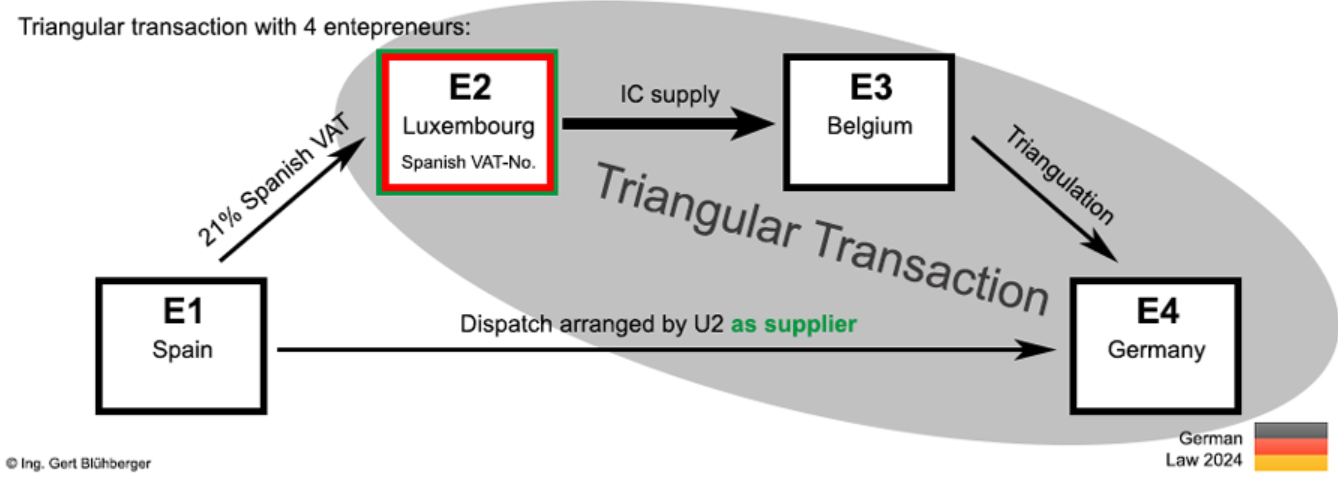

A triangular transaction is a chain transaction where a simplification rule is applied. A triangular transaction may exist where three entrepreneurs enter into sales transactions in three different Member States on one and the same commodity and this commodity passes directly from the first entrepreneur (= first supplier) to the last entrepreneur (= last purchaser).

Facts

- E4, a German entrepreneur, orders tool parts from E3, a Belgian supplier, who then orders from E2, a wholesaler in Luxembourg.

- E2 orders from E1, a Spanish manufacturer, who delivers the parts to Germany where E4 is located.

Legal Consequences

- Triangular Transaction:

- § 25b(1) UStG requires a direct transaction between the first supplier and the last purchaser, seemingly excluding the described scenario from triangular transaction simplifications.

- However, § 25b.1(2) UStAE allows for triangular transactions in chain transactions, like this one, if certain criteria are met.

- Tax Liability:

- E3’s tax liability transfers to E4 (reverse charge), avoiding taxation in Belgium.

- The transaction between E2 and E3 is tax-exempt as an intra-Community supply but taxable in Spain for E1 to E2.

- VAT Registration:

- E2 from Luxembourg must register in Spain due to the transaction’s place of supply but can deduct VAT

Source Chaintransaction-calculator