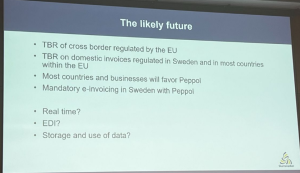

Sweden is likely to move forward with mandatory e-invoicing with a Peppol CTC model.

View that it is easier to integrate with 40 service providers rather than 1m+ businesses, as well as a common proven standard. Longer term view that Peppol model will be extended to new types of information and processes, creating a wider digital ecosystem and benefits for more stakeholders.

Source Axel Baulf

Latest Posts in "Sweden"

- Tax Base for Staff Meals in Restaurants: New Guidelines Effective October 28, 2025

- Reassessment Statement on Tax Base for Staff Meals in Restaurants No Longer Applies

- Clarification: Who Qualifies as a Transport Operator According to the Swedish Tax Agency

- Taxation of Criminal Activities: Income and VAT Implications for Individuals under Swedish Law

- Sweden Clarifies Input VAT Apportionment Rules for Mixed Activities in New Guidance