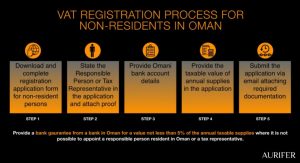

A new guide has been published by the Oman Tax Authority which summarizes the process of VAT registration application for non-residents obligated to register in Oman.

The VAT registration for non-residents in Oman requires the appointment of a Responsible Person resident in Oman or a tax representative. As an alternative to this, where it is not possible to appoint either of them, a non-resident person can register directly. However, it is required to specify a Responsible Person who is a related person and provide a bank guarantee in favor of the Oman Tax Authority.

The concept of appointing a tax representative or submission of bank guarantee for the purposes of registration is similar to the KSA. Bahrain also has an option to appoint a tax representative or tax agent. The UAE, on the other hand, does not require the appointment of a tax representative for the purposes of VAT registration.

The conditions in Oman will surely be prohibitive of a high level of compliance.

Source Oman Tax authority