Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is. For example, taxes on income can do more economic harm than taxes on consumption and property. Countries across the Organisation for Economic Co-operation and Development (OECD) differ substantially in how they raise revenue.

While tax revenue took a hit due to the pandemic, many OECD countries are beginning to bounce back. But as the recovery continues, governments should pay close attention to how they raise revenue and avoid policy changes that could stifle an economic recovery or impose a complex burden on individuals and companies.

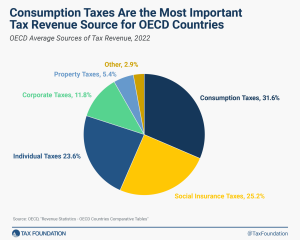

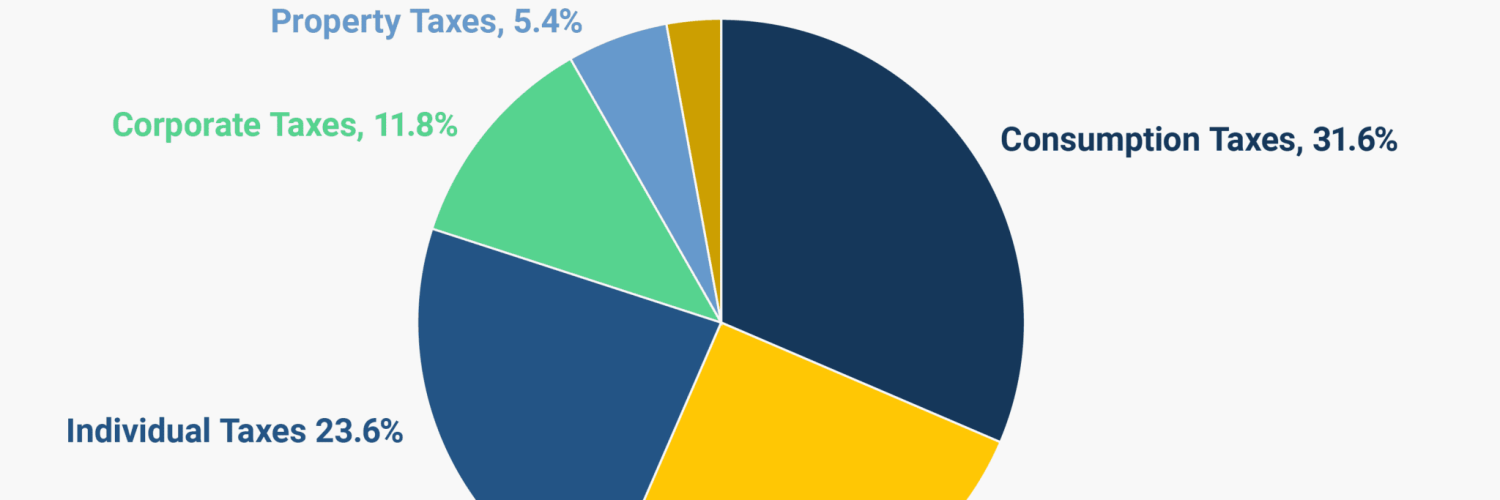

In general, OECD countries lean more on consumption taxes (31.6 percent), social insurance taxes (25.2 percent), and individual income taxes (23.6 percent) than on corporate income taxes (11.8 percent) and property taxes (5.4 percent).

Read further Tax Foundation