📌 Summary of What Consultants Agree On

✔ No separate VAT-able service

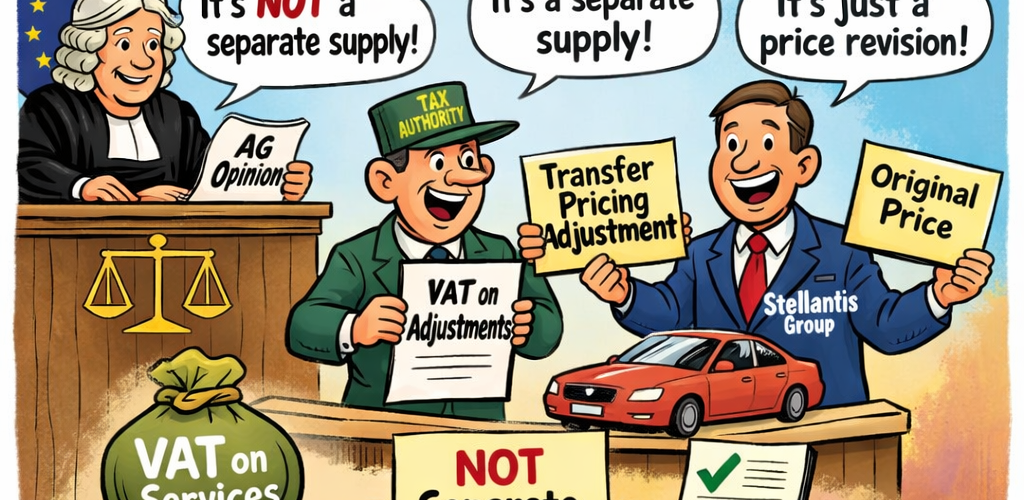

AG Kokott clearly views contractual TP adjustments as not constituting separate supplies unless a specific service can be identified and linked to consideration.

✔ But VAT taxable amount can change

If the TP adjustment reflects:

- a variable purchase price,

- agreed contractually, and

- linked to original supply,

then the adjustment may increase or reduce the VAT taxable amount.

✔ VAT treatment depends heavily on contract + economic reality

- the contractual mechanism,

- presence/absence of a direct link between payment and service,

- whether the TP adjustment is purely profit allocation or part of purchase price structuring.

New AG Opinion in Stellantis (C‑603/24): Transfer Pricing meets VAT (again

- AG Kokott confirms that contractual TP adjustments are not automatically a separate supply for VAT.

- They affect only the taxable amount when linked to a variable purchase price agreed upfront, aligning with Articles 73 and 90 VAT Directive.

- A separate VAT supply arises only if an identifiable service for consideration exists.

- The Portuguese tax authority had argued the adjustment amounted to a service by the purchaser.

Source: VATfaq’s summary & analysis [vatfaqs.com]

A‑G advises: no separate transfer pricing supply of services without a contract

- Baker Tilly confirms AG Kokott’s view: price adjustments are not a supply of services if no contract exists linking consideration to a specific service.

- Adjustments may still modify the taxable amount of the original supply, but they do not trigger VAT as a stand‑alone service.

- They outline three possible CJEU outcomes (taxable, non‑taxable, hybrid) and conclude AG Kokott favors “not taxable”.

Source: Baker Tilly insight article [bakertilly.nl]

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

Latest Posts in "General"

- Merry Christmas!

- Briefing document & Podcast: ECJ C-676/22: No exemption on intra-EU supplies if it can not proven that the recipient is a taxable person

- Contributors wanted – Become our unique country contributor & join the network!!!

- Contributors wanted

- Thank you for visiting our website – Please add us to your favorites!