- Annual Publication of Standard Amounts: The Tax and Customs Administration publishes yearly standard amounts for the private use of energy, water, and agricultural products, which are essential for VAT corrections.

- VAT Correction Requirement: A VAT correction must be applied in the last VAT return for 2025 for the private use of energy and water, as well as for agricultural products, based on the specified standards.

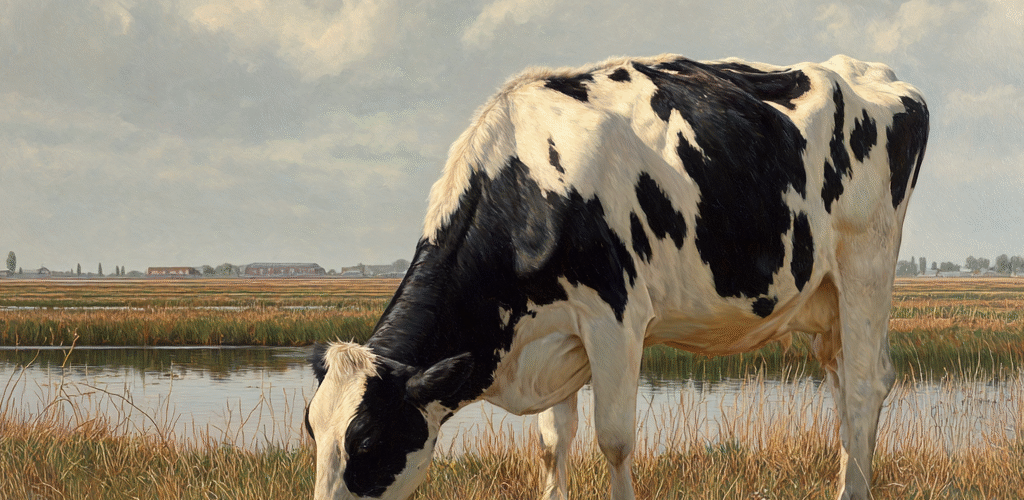

- Application for SMEs: The agricultural standards, which detail the price (excluding VAT) for each product, also apply to SME entrepreneurs, requiring them to indicate the VAT correction in their final tax return of the year.

Source Carola van Vilsteren

Latest Posts in "Netherlands"

- No rental-plus in case of subletting to conservatory

- Knowledge group: rental of solar roof project does not qualify as rental of immovable property

- Annual VAT Corrections in the Netherlands: Understanding the BUA and Private Consumption Rules

- Follow-up Questions on VAT Increase Impact Analysis for Accommodation: Dutch Senate Finance Committee

- Cumulative Leakage Effects from Tax Increases in the Netherlands Cannot Be Precisely Determined