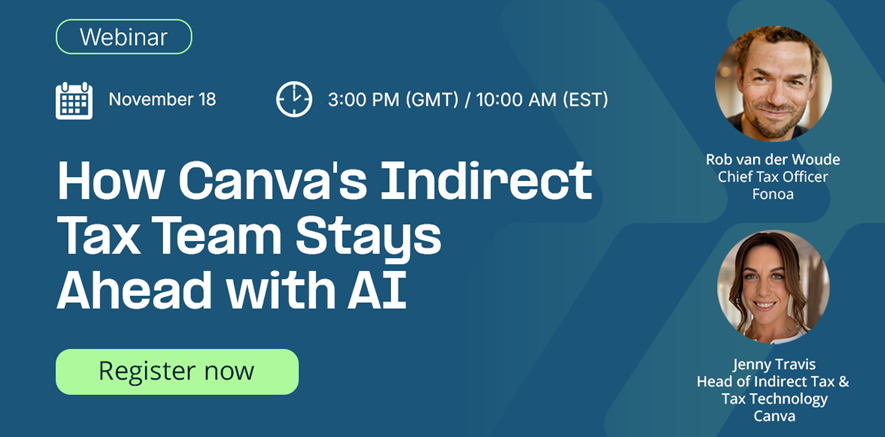

Transforming Tax from Reactive to Proactive: How Canva’s Tax Team Uses AI to Stay Ahead

Join Canva’s Head of Indirect Tax, Jenny Travis, to discover how Canva built an AI-powered tax function. Learn real-world lessons on automation, governance, and AI adoption in tax operations.

Real-world insights on building an AI-powered tax function

AI has been central to Canva’s business and product strategy for years, so it’s no surprise that their tax team leader has real, battle-tested use cases to share. In this session, you’ll learn not just theory but proven implementations from a company that invested in AI long before it became mainstream.

Learn about:

- Canva’s AI Playbook: The four pillars – Set foundations, Automate, Embed, Strategize

- Inside Canva’s Custom GPT: How the team built a model to monitor global eCommerce legislation in real time

- Next-Gen Tax Skills: How AI is reshaping roles, and what to automate vs outsource

- Building Trust: Frameworks for governance, data quality, and human oversight

Key takeaways:

- Fail fast, learn faster: How Canva’s culture of experimentation drives innovation at low cost

- Custom beats generic: Why investing in bespoke GPTs and copilots delivers outsized results

- Map before you automate: A clear understanding of tax processes is the foundation for successful AI integration

- Data drives intelligence: AI is only as good as the data it’s built on — Jenny shares how Canva gets it right

- Prompting for precision: Learn practical prompting methods to get accurate, source backed outputs and confidence levels

- The vision: Moving towards real time and continuous low/no-touch compliance

Who should join

This webinar is essential for tax leaders and indirect tax professionals, and anyone interested in understanding how AI is reshaping tax operations. Whether you’re just starting your AI journey or looking to accelerate existing initiatives, Jenny’s practical insights will help you navigate the path forward.