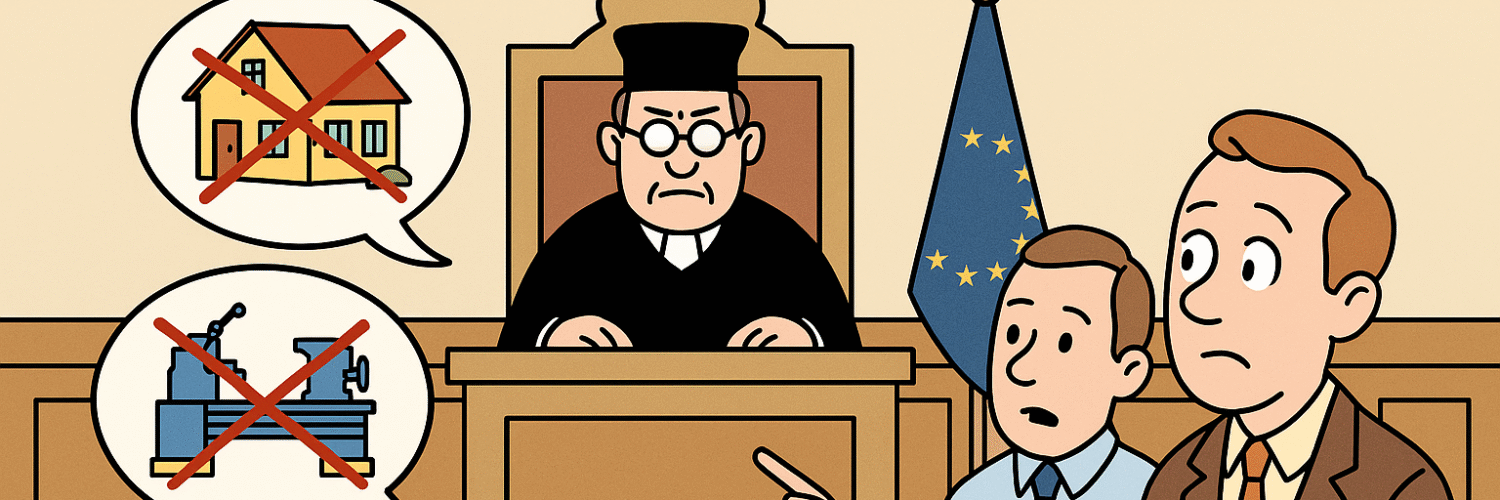

On 19 December 2018, the European Court of Justice gave its judgment in case C‑17/18 (Mailat – Apcom Select). The case concerns the question if the lease of a restaurant can qualify as the transfer of a business.

Summary

- Facts of the Case: The case involves Mr. and Mrs. Mailat and their company, Apcom Select SA, which were prosecuted for tax avoidance after deducting VAT on works carried out in a restaurant building and subsequently leasing the property (along with necessary movable property) to another company without adjusting the VAT as required by Romanian law.

- Legal Issues: The main legal questions referred to the European Court of Justice (ECJ) were whether the lease constituted a “transfer of a totality of assets” under Articles 19 and 29 of the VAT Directive, and whether the transaction fell under the exemption for “letting of immovable property” in Article 135(1)(l) of the VAT Directive.

- Questions to the ECJ: The court was asked to determine:

- Whether leasing a restaurant building with its equipment constituted a transfer of a business.

- If the lease agreement was a “letting of immovable property” or a supply of complex services.

- Decision: The ECJ ruled that:

- The lease did not qualify as a “transfer of a totality of assets” since it was merely a letting of property and equipment without transferring ownership.

- The lease constituted a single supply where the letting of immovable property was the principal service, thus falling under the exemption in Article 135(1)(l).

- Justification of the Decision: The Court emphasized that for a transaction to qualify as a transfer of a business, it must enable the recipient to carry on an independent economic activity. The leasing arrangement in question did not transfer ownership of assets, nor did it constitute a business transfer. Furthermore, the Court established that the letting of the immovable property, along with the necessary equipment, formed a single supply where the main service was the letting of the property itself.

Article in the EU VAT Directive

Article 19 & 135(1)(l) of the EU VAT Directive 2006/112

Article 19

Article 19

In the event of a transfer, whether for consideration or not or as a contribution to a company, of a totality of assets or part thereof, Member States may consider that no supply of goods has taken place and that the person to whom the goods are transferred is to be treated as the successor to the transferor.

Member States may, in cases where the recipient is not wholly liable to tax, take the measures necessary to prevent distortion of competition. They may also adopt any measures needed to prevent tax evasion or avoidance through the use of this Article.

Article 135

1. Member States shall exempt the following transactions:

(l) the leasing or letting of immovable property

Facts (simplified):

Apcom Select, managed by Mr. and Mrs. Mailat, received investment works in a building in which it operated a restaurant. Apcom Select deducted the input VAT incurred on this work as well as for the fixed assets and the property related to the operation of the said restaurant.

At the same time, Apcom Select entered into a lease agreement with another commercial company under the VAT exemption scheme for the building in question and on the capital and property related to the operation of the restaurant. The tenant continued the commercial operation of the restaurant under the same name.

At the time of the conclusion of the said contract, Mr and Mrs Mailat did make any VAT adjustment on the deducted VAT for the work carried out as well as for the fixed assets and the goods related to the operation of the restaurant, even though, under national regulations, they had the obligation to do so.

It is in that context that Mr and Mrs Mailat, as well as Apcom Select, were criminally prosecuted by the national anti-corruption authority for tax evasion before the national court.

In the present case, Mr and Mrs Mailat submit that, through Apcom Select, they leased the immovable in which they operated a restaurant, including capital goods and those related to them. They argued that they supplied the operation of the restaurant to another commercial company, and thus constituted a business transfer, and thus, consequently, Apcom Select was entitled to deduct the VAT relating to modernization carried out, without being required to regularize VAT in favor of the State at the time of the conclusion of the lease contract.

Questions

(1) Does the conclusion of a contract under which a corporation leases an immovable in which it operated a restaurant, with all capital and consumer goods, and the lessee continuing to operate that restaurant under the same sign as that used previously, constitute a business transfer within the meaning of Article 19 and Article 29 of the VAT Directive?

(2) If the first question is answered in the negative, is the operation described a service which can be qualified as a “leasing of immovable property” within the meaning of Article 135(1)(l) of the VAT Directive, or a complex service that can not be qualified as “rental of real estate”, taxed under the law?

AG Opinion

None

Judgment:

(1) The concept of ‘the transfer of a totality of assets, or of a part thereof’, must be interpreted as meaning that it does not cover the transaction by which real property used for commercial exploitation is leased, together with all the capital goods and consumables necessary for that exploitation, even if the lessee continues to lessor’s activity under the same name.

(2) A lease for immovable property used for commercial purposes and for all immovable property equipment and consumables required for this operation constitutes a single service in which the rental of the immovable property is the main service.

Source: Curia

Newsletters

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- CJ Rules on Customs Valuation for Imports with Provisional Prices: Tauritus Case (C-782/23)

- EDPS Opinion on EPPO and OLAF Access to VAT Data for Combating EU Fraud

- EU Agrees on Temporary €3 Customs Duty for Low-Value E-Commerce Parcels from July 2026

- New InfoCuria case-law database and search tool

- New General Court VAT case – C-903/25 (Grotta Nuova) – No details known yet