- The VAT exemption under § 4 Number 4a UStG will be abolished as of January 1, 2026.

- Transitional provisions address the taxation of transactions previously exempt until December 31, 2025.

- New rules cover the taxation, tax base, tax rate, and tax liability for transactions related to the removal of goods from VAT warehouses.

- Documentation and record-keeping requirements for proof of previous exemptions must be maintained beyond December 31, 2025.

- The VAT Application Decree will be amended to reflect these changes.

Source: bundesfinanzministerium.de

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "Germany"

- Germany Urges Clear VAT and Transfer Pricing Classification Following Advocate General’s Opinion

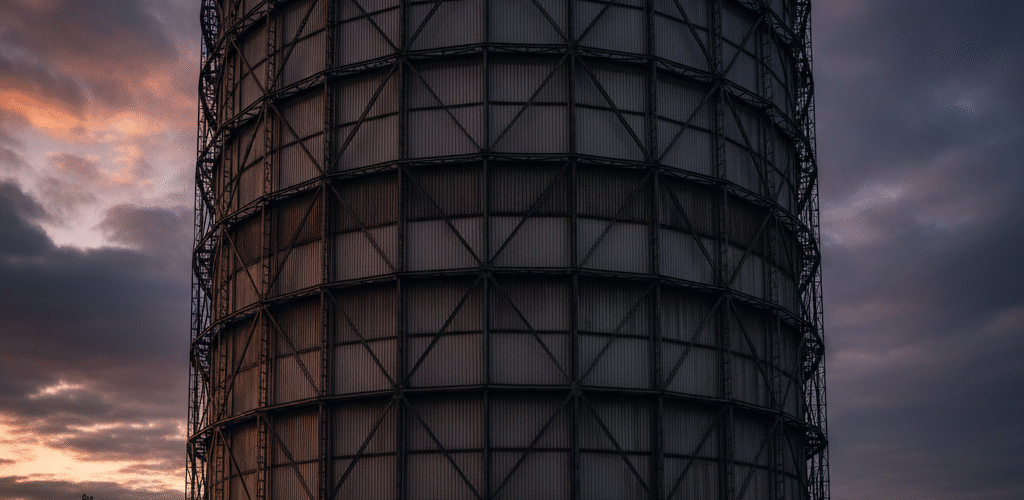

- Germany: Warehouse Deliveries Not VAT-Exempt; Key Recent VAT Developments for Businesses

- Deutsche Fiskal Announces FCC 4.4.0 Release, Mandatory Updates, and Customer Webinar for February 2026

- Overview of 2025 VAT Conversion Rates Published Monthly Under §16(6) UStG

- E-Invoicing in Germany and Europe: Key Actions for Businesses in 2026