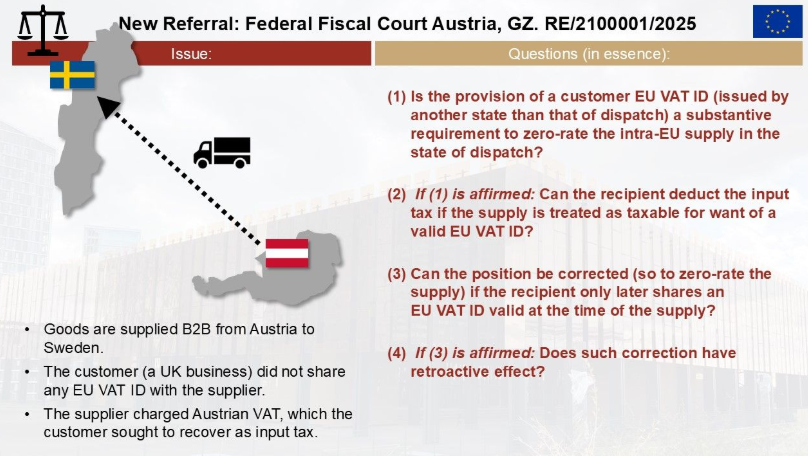

- An Austrian supplier charged VAT on a B2B supply to a UK business in Sweden (deliver to Sweden) because the customer didn’t provide an EU VAT ID, prompting the customer to seek input tax recovery.

- The Austrian Federal Fiscal Court has referred questions to the ECJ concerning whether a customer’s EU VAT ID is a substantive requirement for zero-rating intra-EU supplies, the possibility of input tax deduction without it, and if corrections can be made retroactively.

- The author suggests that the EU VAT ID is not a substantive requirement and that input tax deduction would likely be refused if the supply is treated as taxable due to the absence of a valid EU VAT ID.

Source Fabian Barth

See also

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

Latest Posts in "Austria"

- Austrian Court Denies Input VAT Deduction for Incorrect Invoice from Nonresident Supplier

- Leitner & Leitner conference (Vienna) – ”Saddle Festival into the New Year – Tax Tips for 2026” (Dec 4)

- Austrian Court Denies Input VAT Deduction for Incorrect Invoices from Nonresident Service Providers

- Austria Clarifies E-Invoicing Rules for Foreign Companies Supplying Federal Agencies via Peppol

- EU’s Operation Escape Room Exposes €140 Million Cross-Border VAT Fraud Network Across Six Countries