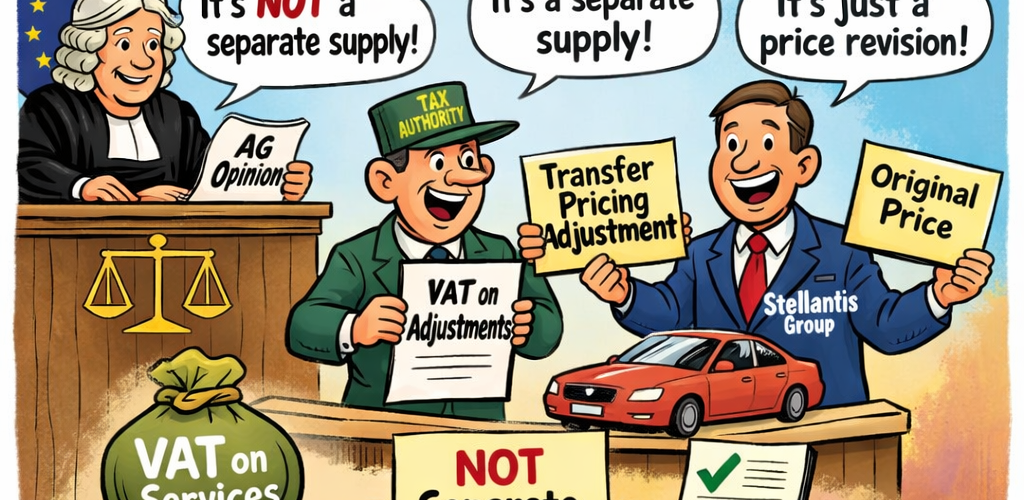

- Advocate General Kokott’s opinion in Stellantis Portugal (C-603/24) addresses the tension between VAT treatment and transfer pricing adjustments within groups, especially after the Arcomet Towercranes (C-726/23) case.

- In Arcomet, the Court ruled that transfer pricing adjustments related to services provided within a group could be considered taxable services, but left key underlying questions unresolved.

- Kokott argues that not every transfer pricing adjustment (true-up) constitutes a service for VAT purposes; it depends on whether the adjustment is merely a price change for a previous supply or a payment for a new service.

- The distinction is crucial: if only the consideration for a previous supply is changed, it falls under VAT rules for price adjustments, not as a separate service.

- The core issue is whether a transfer pricing correction is linked to a specific supply or service, or if it falls outside the scope of VAT altogether.

Source: vat-consult.be

Click on the logo to visit the website

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "European Union"

- Advocate General’s Opinion Clarifies VAT Treatment of Transfer Pricing Adjustments in Stellantis Portugal Case

- Agenda of the ECJ/General Court VAT cases -1 Judgment, 1 Hearing till Feb 25, 2026

- The «Prefilling» headache

- The Fiscalis Programme 2021–2027: Interim Evaluation and Key Insights

- EU ViDA E-Invoicing: Key Changes and Luxembourg Implications for Cross-Border B2B Transactions