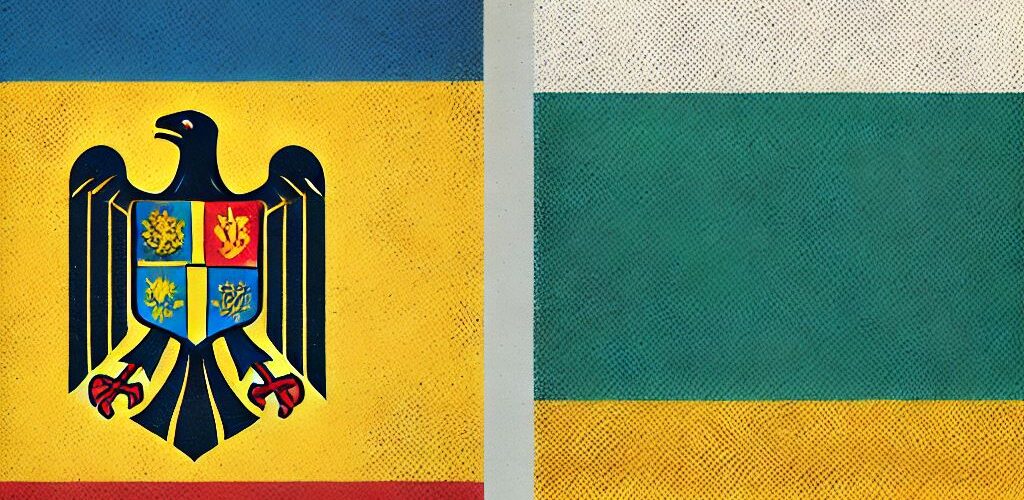

- Implementation Timeline: Romania has phased in SAF-T reporting since January 2022, with large taxpayers already compliant and small taxpayers set to comply by January 2025. In contrast, Bulgaria plans to implement SAF-T for large enterprises by January 2026, with full compliance expected by January 2030.

- Reporting Frequency and Deadlines: Romanian businesses must submit monthly or quarterly SAF-T reports aligned with VAT deadlines, while Bulgarian businesses have a combination of monthly and annual reporting requirements, including specific deadlines for different types of reports.

- Data Structure and Compliance Requirements: Romania’s SAF-T requires a detailed structure with over 390 mandatory elements submitted in a specific XML format. Bulgaria is still finalizing its data structure, with inventory reports submitted only upon request, indicating a less stringent initial requirement.

Source Taxera

Latest Posts in "Bulgaria"

- Today Is the Deadline for January 2026 SAF-T Submission by Large Enterprises in Bulgaria

- 2026 Bulgarian VAT Guide: Essential Updates and Compliance Insights for Businesses

- Bulgaria Consults on VAT Changes for EU Small Business, Defence, and Euro Transition

- Bulgarian Revenue Agency Reminds Companies to Submit SAF-T Files for First Reporting Period by March 2

- Croatia Proposes Extending 5% VAT on Energy Products Until March 2027 to Maintain Price Stability