- The National Tax Court clarified VAT liability in subcontractor agreements.

- The taxpayer was deemed to have received income as an employee, not as an independent contractor.

- The taxpayer was still required to pay the sales VAT stated on invoices, even though the income was as an employee.

- Anyone who enters VAT on invoices must pay it, unless the error is corrected with the service recipient.

Source: news.bloombergtax.com

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

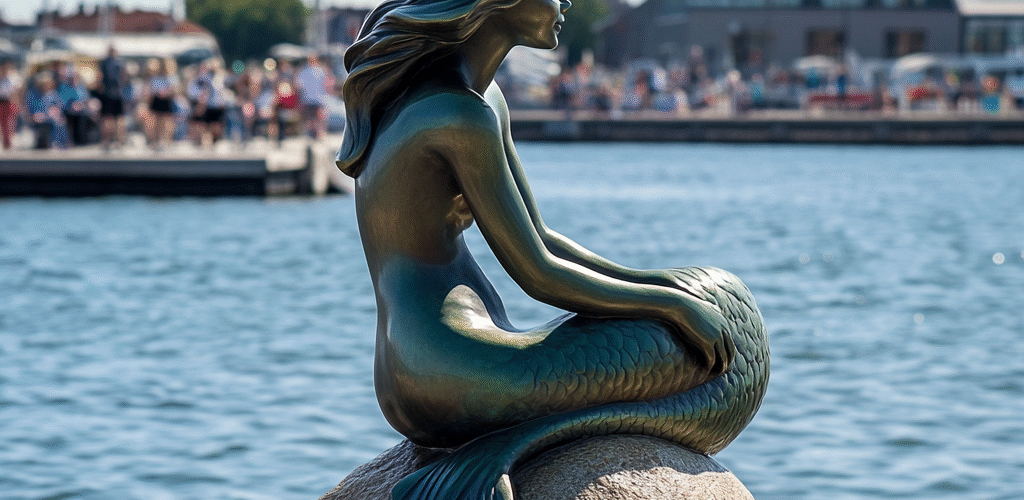

Latest Posts in "Denmark"

- Denmark Debates Cutting VAT on Food Amid Government Disagreement Over Model and Scope

- Government Divided Over Priorities in Negotiations to Reduce VAT on Food Items

- New General Court VAT case – C-903/25 (Grotta Nuova) – No details known yet

- Denmark Unveils Tax Reform: Cuts on Sweets, Coffee, VAT on Books, and Business Incentives

- Fiscalization and VAT Treatment of EV Chargers in Denmark: Legal Framework and Key Characteristics