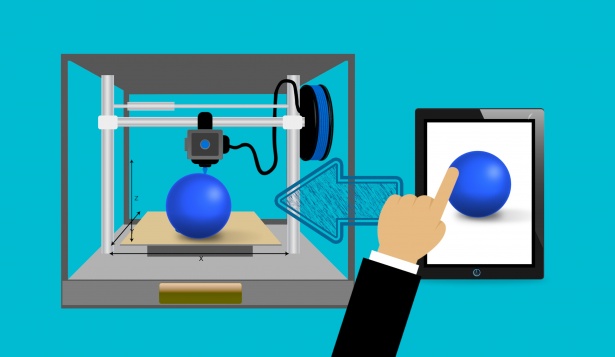

The technology of 3D printing can simplify a supply chain to two entities: a designer preparing the blueprint and the printer at the other end. Particularly in Asian and other less developed countries e.g., the Philippines, where customs authorities (and the government) often depend on customs and value-added tax (VAT) earnings for their wages and bonuses, this trend is unlikely to pass unnoticed.

Source: EY TaxInsights

Latest Posts in "Indonesia"

- Finance Ministry Probes 40 Steel Firms for Rp5 Trillion Annual VAT Losses

- Finance Ministry to Inspect Steel Giants After Uncovering Widespread VAT Evasion Scheme

- VAT Registration and E-Faktur Compliance in Indonesia: Key Challenges for Foreign Investors

- Indonesia Reinstates 100% VAT Incentive for Home, Apartment Purchases up to Rp2 Billion in 2026

- Finance Ministry Offers 100% VAT Incentive for Home Buyers Throughout 2026