- Sweden proposes amendments to the VAT Act to align with the EU VAT Directive.

- The turnover-based method will become the standard for allocating input VAT in mixed activities.

- Alternative allocation methods will be allowed only if they provide more accurate results.

- The changes are set to take effect on January 1, 2027.

Source: kpmg.com

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "Sweden"

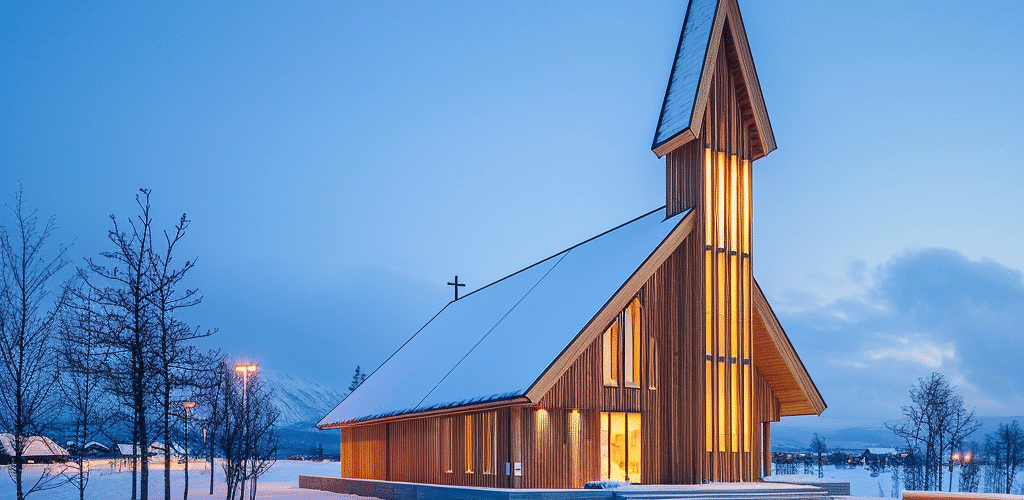

- VAT Treatment of Transactions Within the Church of Sweden’s Organizational Units

- Sweden: Comprehensive VAT Country Guide (2026)

- Swedish Tax Agency Clarifies VAT Rules for Transactions with Foreign VAT Groups and Swedish PEs

- Discontinuation of Position on Taxation Country and Burden of Proof for VAT on Services

- VAT Exemption for Timeshare Vacation Apartments: Updated Guidance Effective January 19, 2026