Introduction

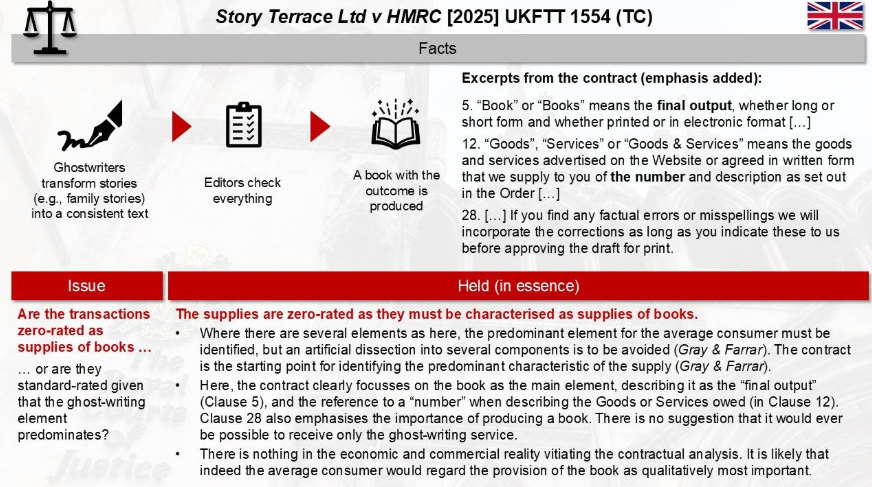

In late 2025, Story Terrace Ltd, a UK-based company that creates personalised autobiographical books, won a significant victory against HM Revenue & Customs (HMRC) in a dispute over the VAT treatment of its services. The case—Story Terrace Ltd v HMRC [2025] UKFTT 1554 (TC)—centered on whether the company was supplying zero‑rated physical books or providing a standard‑rated ghostwriting service. The First‑tier Tribunal (FTT) ultimately ruled in favour of Story Terrace, setting a meaningful precedent for businesses that convert personalised services into tangible products.

This article outlines the background, arguments, tribunal reasoning, and implications of the decision.

Background: Who Are Story Terrace?

Story Terrace specialises in producing bespoke autobiographical books. Clients are interviewed by professional writers, who create a manuscript that is then edited, designed, and printed as a high‑quality hardback book. The business model focuses on a tangible end product—a physical, shareable biography for families and future generations. [accountingweb.co.uk]

The company’s mission is “to turn one million life stories into books by 2028,” driven by founder Rutger Bruining’s desire to preserve family histories. [accountingweb.co.uk]

HMRC’s Position: A Ghostwriting Service

HMRC argued that Story Terrace was not supplying zero‑rated books but instead delivering a predominantly personalised ghostwriting service, which should be standard‑rated for VAT. Their position relied on several points:

- The product involved extensive services such as interviews, writing, research, and editing.

- The printed book was merely an output of these personalised services.

- Cost data showed that writers accounted for a major share of the price paid by customers.

- Pricing and commentary from the company’s appearance on Dragon’s Den emphasized service components over the book itself.

HMRC also pointed to VAT Notice 701/10, which suggests that bespoke or “specialist” items may not fall within zero‑rating. [accountingweb.co.uk]

Story Terrace’s Position: A Zero‑Rated Physical Book

Story Terrace accepted that its offering constituted a single supply, but argued that the predominant element purchased by the customer was a physical book, making the supply zero‑rated under Item 1, Group 3, Schedule 8 VATA 1994, which zero‑rates books.

Key arguments included:

- Consumers ultimately want a physical, printed book, not a writing service.

- Marketing, terms and conditions, and customer communications all emphasised the finished book.

- Ghostwriting could not be purchased separately.

- Personalisation alone does not change VAT classification—e.g., personalised photo books are still zero‑rated.

The company stressed the “economic and commercial reality”: customers expected a tangible book they could share and preserve. [accountingweb.co.uk]

The Claritax summary of the decision confirms that the tribunal agreed the typical consumer views the book as “qualitatively the most important element.” [claritaxnews.com]

The Tribunal’s Analysis

The tribunal applied the predominance test, asking:

What does the typical consumer think they are acquiring?

It made several key findings:

1. A Single Supply Exists

Both parties agreed that the transaction was a single supply, simplifying the analysis. [accountingweb.co.uk]

2. The Book Is the Predominant Element

The tribunal concluded that:

- The book—not the writing process—is the main element from the consumer’s viewpoint.

- The physical product represents the “economic purpose” of the contract.

- Customisation does not automatically remove zero‑rating (consistent with EU and UK case law).

As described in Claritax, the tribunal held that customers want a book “to be shared and enjoyed in its physical form,” making it the predominant element. [claritaxnews.com]

3. HMRC’s Focus on Services Was Too Narrow

The tribunal rejected HMRC’s attempt to break the process into components, citing previous case law cautioning against this type of dissection. [accountingweb.co.uk]

Outcome of the Case

The FTT upheld Story Terrace’s appeal, ruling that the supply should be treated as the production of zero‑rated books, not standard‑rated ghostwriting services. [vlex.co.uk]

This ruling reversed HMRC’s earlier VAT liability decision from 2023 and was seen as a notable defeat for HMRC in interpreting the VAT treatment of mixed supplies involving customised goods.

Implications of the Decision

1. Clarity for Businesses Combining Services and Goods

Companies offering bespoke products—such as custom books, art, or personalised memorabilia—gain stronger footing to argue that the physical product predominates, even if substantial creative services are involved.

2. Limits on HMRC’s Use of Cost Breakdown

The tribunal signaled that value to the consumer, not internal cost structures, drives VAT classification.

3. Reinforces “Typical Consumer” Test

The case strengthens jurisprudence focusing on the consumer’s perception rather than the supplier’s internal processes.

4. Potential Wider Application

Industries such as personalised publishing, digital‑to‑physical goods, and family history services may use this decision to challenge HMRC assessments.

Conclusion

The Story Terrace case marks a significant development in VAT law relating to composite supplies that combine bespoke services with the production of a physical good. By emphasising the consumer’s expectation of receiving a tangible book, the tribunal clarified that customisation alone does not transform a zero‑rated product into a standard‑rated service.

For businesses built around turning personal narratives into keepsakes, the judgment reinforces the principle that the essence of the final product—not the complexity of the process—is what matters most for VAT purposes.

Source Fabian Barth

Other newsletters

- Taxpayer’s Position: Story Terrace Ltd (STL) argued that its services, which include producing bespoke books on individuals’ lives, fall under the zero-rated category for “books” as defined in VATA 1994 Schedule 8 Group 3 Item 1. STL emphasized that the primary focus of its offering is the final product—a book—rather than the ghost-writing services, which are integral to the book’s production.

- HMRC’s Argument: HMRC contended that the predominant service provided by STL is ghost-writing, which should be standard-rated. They cited evidence from contracts and customer interactions to support their claim that the ghost-writing service is the principal component of the overall offering, thereby excluding it from the zero-rating provisions.

- FTT Ruling: The First-tier Tribunal (FTT) ruled in favor of STL, concluding that the main purpose of the service is to produce a physical book, which qualifies for zero-rating. The FTT applied the “predominance test,” determining that the qualitative significance of the book outweighs the bespoke nature of the ghost-writing service, thus allowing STL to reclaim VAT on its costs associated with producing the books.

Source KPMG

Latest Posts in "United Kingdom"

- Littlewoods Wins Full VAT Recovery on Product Photography: UKFTT Confirms Direct Link to Taxable Sales

- Supreme Court Confirms No VAT Recovery on Professional Fees for Exempt Share Sales – Hotel La Tour Case

- Nursery Hot Meal Supplies Deemed Standard-Rated Catering, Not Zero-Rated Food, Tribunal Rules

- Appeal Dismissed: Director Held Personally Liable for Deliberate VAT Error on Opted Commercial Property Sale

- UK May Cut VAT on Public EV Charging to 5% to Boost Electric Car Adoption