- The term “e-invoice” is used in the B2B and B2G contexts, referring to the electronic transmission of invoices between suppliers and purchasers, excluding data exchanges with tax authorities.

- Definitions and practices vary globally. In the Western hemisphere, “e-invoice” is used for B2B transactions, while “e-bill” is used for consumer transactions. The EU provides a comprehensive definition for B2B e-invoices, while Latin America and Asia have their own variations.

- The future of e-invoicing is moving towards standardized structured data use across B2B and B2G mandates, aiming to standardize invoice exchange methods.

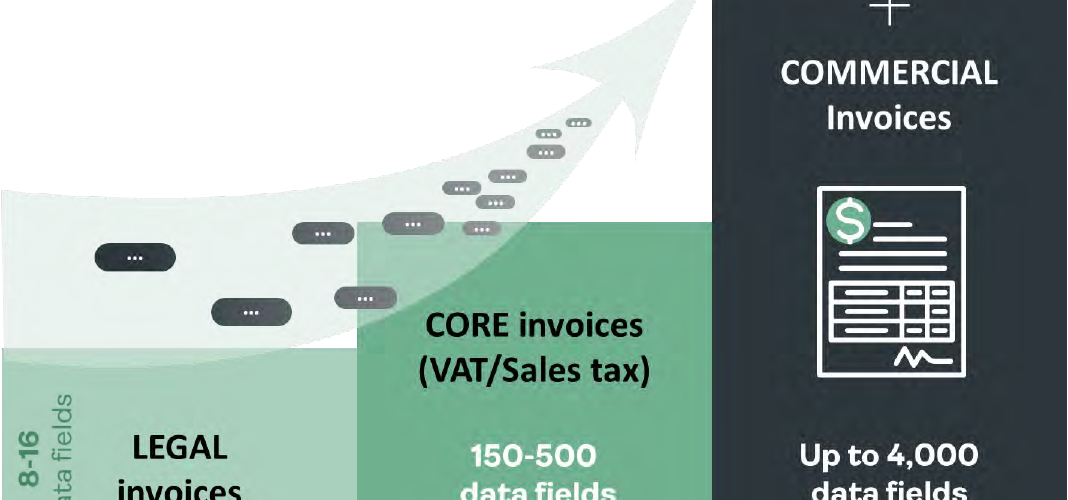

- Different types of e-invoices are recognized, including legal invoices (meeting tax compliance requirements), core invoices (compliant with VAT/ST and trade invoicing standards), and commercial invoices (tailored for specific industries).

- It is important to distinguish between e-invoices and e-billing, with the latter referring to electronic bills for consumer and G2C transactions. However, the terms are often used interchangeably

- Legal invoices are electronic invoices that include essential fields and authentication, exchanged between suppliers and buyers. They serve as the original invoices recognized by tax authorities and are preserved meticulously for compliance purposes.

- Core invoices comply with VAT, sales tax, and trade invoicing standards. They have a comprehensive format with numerous fields to facilitate automated processing. Core invoices are commonly generated by accounting/ERP systems and form the basis for electronic tax reporting and automation of business processes.

- Commercial invoices utilize the Universal Business Language (UBL) standard, which includes thousands of data fields exclusively for invoicing purposes. Industries like healthcare and transport logistics rely on these specialized invoices for full automation of their processes.

Source Billentis report: The global e-invoicing and tax compliance report: Watch the tornado!

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE