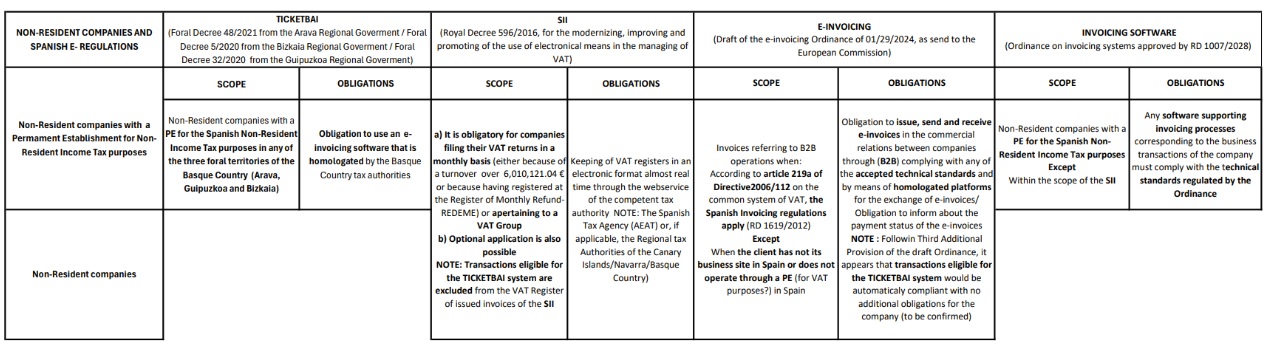

The Spanish Government has notified the European Commission the final draft of the Ordinance regulating B2B e-invoicing obligation in Spain. This regulation extends the obligation to e-invoice for B2B transactions introduced by Law 18/2022. The effective date will be 12 months (24 for companies with a turnover under 8 million Euros) after the e-invoicing Ordinance is published. Non-resident companies operating in Spain may be marginally affected, as the ordinance excludes B2B transactions where the recipient is not a tax resident or does not have a permanent establishment in Spain. It is important for non-resident companies operating in the Spanish market to analyze their position regarding the legal framework on tax technology in Spain.

Source ivaconsulta

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE