- The Union Budget 2026-27 is expected to significantly reduce Customs duties and simplify tariff structures, moving India toward a low-tariff regime.

- Ongoing and upcoming free trade agreements (FTAs) will further expand preferential trade routes, making MFN tariffs less relevant.

- Customs revenue now forms less than 4% of total budget receipts, giving scope for large-scale duty reductions.

- Industry experts anticipate reforms to reduce compliance burdens, increase digitisation, and focus on targeted rate cuts for industrial inputs.

- Think tanks recommend a phased move to zero duties on most raw materials and a low, uniform rate on finished goods, along with further reduction in the number of duty slabs.

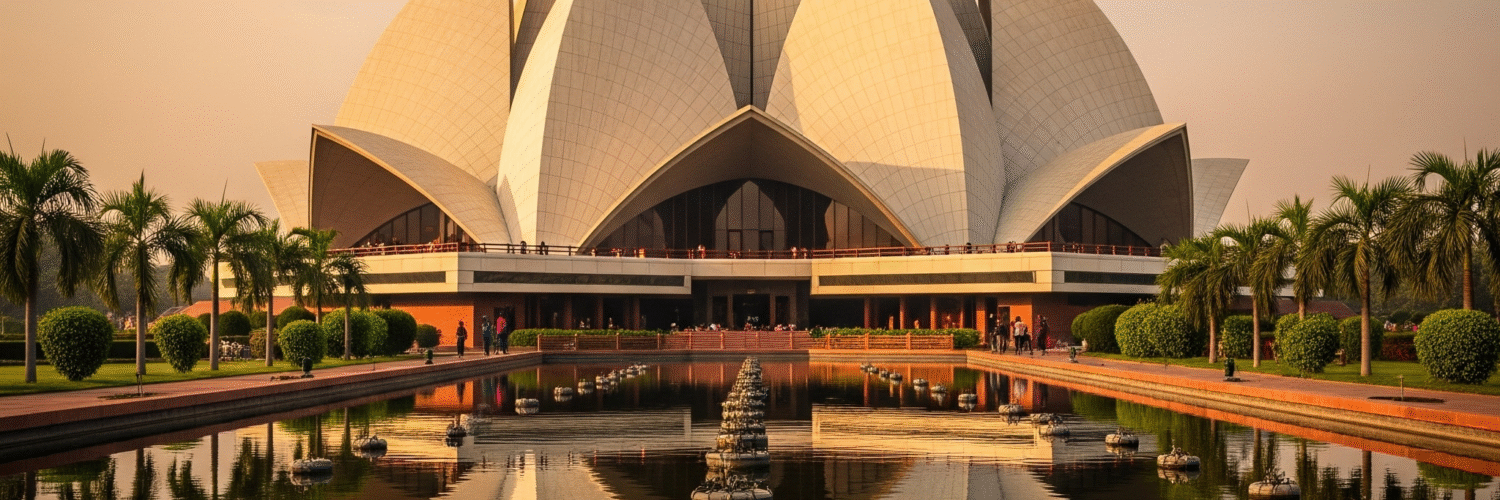

Source: a2ztaxcorp.net

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "India"

- Budget 2026 in Depth: India Proposes Changes to Place‑of‑Supply Rules for Intermediaries and Moves to Rationalize Customs Duties

- CBIC Releases FAQs on Union Budget 2026-27 Customs Reforms: Key Changes for Trade and Passengers

- FM Sitharaman Unveils Major Customs Reforms to Boost Trade, Ease Imports, and Support Exports

- Invoice vs Receipt: Key Differences, Purposes, and Importance for Indian Businesses Explained

- High Court Grants Anticipatory Bail in GST Case, Citing Cooperation and No Life Sentence Provision