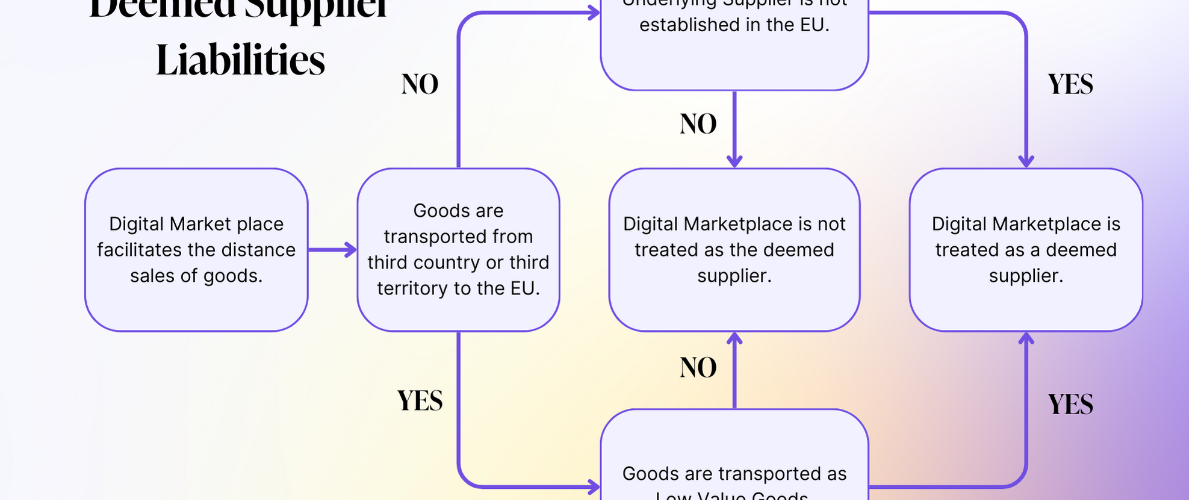

The EU E-Commerce package brought significant changes to electronic commerce transactions, including the introduction of the deemed supplier provision. This provision transfers the VAT liability from the supplier to the taxable person, who acts as the facilitator in the digital marketplace. The amendment to the EU VAT Directive requires the digital marketplace to be treated as the deemed supplier for certain types of goods, such as low-value goods imported from third countries or distance supplies of goods where the supplier is non-EU established. The E-commerce package is effective from July 1, 2021.

Source 1stopvat

Join the Linkedin Group on VAT/GST and E-Commerce HERE

Latest Posts in "European Union"

- From Accounting Entry to Taxable Event: The Acromet Case and VAT-TP Implications

- DG TAXUD Extends ICS2 Road and Rail Transport Deadline to December 31, 2025

- Potential VAT Changes for Travel Businesses: UK and EU TOMS Reforms, New Platform Rules

- EU Report Highlights Need for Enhanced Customs Controls Amid E-Commerce Growth and Non-Compliance

- Recent ECJ/General Court VAT Jurisprudence and Implications for EU Compliance (Jul–Aug 2025)