- The case concerned a Croatian company, FLO VANEER, denied VAT exemption for intra-community supply due to incomplete documentation under EU Quick Fixes rules.

- The CJEU ruled in favor of the taxpayer, emphasizing that material requirements for VAT exemption outweigh strict formal documentation requirements.

- Article 45a of the Implementing Regulation should be seen as a privilege, not an obligation; lack of perfect documentation does not automatically remove the right to VAT exemption.

- Tax authorities must consider all alternative evidence proving intra-community delivery, not just the documents listed in the regulations.

- The ruling strengthens taxpayers’ ability to defend 0% VAT rates during audits, confirming that the list of acceptable documentation is open and not exhaustive.

Source: mddp.pl

Click on the logo to visit the website

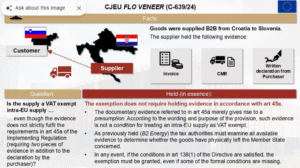

- Background of the Case: Croatian company FLO VENEER faced a VAT assessment after issuing invoices for intra-Community supplies to a Slovenian customer while applying for a VAT exemption. Although the goods’ transport was confirmed, the Croatian tax authorities rejected the exemption due to formal deficiencies in the documentation provided.

- Legal Argument and CJEU Reference: FLO VENEER argued that the rebuttable presumption established in Article 45a of the VAT Regulation should ease the proof requirements for intra-Community supplies. The CJEU supported this by stating that the VAT exemption should not be denied solely based on missing specific evidence if the substantive conditions for exemption are met.

- CJEU Conclusion on VAT Exemption: The CJEU ruled that while Article 45a provides a presumption for proving intra-Community supplies, it does not limit the types of evidence that can be used. National tax authorities must evaluate all evidence submitted by sellers, and formal deficiencies should not negate the right to exemption unless there is evidence of fraud or inability to prove substantive conditions.

Source BTW Jurisprudentie

Croatian refusal to grant VAT exemption to ICL in breach of EU law

- The Court of Justice of the European Union ruled that Croatia cannot deny VAT exemption under Article 138(1) of the VAT Directive solely due to insufficient proof of intra-Community supply (ICL) as outlined in Article 45a, regardless of the absence of Regulation 282/2011.

- FLO Veneer d.o.o. faced VAT assessments from Croatian tax authorities despite evidence showing oak logs were transported to Slovenia, as the authorities claimed the supporting documents did not meet exemption conditions.

- The Court emphasized that tax authorities must evaluate all submitted evidence to determine whether goods were dispatched or transported from one Member State to another within the EU, reinforcing the principle of fiscal neutrality in VAT exemptions.

Source Taxlive

CJEU Confirms Flexible Proof of Transport for Intra-Community VAT Exemption

- The CJEU ruled that the list of evidence for intra-community transport in Article 45a of Regulation No 282/2011 is not exhaustive; proof of transport is free.

- The Court’s decision supports the French practice, allowing various forms of evidence to justify VAT exemption on intra-community deliveries.

- In the FLO VENEER case, the Croatian tax authority denied VAT exemption based on a strict reading of the regulation, despite not disputing the actual transport of goods.

- The CJEU clarified that tax authorities cannot refuse VAT exemption solely for formal reasons if the intra-community supply is proven.

- The judgment limits administrative power and secures more flexible practices for proving intra-community deliveries.

Source: cyplom.com

- Core Issue: The case concerned whether the strict documentary requirements in Article 45a of the VAT Implementing Regulation should be treated as conditions for VAT-exempt intra-EU supplies.

- Court’s Decision: The CJEU rejected elevating these burdensome documentation rules into substantive conditions, thereby safeguarding the functioning of the EU VAT exemption system.

- Remaining Concern: The Court appeared to implicitly endorse the customer’s VAT ID as a condition for exemption, raising uncertainty that may be clarified in a pending referral.

Source Fabian Barth

See also

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

Latest Posts in "European Union"

- EU VAT Tax Gaps 2023: Compliance, Policy Gaps, and Member State Comparisons

- CJEU Expands VAT Exemption Scope for Credit Intermediaries, Clarifies Criteria for Eligibility

- Czech Republic, Greece, Slovakia Face Action Over Delays in Customs Import and Storage Systems

- EU Issues Reasoned Opinions to Five States Over Incomplete Customs Data Transmission via SURV3 System

- ICS2 Mandatory for Entry Summary Declarations from January 2026 for GB, NI, and EU Shipments