When participating in or organizing events for the Paris Olympics 2024 in France, you may incur various expenses. Let’s explore how you can recover VAT and which expenses are eligible:

- Methods for Reclaiming VAT:

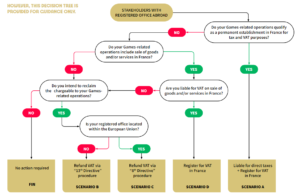

- Depending on your place of establishment, three methods are available for reclaiming VAT:

- Refund Procedure for European Established Companies:

- If your company is established within the EU, you can follow the refund procedure for VAT incurred in France.

- Refund Procedure for Non-EU Established Companies:

- Companies outside the EU can also reclaim VAT by following specific procedures.

- Refund Procedure for Companies Registered for VAT in France:

- If your business is registered for VAT in France, you can recover VAT directly.

- Refund Procedure for European Established Companies:

- Depending on your place of establishment, three methods are available for reclaiming VAT:

- Eligible Expenses for VAT Recovery:

- Refunds are possible for the following types of expenses:

- Hotel and Accommodation Expenses

- Meals and Entertainment Expenses

- Fuel Expenses (Petrol and Diesel)

- Transport of Passengers’ Expenses

- Other Specific Expenses (such as leasing private cars, private jets, gifts, and samples)

- VAT Margin Scheme (if applicable)

- Refunds are possible for the following types of expenses:

Remember that VAT recovery can be complex, so seeking professional advice is essential. Best of luck with your participation in the Paris Olympics 2024! .

When participating in the Paris Olympics 2024 in France, businesses can reclaim VAT on eligible expenses. For personalized guidance, consult

When participating in the Paris Olympics 2024 in France, businesses can reclaim VAT on eligible expenses. For personalized guidance, consult

Sources

- Olympics Paris 2024 – Tax & VAT Guide

- Paris 2024 Olympic Games – How to claim back your VAT in France?

- VAT Recovery for Olympics Operators: Navigating Tax Issues in France

- VAT recovery for Olympics operators with new expenses in France

Your company as able to assist in VAT recovery for the Olympics 2024? Become our partner and send an e-mail to [email protected] for advertising opportunities.