Updated October 7, 2024

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

- Join the LinkedIn Group on ”VAT in the Digital Age” (VIDA), click HERE

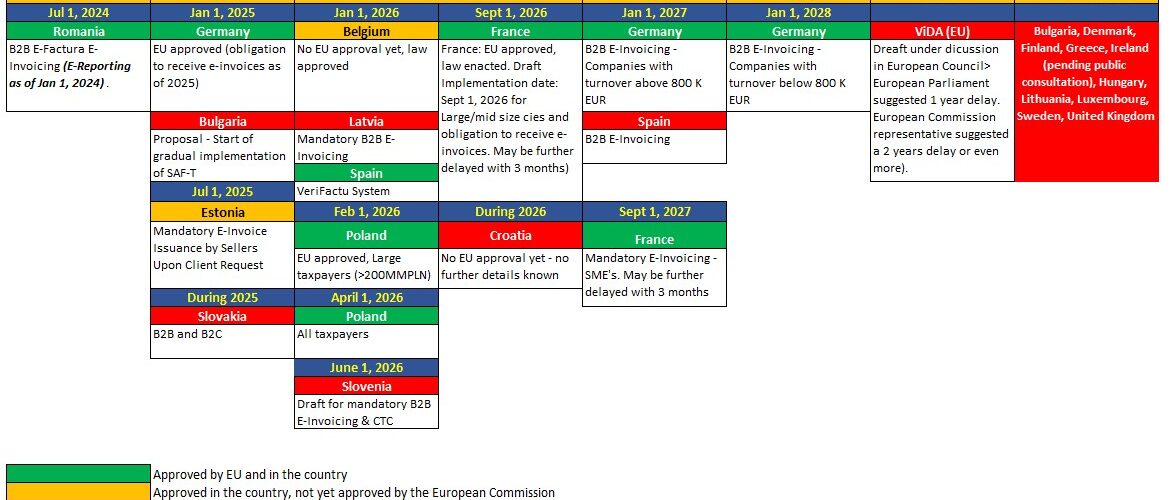

Country updates

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

See also

- Worldwide Upcoming E-Invoicing mandates, implementations and changes – Chronological

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

- Join the LinkedIn Group on ”VAT in the Digital Age” (VIDA), click HERE

Latest Posts in "European Union"

- Navigating VAT Exemptions: Recent ECJ Judgments and Their Implications for Intra-Community Transactions and Imports

- Roadtrip through ECJ Cases – Focus on Place of Supply of Intra-Community Acquisitions – ”Triangulation” (Art. 42)

- ECJ/General Court VAT Cases – Pending cases

- ECJ VAT Cases decided in 2025

- Comments on GC T-646/24: Simplification measure for triangular transactions applicable to fourth link in the chain