MYBA and Federagenti Yachting raise concerns over implementation of new Italian VAT system on charters…

In 2019, the European Commission announced that the application of VAT on charters as practised in Italy, France, Malta, Cyprus and Greece would no longer be applicable in 2020. In other words, merely cruising into international waters and benefitting from a lump sum reduction in VAT will no longer be possible. Instead, VAT reductions are now to be determined on a strictly pro rata basis.

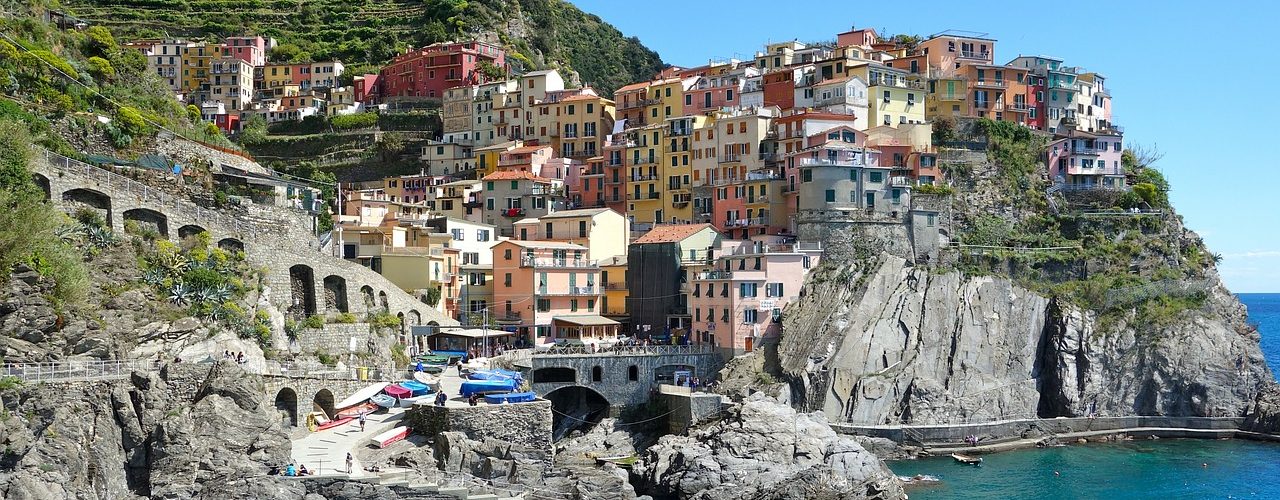

Source: superyachtnews.com

Latest Posts in "Italy"

- Italy Extends Suspension of Plastic and Sugar Tax Until End of 2026

- 10% VAT Applies to Musical Entertainment Accessory to Restaurant Services, Rules Italian Supreme Court

- VAT Refund on Invoices: When Undue Tax Payments Can Be Reclaimed

- Local Authority Reimbursements for Employee Electoral Mandate Leave Not Subject to VAT

- VAT Refund Denied in Fraud Context After Contract Reclassification