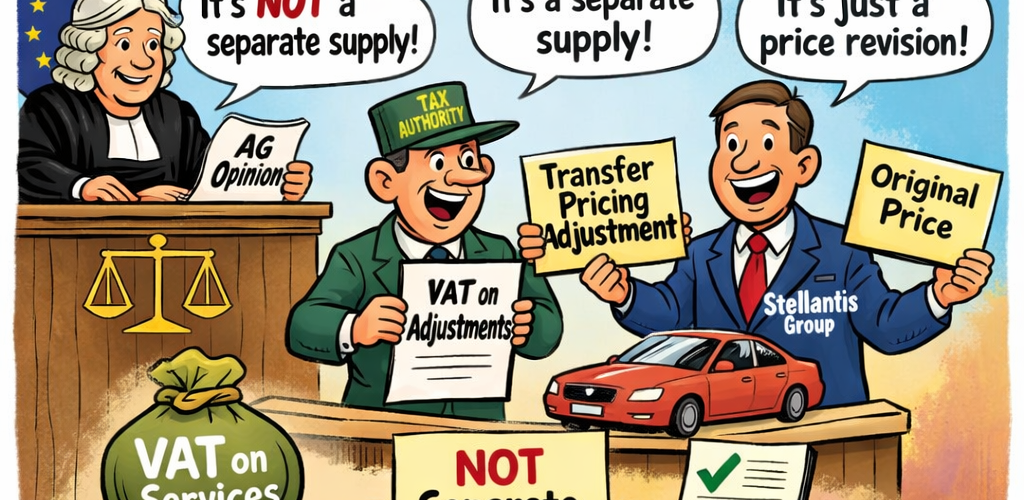

- Advocate General Kokott’s opinion in Stellantis Portugal (C-603/24) addresses the tension between VAT treatment and transfer pricing adjustments within groups, especially after the Arcomet Towercranes (C-726/23) case.

- In Arcomet, the Court ruled that transfer pricing adjustments related to services provided within a group could be considered taxable services, but left key underlying questions unresolved.

- Kokott argues that not every transfer pricing adjustment (true-up) constitutes a service for VAT purposes; it depends on whether the adjustment is merely a price change for a previous supply or a payment for a new service.

- The distinction is crucial: if only the consideration for a previous supply is changed, it falls under VAT rules for price adjustments, not as a separate service.

- The core issue is whether a transfer pricing correction is linked to a specific supply or service, or if it falls outside the scope of VAT altogether.

Source: vat-consult.be

Click on the logo to visit the website

AG opines on VAT treatment of transfer pricing adjustments to intragroup supplies

- Advocate-General Kokott issued her opinion on January 15, 2026, in the Stellantis Portugal case, concluding that transfer pricing adjustments related to intragroup sales do not constitute a separate supply of services under VAT law.

- The opinion challenges the Portuguese tax authorities’ stance, stating that price adjustments based on actual costs incurred do not create VAT liabilities, as they merely reflect modifications to the sale price rather than a service rendered.

- The AG’s analysis emphasizes the need to differentiate between VAT and transfer pricing principles, suggesting that the CJEU’s forthcoming decision may clarify how such adjustments should be treated for VAT purposes, impacting future intercompany transactions.

Source Deloitte

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

Latest Posts in "European Union"

- Agenda of the ECJ/General Court VAT cases – 6 Judgments and 2 Hearings till March 25, 2026

- EGC T-184/25 (Veronsaajien oikeudenvalvontayksikkö) – AG Opinion – VAT Exemptions for Credit Management: No Exemption for Former Lenders

- EGC T-638/24 (D GmbH) – Judgment – VAT on Intra-Community Acquisitions Not Precluded by Errors

- EGC T-575/24 (Digipolis) – Judgment – Public Law body Held Liable for VAT on Telecommunication Services Provided

- EU Tax Symposium 2026 (March 16-17)