invoicing implementation

- Saudi Arabia to Launch E-Invoicing Wave 24 by June 30, 2026

- Pakistan updates e-invoicing deadlines for corporate taxpayers and importers

- UAE specifies Implementation Timeline and Scope of e-invoicing obligation

- Peppol International (PINT) Specifications for the European Union – EU PINT Billing V1.0.0

- E-Invoicing & E-Reporting developments in the news in week 39/2025

- EU Commission Publishes ViDA Implementation Strategy for Digital VAT System Modernization

- Belgium – Look up Peppol status of your customers and suppliers

- France Opens E-Invoicing Directory for Upcoming B2B Electronic Billing Mandate

- Germany Introduces Language Flexibilities for E-Invoicing

- Taiwan becomes the most recent Peppol Authority

- E-Invoicing & E-Reporting developments in the news in week 36-38/2025

- Greece: Electronic invoicing in B2B transactions mandatory as of February 2, 2026

- Belgium: Discover the New Documentation on E-Invoicing: Mandatory in Belgium from January 2026

- Bolivia Extends E-Invoicing Deadline for Select Taxpayers to March 31, 2026

- Australia Announces Timeline for B2G E-Invoicing Adoption

- European Union – Briefing Document & Podcast: What is the EN 16931 E-Invoicing Standard?

- France launches access to directory for taxpayers ahead of the e-invoicing mandate

- France publishes information on simplifications and allowances regarding e-invoice obligations

- South Africa’s 5-Corner Peppol Integration to Modernize E-Invoicing and VAT Reporting by 2028

- E-Invoicing & E-Reporting developments in the news in week 34 & 35/2025

- Colombian E-Invoicing: DIAN Validation Required for UBL 2.1 Invoices Before Delivery

- Egypt Expands E-Receipt Requirements for B2C Transactions from September 2025

- France: Chorus Pro Confirmed as Official E-Invoicing Platform for French Public Sector Post-2026

- Greek Parliament Approves Mandatory B2B E-Invoicing Bill, Implementation Expected by 2027

- Hungary: NAV Online Invoice System – stricter validations from September underscore NAV’s commitment to data quality

- North Macedonia Mandates E-Invoicing with e-Faktura Project for Tax Compliance by 2026

- Poland Officially Moves Ahead with KSeF 2.0 After Presidential Signature

- South Africa Proposes New Regulations for E-Invoicing and E-Reporting in Draft Bill

- UAE PINT AE v1.0.1 Released as an Official E-Invoicing Standard for the Upcoming Mandate

- E-Invoicing & E-Reporting developments in the news in week 32 & 33/2025

- Denmark Releases Draft SAF-T 2.0 for Enhanced Tax Reporting and Data Exchange Feedback

- France publishes updated technical standards for 2026 e-invoicing mandate

- Germany Updates VAT Invoicing Rules: Mandatory B2B E-Invoicing and Shortened Retention Periods

- Ivory Coast: Mandatory Electronic Invoicing in Ivory Coast Begins September 1, 2025

- Kazakhstan: 2026 E-Invoicing Reform: VAT Must Be Prepaid Before Invoice Issuance

- Nigeria’s New E-Invoicing Platform Goes Live with Large Taxpayers Required to Onboard by 1 November 2025

- Norway to Mandate Digital Accounting and E-Invoicing for Businesses by 2030

- Poland’s Senate Approves KSeF Implementation and Tax Code Amendments, Awaits Final Sejm Approval

- Serbia Extends VAT Reporting Grace Period in SEF System Until End of 2025

- E-Invoicing & E-Reporting developments in the news in week 31/2025

- Polish Parliament Approves B2B E-Invoicing law starting February 1, 2026

- Singapore Enhances InvoiceNow with Advanced Ordering to Streamline Procurement Processes by 2025

- Slovakia Proposes Mandatory Electronic Invoicing for VAT Transactions Starting 2027, Seeks Public Feedback

- Cambodia Expands Mandatory E-Invoicing to Six Ministries Under Phases 1 and 2 by 2025

- France – Chorus Pro will remain the B2G e-invoicing framework in France

- E-Invoicing & E-Reporting developments in the news in week 30/2025

- Australia mandates e-invoicing for Commonwealth entities

- Botswana’s 2026 e-Invoicing Mandate: Key Insights and Business Preparation Guide

- Costa Rica Mandates Electronic Invoicing Format 4.4 Starting September 2025 for Tax Compliance

- EU VAT Committee Updates: Digital Assets, eInvoicing Rules, and 2025 Country Factsheets

- Greece – Mandatory Electronic Invoicing Provision and New Incentives Submitted to Parliament

- Malaysia’s Mandatory E-Invoicing Rollout: Updated Guidelines and FAQs

- Sweden Prepares for ViDA Directive with National E-Invoicing and Digital VAT Strategy Inquiry

- UK – HMRC reveals 5-point plan to make UK world’s most digitally advanced tax jurisdiction

- E-Invoicing & E-Reporting developments in the news in week 29/2025

- Belgium – Royal Decree on Structured Electronic Invoices

- France Designates DGFiP as Its National Peppol Authority Ahead of 2026 B2B E-Invoicing Mandate

- Greece – Draft Legislation On E-invoicing Mandate Submitted To Parliament

- Lithuania e-invoicing 2028 – eSaskaita

- Nigeria Implements Mandatory E-Invoicing for Large Taxpayers Starting August 2025

- E-Invoicing & E-Reporting developments in the news in week 28/2025

- Blog Post: The Urgent Need for Standardization in E-Invoicing and E-Reporting Across EU Member States

- SWISSHOLDING Meeting on E-Invoicing and International Tax Considerations

- Denmark Considers Replacing National E-Invoicing System with International Peppol Standard After Review

- Philippines to Implement Mandatory E-Invoicing for Select Taxpayers by March 2026

- Polish Parliament Advances Simplified E-Invoicing System, Reduces VAT Refund Time to 40 Days

- E-Invoicing & E-Reporting developments in the news in week 27/2025

- Norway Proposes Mandatory Digital Bookkeeping and E-invoicing

- Poland Releases Final KSeF 2.0 API Documentation and FA(3) Schema

- Qatar Modernizes Tax System with VAT and E-Invoicing for Economic Diversification

- Saudi Arabia Sets Criteria for 23rd Wave of E-Invoicing Integration Phase Under New National Requirements

- Sri Lanka to Implement E-Invoicing for VAT and Connect POS Systems to Tax Authority

- Sweden: Survey on Business Attitudes Toward E-Invoicing

- E-Invoicing & E-Reporting developments in the news in week 26/2025

- Burkina Faso Advances Electronic Invoicing: Developments and Future Outlook

- Danish Business Authority launches review of the future for OIOUBL

- Revision of the European E-Invoicing Standard EN16931

- Madagascar Advances Toward Mandatory Electronic Invoicing with 2025 Implementation Target

- Mauritius Expands E-Invoicing Mandate to Include Businesses with Turnover Over MUR 80 Million

- Netherlands – Letter to Parliament Regarding the Implementation of ViDA

- Pakistan – Further Extension of E-Invoicing Integration Deadline

- Tunisia Leads Africa in Digital Tax Administration with Pioneering E-Invoicing System “El Fatoura”

- E-Invoicing & E-Reporting developments in the news in week 25/2025

- France – B2B Electronic Invoicing: Transforming Business Operations with XP Z12-014

- Greece Postpones B2G E-Invoicing Mandate to 1 September 2025

- Ivory Coast’s Digital Tax Transformation: Mandatory E-Invoicing System Set for 2025 Implementation

- Tanzania’s 2025/26 Budget Proposes E-Invoicing Integration with Revenue Authority via EFDMS

- UAE Releases Key Technical Specifications for E-Invoicing: PASR and Supporting Documents Unveiled

- Zimbabwe Advances Digital Transformation Through New VAT Reforms

- E-Invoicing & E-Reporting developments in the news in week 24/2025

- Croatia’s Fiscalization 2.0: Mandatory E-Invoicing Reform Begins January 2026 for All Businesses

- Dominican Republic Mandates E-Invoicing for All Taxpayers by May 2026 Deadline

- France – AFNOR issued XP Z12-013 Standard: API for B2B and B2C E-Invoicing

- Malaysia Updates e-Invoicing Timeline – New Implementation Dates & Practical Guidance

- Uzbekistan – Timely Completion of Electronic Invoices Required for Goods and Services with Compliance and Penalties

- E-Invoicing & E-Reporting developments in the news in week 23/2025

- Estonia Mandates E-Invoicing for Registered Businesses Starting July 2025

- France – AFNOR issued XP Z12-013 Standard: API for B2B and B2C E-Invoicing

- Germany – Merge of the German federal Invoice platforms ZRE and OZG-RE in 2025

- Ghana Revenue Authority Extends E-VAT System for Real-Time VAT Invoice Issuance and Compliance

- Latvia Postpones B2B E-Invoicing Mandate to 2028, Encourages Voluntary Adoption from 2026

- Poland Unveils Draft KSeF 2.0 Framework for Upcoming Mandatory E-Invoicing Regulations

- Portugal – Launch Automatic VAT Returns in July 2025

- E-Invoicing & E-Reporting developments in the news in week 21/2025

- Brazil – Implementation of Alphanumeric CNPJ in Brazilian Electronic Fiscal Documents

- Brazil’s Technical Note 2025.002: Preparing for the 2026 VAT Implementation

- Bulgaria – NRA holds public consultations on draft order for SAF-T submission

- Denmark – OIOUBL 3.0 delay officially confirmed in Denmark

- Dominican Republic Extends E-Invoicing Deadline for Large and Medium Taxpayers to November 2025

- France Moves Forward with E-Invoicing: Updated Specs and Factur-X v1.07 Released

- Mozambique Implements New Monthly VAT Invoice Reporting Procedures Effective May 2025

- Turkey: e-Invoice and UBL-TR Guide Update from GİB

- E-Invoicing & E-Reporting developments in the news in week 20/2025

- E-Invoicing & E-Reporting developments in the news in week 19/2025

- European Union – VAT Committee: Minutes 126th meeting – March 21, 2025

- France – DGFiP and AFNOR drive progress on France’s B2B e-invoicing mandate

- Germany – Info package for ZUGFeRD 2.3.3 is now available for you to download free of charge

- Hungary’s 2025 E-Invoicing Law: Enhancements and Compliance Requirements

- Latvia Considers Postponing E-Invoicing Mandate

- Malaysia – SDK 1.0 Release

- Nigeria Launches New E-Invoicing Platform to Enhance Tax Compliance and Business Efficiency

- Oman Prepares for E-Invoicing Rollout

- Poland Releases New Draft of KSeF FA(3) Schema with Key Updates and Features

- South Africa – E-Invoicing Planned for 2028

- E-Invoicing & E-Reporting developments in the news in week 17/2025

- Germany Equates Peppol BIS Billing 3.0 and XRechnung for E-Invoicing with Public Authorities

- US and EU Join Forces to Improve e-Invoicing Compatibility

- The Hungarian Ministry of National Economy starts preparations for the implementation of ViDA

- Pakistan’s e-Invoicing Mandate: FBR Sets Integration Deadlines for Corporate and Non-Corporate Entities

- Vietnam – E-Invoicing Updates: Key Amendments and Implementation Timeline for 2025

- E-Invoicing & E-Reporting developments in the news in week 16/2025

- Poland: KSeF 2.0 is taking shape. What does the latest bill change?

- Future of E-Invoicing in Canada: Trends, Challenges, and Preparation for Businesses

- Chile’s E-Invoicing and New Tax Documentation Rules

- Israel advances timeline for allocation number requirements

- Morocco to implement Mandatory E-Invoicing in 2026

- Slovakia adopts Peppol Network for Decentralized E-Invoicing System

- Spain Extends E-Invoicing Deadline, Introduces New Exemption for Third-Party Invoicing Compliance

- Swedish Tax Agency Prevents SEK 534 Million VAT Fraud, Supports Mandatory E-Invoicing Measures

- E-Invoicing & E-Reporting developments in the news in week 15/2025

- Bulgaria Mandates SAF-T Reporting from 2026: A Complete Guide for Businesses

- France – Parliament rejects 1-year delay to Sept 2026 launch of B2B e-invoicing & B2C e-reporting

- Germany – Peppol BIS Billing 3.0 and XRechnung: Interchangeable Within Germany

- Greece’s e-Transport System: Key Deadline Changes and What Businesses Need to Know

- India – New GST E-Invoice Rule: Mandatory 30-Day Reporting for Businesses with Rs. 10 Crore Turnover

- E-Invoicing & E-Reporting developments in the news in week 13/2025

- European Union: ViDA – Council Directive with changes to the VAT Directive 2006/112/EC published

- France’s E-Invoicing Mandate Delayed Again: New Deadlines and Business Implications

- Malaysia Updates e-Invoice Guideline in Regard to MyInvois System Disruptions

- Saudi Arabia Announces Wave 22 of Phase 2 E-Invoicing for High-Revenue Taxpayers

- Denmark – The final release of OIOUBL 3 is postponed to October 2025

- E-Invoicing & E-Reporting developments in the news in week 12/2025

- Belgium: No obligation to receive structured electronic invoices for non-resident VAT taxpayers

- Angola’s E-Invoicing Mandate: A Phased Approach

- Philippines Mandates Cross-border E-Invoicing for Imports

- Singapore: Adopting the GST InvoiceNow Requirement: A Guide for Businesses in Singapore

- Spain Opens Public Consultation on B2B E-Invoicing Mandate

- E-Invoicing & E-Reporting developments in the news in week 11/2025

- European Union – European Council Adopted the VAT in the Digital Age (ViDA) package on March 11, 2025

- Costa Rica Clarifies Electronic Invoice Rules for Imports

- Estonia Approves Optional Mandatory E-Invoicing from July 2025

- Greece – Formal EU Approval for B2B E-Invoicing Mandate Published

- Philippines: Understanding the New e-Invoicing Regulation: Key Changes and Compliance Guide

- UAE releases service provider accreditation requirements

- E-Invoicing & E-Reporting developments in the news in week 10/2025

- Bolivia revises the digital tax document issuing deadline for taxpayer groups 9, 10, 11 and 12

- Croatia Proposes Mandatory Electronic Invoicing as of Jan 1, 2026 – DRAFT law in English

- Latvia – Mandatory B2B E-Invoicing and E-Reporting as of Jan 1, 2026

- Norway Explores Mandatory E-Invoicing for B2B Transactions

- Saudi Arabia announces 21st wave of Phase 2 e-invoicing integration

- Sweden Adopts Peppol for Customs Invoicing in 2025

- E-Invoicing & E-Reporting developments in the news in week 9/2025

- Belgium – Non-established entities may be exempt from the E-Invoicing obligation

- Bosnia and Herzegovina Holds Public Hearing on Draft E-Invoicing Law

- Croatia Proposes Mandatory Electronic Invoicing as of Jan 1, 2026

- Greece – Council of the EU approves implementation of Mandatory Electronic Invoicing for B2B Transactions in Greece

- Malaysia Updates e-Invoicing Timeline – New Implementation Dates & Interim Measures

- Nigeria’s FIRS Launches E-Invoicing Pilot for Large Taxpayers

- Slovenia Postpones Mandatory B2B E-Invoicing to 2027

- E-Invoicing & E-Reporting developments in the news in week 8/2025

- Malaysia’s Updated Timeline for e-Invoicing Implementation

- Norway Explores e-Invoicing for Businesses as a future Outlook

- Dominican Republic Offers Tax Credit for E-Invoicing Adoption

- Indonesia – E-Faktur Client Desktop: New Option for Tax Invoice Creation

- Costa Rica Extends Electronic Invoicing Deadline to September 2025

- E-Invoicing & E-Reporting developments in the news in week 7/2025

- EU Parliament Advances ViDA Reforms, Final Ratification Expected by March 2025

- UK Government Launches Consultation on e-Invoicing: A Step Toward Digital Efficiency

- Bolivia postpones deadline to comply with the e-invoicing obligation for taxpayer groups 10 and 11

- Botswana: E-invoicing solution set to transform tax compliance in Botswana by March 2026

- Brazil Introduces NFCom as a New Mandatory E-Invoicing Requirement

- Malaysia – New e-Invoice Guideline Version 4.1 and Specific Guideline Version 4.0

- E-Invoicing & E-Reporting developments in the news in week 6/2025

- Belgium will introduce near-real time reporting as of 2028

- Italy E-invoicing Schema Update: Key Changes Effective April 1, 2025

- Pakistan Implements New Electronic Invoicing Mandate for Taxpayers Effective Feb. 3, 2025

- Saudi- Arabia: ZATCA Determines Criteria for Selecting Taxpayers for 20th Wave of E-Invoicing Integration

- UAE e-Invoicing: A New Digital Era for Tax Compliance

- E-Invoicing & E-Reporting developments in the news in week 5/2025

- Bahrain’s Electronic Invoicing Initiative

- Bulgaria to Introduce Mandatory SAF-T Reporting for Tax by January 2026 with Grace Period

- Croatia to Introduce Mandatory Electronic Invoicing and Financial Reporting Tools by 2026

- Jordan Prepares Phase 2 of the JoFotara Electronic Invoicing System

- Latvia Mandates Structured E-Invoices for B2G (2025) and B2B (2026) transactions

- Norway’s Mandatory B2B e-Invoicing: Enhancing Financial Processes and Tax Compliance

- E-Invoicing & E-Reporting developments in the news in week (3 &) 4/2025

- Bosnia and Herzegovina: Mandatory E-invoice Law to Combat Tax Fraud and Improve Transparency

- Greece Granted EU Approval for Mandatory Electronic Invoicing Implementation by Jan. 15, 2025

- Greece is likely to mandate e-invoicing for B2B transactions in 2025

- Morocco Plans for Mandatory e-Invoicing by 2026

- Slovakia Proposes Mandatory B2B E-Invoicing by 2027

- E-Invoicing & E-Reporting developments in the news in week 2/2025

- Worldwide Upcoming E-Invoicing mandates, implementations and changes – Chronological

- Greenland to Implement E-Invoicing for Public Sector Starting 2025

- Estonia Sets 2027 Launch for Mandatory B2B E-Invoicing to Curb VAT Fraud

- Senegal to impose mandatory electronic invoicing

- Venezuela: SENIAT Introduces New Digital Invoicing Guidelines for Businesses

- What is the difference between Peppol BIS and Peppol PINT?

- E-Invoicing & E-Reporting developments in the news in week 1/2025

- Fiscalization/E-Invoicing Law (draft) in Federation of Bosnia and Herzegovina

- Cambodia Launches Voluntary B2G e-Invoicing, Pioneering Digital Tax Transformation

- European Parliament issues draft report on the Council’s draft directive amending ViDA

- Italy Delays Electronic Invoicing for Some Healthcare Providers

- ZATCA Sets Criteria for 19th E-Invoicing Wave in Saudi Arabia

- E-Invoicing & E-Reporting developments in the news in week 52/2024

- E-Invoicing & E-Reporting developments in the news in week 51/2024

- Australia/ New Zealand – November 2024 release of A-NZ Peppol v1.0.12 and PINT A-NZ Billing v1.1.0

- Bulgaria plans to introduce mandatory SAF-T requirement from 2026

- European Union – ViDA Initiative Drives Digitalization with E-Invoicing Pilot and Electronic VAT Certificates

- France – OpenPeppol to Act as Interim Peppol Authority for France’s e-Invoicing

- Ivory Coast – The electronic standardized invoice comes into force in January 2025

- Senegal’s Move Towards e-Invoicing: A Key Element of the 2025 Finance Bill

- E-Invoicing & E-Reporting developments in the news in week 50/2024

- Mandatory e-invoicing on the horizon in Bosnia and Herzegovina

- Brazil Updates E-Invoicing for New Indirect Tax Implementation

- France – E-Invoicing in France – FAQs – Unofficial translation in English – Electronic invoicing: the DGFIP updates its information sheets!

- India Lowers e-Invoicing Threshold: Key Changes and Compliance by April 2025

- Japan – Publication of Peppol Specifications for JP PINT Specifications

- Serbia’s National Assembly Passes Amendments to E-Invoicing Law

- E-Invoicing & E-Reporting developments in the news in week 49/2024

- China to Enable Nationwide Voluntary E-Invoicing Starting December 2024

- Denmark’s OIOUBL 3.0 e-Invoicing Standard: Key Dates and Business Implications

- Estonia Proposes Mandatory E-Invoicing for B2B Transactions Starting 2027

- Romania provides further insight into upcoming B2C invoicing requirements

- Uruguay Sets December Deadline for VAT Payers to Adopt E-Invoicing

- E-Invoicing & E-Reporting developments in the news in week 48/2024

- E-Invoicing & E-Reporting developments in the news in week 47/2024

- E-Invoicing & E-Reporting developments in the news in week 46/2024

- E-Invoicing & E-Reporting developments in the news in week 45/2024

- E-Invoicing & E-Reporting developments in the news in week 44/2024

- E-Invoicing & E-Reporting developments in the news in week 43/2024

- E-Invoicing & E-Reporting developments in the news in week 42/2024

- E-Invoicing & E-Reporting developments in the news in week 41/2024

- E-Invoicing & E-Reporting developments in the news in week 40/2024

- E-Invoicing & E-Reporting developments in the news in week 39/2024

- E-Invoicing & E-Reporting developments in the news in week 38/2024

- E-Invoicing & E-Reporting developments in the news in week 37/2024

- E-Invoicing & E-Reporting developments in the news in week 36/2024

- E-Invoicing & E-Reporting developments in the news in week 35/2024

Latest Posts in "World"

- Global VAT, GST, and Sales Tax Changes Effective January 2026: Key Updates and New Implementations

- E–invoicing Developments Tracker

- The Essential Guide to e-Invoicing for Tax Professionals

- VATupdate Newsletter Week 50 2025

- Unifying Disconnected Invoice Processes: How Invoice Lifecycle Management Transforms AP Efficiency and Compliance