Historically, many businesses have wanted a quick local tactical solution to comply with new digital reporting requirements in Europe. For example, licensing a solution from a local niche software vendor or even simply outsourcing the digital reporting of data to a third-party compliance provider. In these early days of e-invoicing and e-reporting mandates, we saw parallel tax and invoicing processes where data was periodically uploaded or submitted to tax authority platforms as well as traditional invoices issued to customers and trading partners. This was going against what tax authorities were really aiming at – real time transactional reporting, the move away from paper to digital and certainly not trying to double up on efforts.

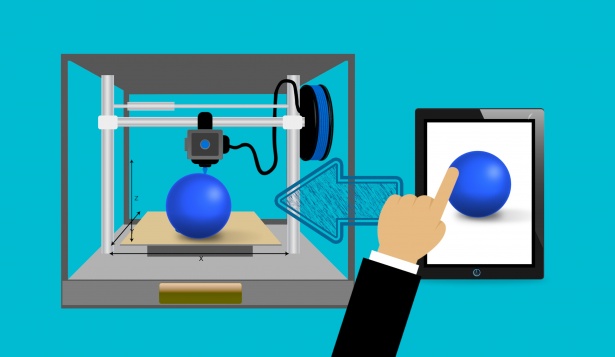

Source Avalara