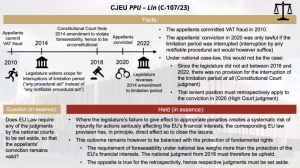

A difficult balancing act had to be faced by the Grand Chamber of the CJEU in this remarkable judgment: To what extent can the direct effect of EU law justify the conviction of a person that committed VAT fraud when the offence, under national law, would go unpunished due to procedural mistakes?

The balance found appears reasonable, but the striking part is that the question arises in the first place: Historically, vertical direct effect used to be a principle to be invoked by individuals where national law had deprived them of their EU law rights. The state, so the idea, shall not benefit vis-à-vis its citizen from its own failure to give effect to EU law. Silently however, vertical direct effect seems to have been expanded (and the present judgment is not the first to suggest so). Apparently, direct effect now also protects the EU’s interests where national law fails to do so, even if its invocation is to the detriment of the citizen. If that works even in criminal law, one wonders why it should not also apply for material VAT law (e.g., where national law unambiguously allows for an exemption that the Directive does not foresee) – after all, the EU’s financial interests are likewise affected.

Source Fabian Barth

See also

Join the Linkedin Group on ECJ VAT Cases, click HERE

For an overview of ECJ cases per article of the EU VAT Directive, click HERE