Updated October 1, 2023

Highlights

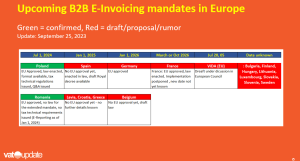

- Poland will implement mandatory B2B E-Invoicing and Real Time Reporting per July 1, 2024

- Romania will implement mandatory B2B E-Invoicing as of July 1, 2024. Certain transactions will be subject to E-Reporting as of Jan 1, 2024

- France has postponed the mandate from July 1, 2024 to most probably March (Big cies) and October 2026 (Medium entities)

- Spain was targetting to implement madatory B2B E-Invoicing as of July 1, 2024. The implementation will be delayed as the final version of the Royal Decree has not yet been published. Spain does not have the approval yet from the European Commission t implement mandatory B2B E-Invoicing.

- Germany: Implementation of B2B E-Invoicing mandate delayed till most probably Jan 1. 2026 (EDI not longer accepted as 2028)

- Belgium: The Council of Ministers agreed on September 29, 2023 to implement mandatory B2B E-Invoicing as of Jan 1, 2026

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

- Join the LinkedIn Group on ”VAT in the Digital Age” (VIDA), click HERE

Country updates

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

See also

- Worldwide Upcoming E-Invoicing mandates, implementations and changes – Chronological

- Upcoming E-Invoicing & E-Reporting mandates in the European Union (incl. ViDA)

Latest Posts in "European Union"

- Business Leaders Call on EU to Modernize Customs Union and Revive Türkiye Membership Talks

- EU VAT Compliance Gap Hits €128 Billion in 2023, Driven by Six Major Economies

- EU Triangular Transactions: More Than Three Parties Allowed, Rules European Court in 2025 Decision

- INTA Reviews EU Proposal to Extend CBAM to Downstream Goods and Strengthen Anti-Circumvention Measures

- European Commission Evaluates Fiscalis Programme’s Impact on EU Tax Fraud Prevention and Cooperation