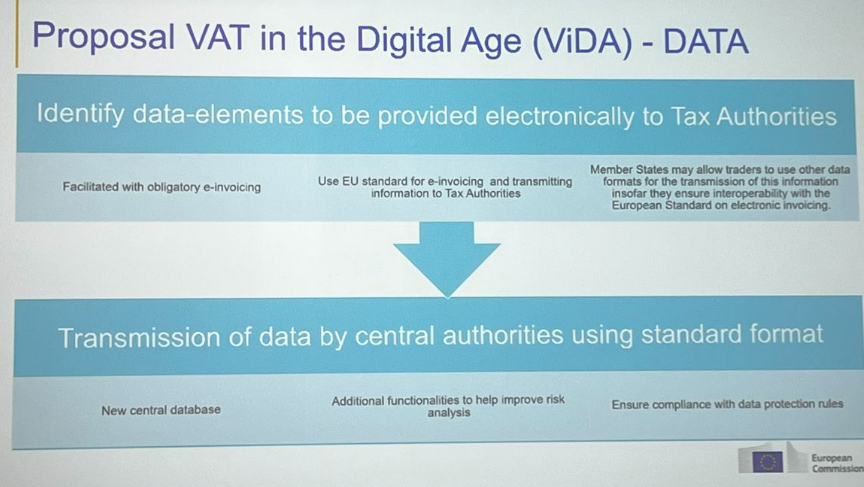

ViDA will clearly identify the data-elements to be provided electronically to Tax Authorities

– Facilitated with obligatory e-invoicing

– Use EU standard for -invoicing and transmitting information to Tax Authorities

– Member States may allow traders to use other data formats for the transmission of this information insofar they ensure interoperability with the European standard

The Transmission of data to the central authorities (EU level) using a standard format

– New central database

– Additional functionalities to help improve risk analysis

– Ensure compliance with data protection rules

Source Axel Baulf

Latest Posts in "European Union"

- EU’s ViDA in Motion: How EU Member States Are Preparing for implementing Digital Reporting Requirements (DRR)

- EU Court Rules Triangulation VAT Simplification Inapplicable to Multi-Party Drop Shipments Involving Fraud

- EU Commission Seeks Feedback on Revising E-Invoicing Rules for Public Procurement

- CBAM from 2026: New TARIC Codes Mandatory for Import – No Correct Coding, No Import Approval

- Navigating VAT Exemptions: Recent ECJ Judgments and Their Implications for Intra-Community Transactions and Imports