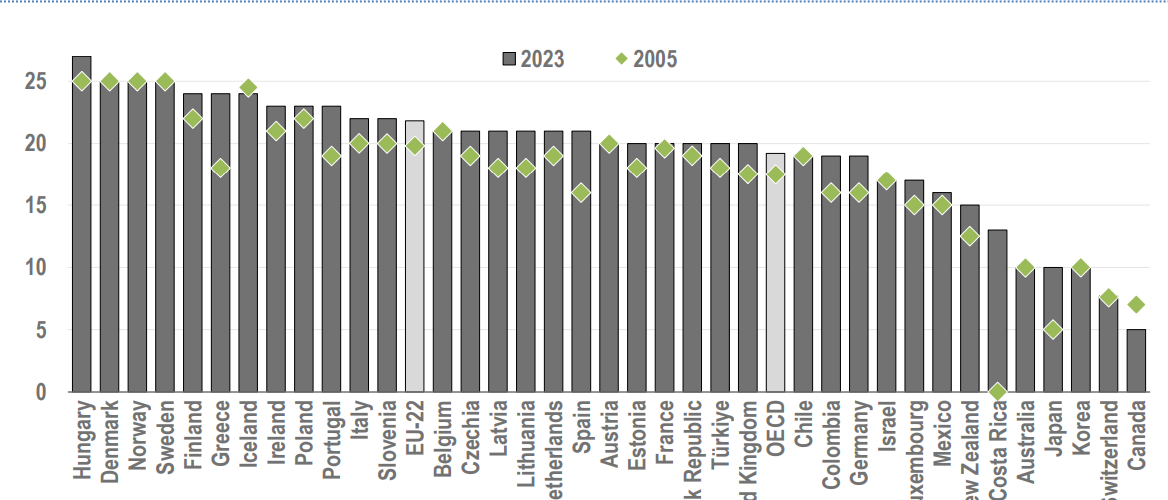

The OECD Tax Database presents comparative information on a range of statutory tax rates and tax rate indicators in OECD countries, encompassing personal income tax, social security contributions, corporate income tax rates and value-added taxes. Access the latest data from 2022-23 and discover more about countries’ evolving tax landscapes.

Source OECD