- Solidarity for VAT payment

This measure (included in the anti-fraud law n°2018-898 of October 23rd, 2018), was amended by the Finance Bill for 2020 (voted on the sly, as it was not provided for in the draft finance bill for 2020).

Initially, a solidarity payment of VAT was planned for platforms with more than 5 million connections per month (articles 283 bis and 293 A ter of the French Tax Code (FTC).

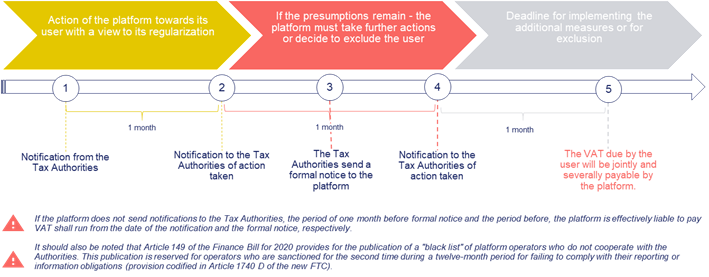

This solidarity is implemented after a procedure of alert and formal notice:

Article 182 of the Finance Act for 2020 has modified the definition of the platforms concerned by this measure.

The threshold of 5 million monthly connections is removed. The VAT payment solidarity scheme therefore applies to all platforms (except for those performing a content sharing activity).

This solidarity of payment is different from the new rule provided for by the “E-commerce” Directive (that will come into force on January 1st, 2021), which consists in making the platform liable for VAT on certain sales made by suppliers.

2. Obligation to file a summary document before January 31st, 2020 (Article 242 bis of the FTC)

Platforms must file a summary document before January 31, 2020, for transactions carried out in 2019, to be transmitted (i) to the supplier and (ii) to the tax Authorities.

This document must include the elements relating to the operations carried out by the suppliers on the platform (Art. 242 bis of the FTC).

A decree dated December 30, 2019 specifies the information to be included in this document and the administrative doctrine has been amended accordingly (BOI-BIC-DECLA-30-70-40-20-20200107).

Sending this declaration to suppliers could be the opportunity to carry out an audit of the internal processes to be put in place to ensure that suppliers comply with their VAT obligations.

This first approach will make it possible to justify to the Authorities that the means have been implemented to ensure that suppliers fulfil their obligations and thus justify the good faith of the platform in the event that the Authorities tries to apply solidarity of payment.

Nathalie Habibou, is a partner in the Arsene law firm, first independent law firm specializing exclusively in tax and founder of the international Taxand network. Nathalie oversees the VAT & indirect taxes matters in the firm and intervenes in Taxand network.