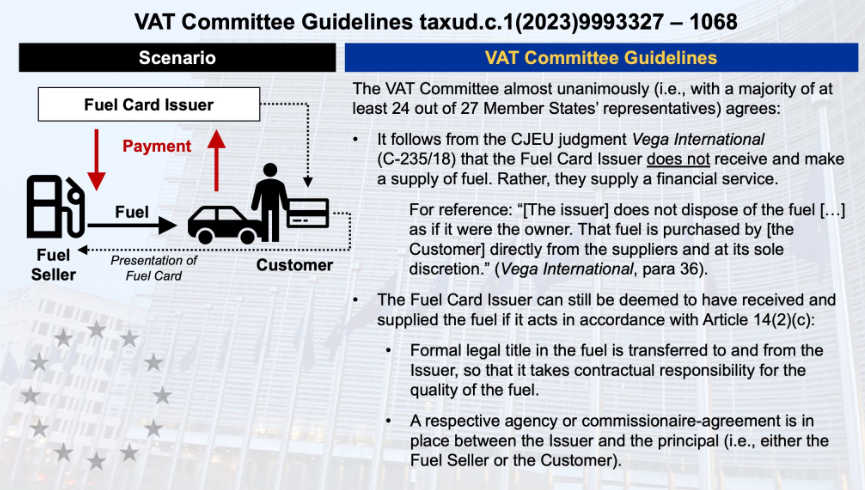

The VAT Committee has finally agreed on guidelines with regard to the VAT treatment of fuel cards in the light of the CJEU judgment Vega International. Sensibly, the Committee did not try to distinguish on non-convincing grounds what constitutes a sensible judgment with legal reasoning beyond reproach.

With regard to the commissionaire-structure, it appears however that the Committee went slightly overboard in terms of the conditions which allegedly need to be fulfilled. In particular, while the transfer of formal legal title might be an inherent part of acting as a commissionaire in some continental law systems, it makes little sense for example where the contract is governed by English law (which may well be true for many transactions even if they take place in the EU). Indeed, the only condition emerging from the VAT Directive and case-law is that the intermediary shall act in their own name. Whether this can and will be fulfilled by the Fuel Card Issuer turns on the specific facts and is perhaps a matter for future case-law to determine.

Source Fabian Barth

See also VAT Committee on ECJ C-235/18 Vega International: Fuel cards – follow-up