ECJ judgment (T-646/24) sheds new light on simplified triangular transactions

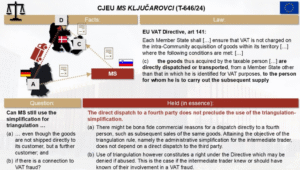

- Case Background: The case involves MS KLJUČAROVCI, a Slovenian VAT-registered company that applied a simplification in VAT settlement for a triangular transaction involving goods ordered from Germany and sold to contractors in Denmark. However, the goods were ultimately collected by a fourth entity, raising doubts from Slovenian tax authorities about the validity of the simplification due to the actual delivery circumstances.

- ECJ’s Key Ruling: The Court of Justice of the European Union (ECJ) ruled that the provisions of the VAT Directive do not require the recipient to physically possess the goods for the simplification to apply. Therefore, the fact that the goods were delivered to the fourth entity (a customer of the third entity) does not preclude the application of the triangular transaction simplification.

- Implications for Polish Entrepreneurs: The ECJ ruling is significant for Polish businesses involved in international VAT settlements, particularly triangular transactions, as it clarifies that the knowledge of the delivery circumstances does not affect the application of simplification. This decision offers greater flexibility for companies navigating VAT regulations, provided they adhere to necessary procedures and requirements.

Source MDDP

Click on the logo to visit the website

Triangular Transactions in Focus: General Court Rejects German Tax Authority’s View

- The General Court ruled that triangular transaction simplifications can apply to chain transactions involving more than three parties, emphasizing that physical possession of goods is not required, but rather the legal ability to dispose of the goods is key.

- The court’s decision challenges the restrictive interpretation of the German tax authority, which had previously denied triangular transaction simplifications if the last three parties in the chain were not involved, leading to significant tax and administrative burdens for taxable persons.

- The ruling stresses that the simplification does not apply if a taxable person is aware or should be aware of VAT fraud within the supply chain, reinforcing the need for due diligence and accurate documentation to ensure compliance and mitigate potential tax liabilities.

Source KMLZ

ABC regulation in four-party chain: physical delivery and abuse

- Triangular Transaction and VAT Fraud: The Slovenian intermediary MS KLJUČAROVCI engaged in a triangular transaction scheme by purchasing goods from German suppliers and selling them to Danish customers, while the goods were actually transported directly to a fourth party in Denmark. The Slovenian tax authorities deemed this fraudulent, holding MS KLJUČAROVCI liable for VAT.

- Legal Interpretation of Article 141: The referring court sought clarification on whether the simplification scheme for triangular transactions applies when goods are transported directly to a final customer rather than through the intermediary, as stated in Article 141(c) of the VAT Directive.

- General Court’s Ruling: The General Court ruled that the simplification measure can apply in a four-party chain without physical delivery to the third party; however, it also stated that tax authorities can deny this benefit if the intermediary knew or should have known about the VAT fraud involved in the transactions.

Source BTW Jurisprudentie

- The Court of First Instance determined that for the application of Article 141(c) of the VAT Directive, it is irrelevant whether MS Ključarovci, d.o.o. knew the goods were transported to the ANC Group instead of the three Danish companies, as long as the ANC Group is subject to VAT in Denmark.

- MS purchased goods from German companies, organized their transportation to Denmark, and applied a simplification measure for triangular transactions, transferring the VAT obligation to the Danish companies, despite the Slovenian tax authorities questioning the legitimacy of this arrangement due to the absence of those companies in Denmark.

- The court noted that MS could lose the simplification measure if it is proven that it was aware or should have been aware that its transactions were part of a VAT fraud scheme involving the supply chain, highlighting the importance of due diligence in VAT compliance.

Source Taxlive

See also

Source Fabian Barth

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

Latest Posts in "European Union"

- Comments on ECJ C-796/23: Consideration of Czech company for VAT purposes as ‘designated partner’ in violation of EU law

- Advocate General’s Opinion Clarifies VAT Treatment of Transfer Pricing Adjustments in Stellantis Portugal Case

- Agenda of the ECJ/General Court VAT cases -1 Judgment, 1 Hearing till Feb 25, 2026

- The «Prefilling» headache

- The Fiscalis Programme 2021–2027: Interim Evaluation and Key Insights