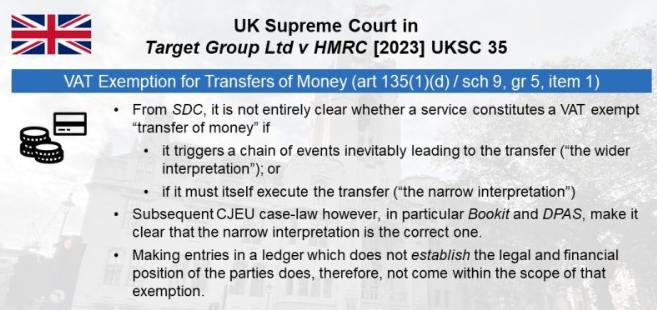

The VAT exemption for transfers of money requires the service to comprise the actual effecting of a transfer of legal title in the funds. It is not sufficient if it sets off a chain of events inevitably and automatically leading to the transfer. This interpretation by the UK Supreme Court of the CJEU’s case-law is perhaps beyond reproach – but it does render the exemption painfully narrow, and leads to services being taxed that are integral to the overall transfer and, from a consumer’s perspective, just as indistinguishable. As I have argued in my paper before, this might be an area where the post-Brexit UK can consider legislative intervention.

Source Fabian Barth

See also