Briefing: VAT Treatment of Chain Transactions in Intra-Community Trade (C-245/04 EMAG Case)

This briefing provides a detailed review of the main themes and important concepts from the provided sources concerning the Value Added Tax (VAT) treatment of “chain transactions” within the European Union, with a specific focus on the European Court of Justice (ECJ) judgment in EMAG Handel Eder OHG v Finanzlandesdirektion für Kärnten (Case C-245/04).

I. Core Concepts and Legal Framework

The Sixth VAT Directive (Council Directive 77/388/EEC) is the foundational EU legislation harmonizing Member States’ laws on turnover taxes, establishing a common system of VAT. Council Directive 91/680/EEC supplemented the Sixth Directive to abolish fiscal frontiers within the EU, leading to the creation of Transitional Arrangements (Title XVIa of the Sixth Directive) for intra-Community trade.

The primary objective of these transitional arrangements is to ensure that “the revenue from Value Added Tax (VAT) accrues to the Member State where the final consumption of goods takes place.” This system maintains the principle that the consumption state should benefit from the tax revenue, even after traditional import/export taxes were eliminated.

Key elements of this framework include:

- Exempted Intra-Community Supplies (Article 28c(A)(a)): “Supplies of goods… dispatched or transported… out of the territory… but within the Community, effected for another taxable person or a non-taxable legal person acting as such in a Member State other than that of the departure of the dispatch or transport of the goods” are exempt in the Member State of departure. This means no VAT is charged at the origin.

- Taxed Intra-Community Acquisitions (Article 28a(1)(a)): “Intra-Community acquisitions of goods for consideration within the territory of the country by a taxable person acting as such or by a non-taxable legal person where the vendor is a taxable person acting as such” are subject to VAT. This is defined as the “acquisition of the right to dispose as owner of movable tangible property dispatched or transported to the person acquiring the goods… to a Member State other than that from which the goods are dispatched or transported.” This acquisition is taxed in the Member State of arrival. This correlative exemption-and-taxation mechanism effectively shifts the tax liability and thus the revenue to the destination country where the goods are ultimately consumed.

- Place of Supply/Acquisition Rules:Article 8(1)(a): For goods dispatched or transported, “the place where the goods are at the time when dispatch or transport to the person to whom they are supplied begins.”

- Article 8(1)(b): For goods not dispatched or transported, “the place where the goods are when the supply takes place.”

- Article 28b(A)(1): The place of intra-Community acquisition is “the place where the goods are at the time when dispatch or transport to the person acquiring them ends.”

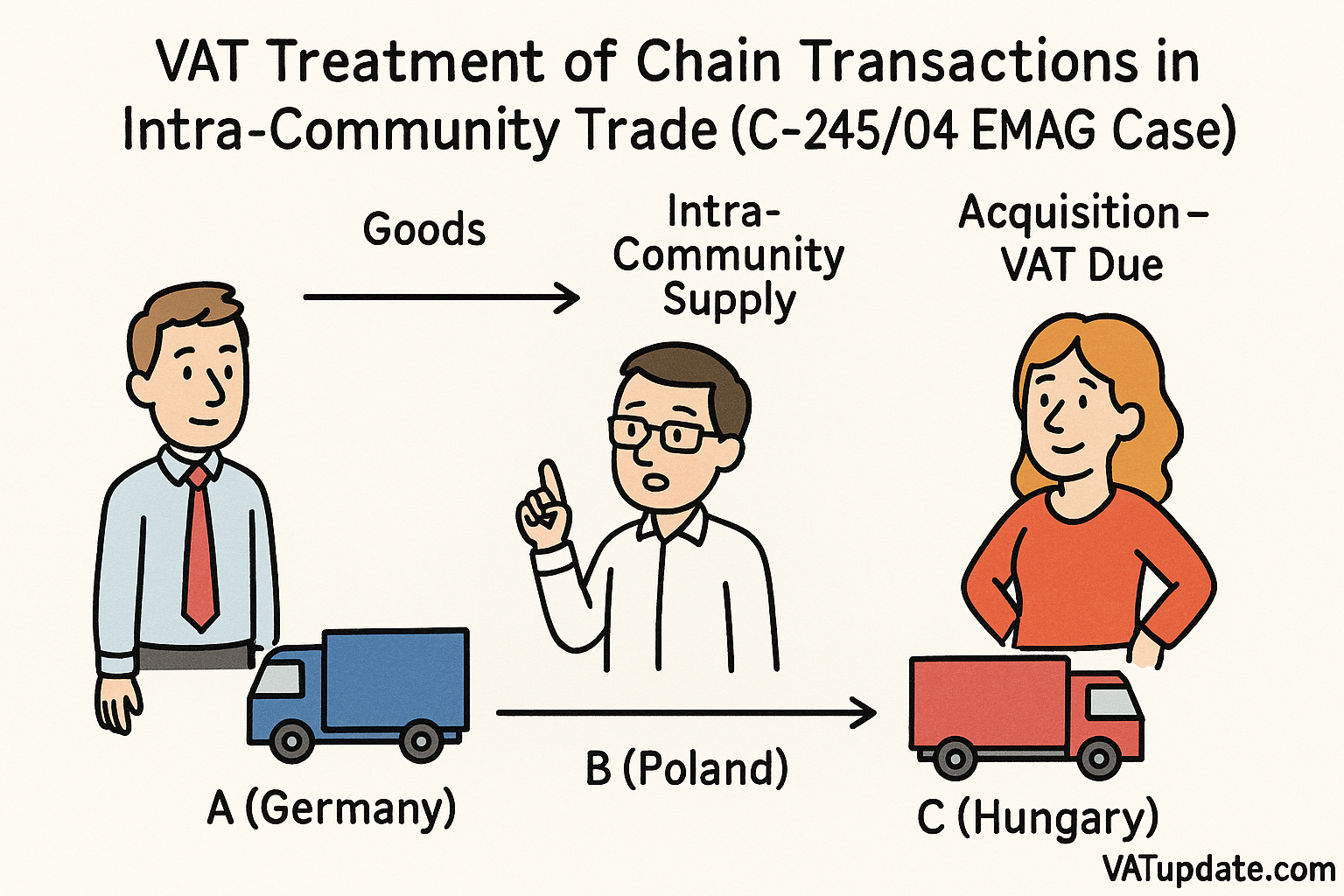

- Chain Transactions: These involve “two or more supplies of the same goods, where the goods are subject to only one physical movement from the initial supplier to the final customer.” The central challenge in such scenarios is determining which supply in the chain the single intra-Community movement should be attributed to for VAT purposes.

- Right to Deduct Input VAT (Article 17): Taxable persons are entitled to deduct VAT paid on goods or services supplied to them, provided these are used for their taxable transactions. This includes VAT due on intra-Community acquisitions and transactions exempt under Article 28c(A).

II. The EMAG Case Scenario and Key Issues

The EMAG case concerned an Austrian company, EMAG, which purchased non-ferrous metals from K GmbH (also Austrian). K GmbH had acquired these metals from suppliers in Italy or the Netherlands and instructed its suppliers to deliver the goods directly to EMAG’s premises or its customers in Austria. EMAG subsequently claimed the deduction of Austrian VAT that K had included in its invoice. The Austrian tax authority refused this deduction, arguing that K’s supply to EMAG took place in Italy or the Netherlands, not Austria, and therefore K had wrongly charged Austrian VAT.

The core problem was how to apply the Sixth Directive’s place of supply rules, particularly Article 8(1)(a), to this “chain transaction” involving a single intra-Community movement of goods across multiple successive supplies.

III. The Court’s Central Findings and Reasoning

The ECJ addressed four key questions in its preliminary ruling, providing crucial interpretations for chain transactions:

Attribution of Single Intra-Community Movement (Questions 2 & 4):

- The Court unequivocally ruled that “where two successive supplies of the same goods… gives rise to a single intra-Community dispatch or a single intra-Community transport of those goods, that dispatch or transport can be ascribed to only one of the two supplies.” It cannot be attributed to both.

- This interpretation holds true “regardless of which taxable person – the first vendor, the intermediary acquiring the goods or the second person acquiring the goods – has the right to dispose of the goods during that dispatch or transport.”

- Reasoning for single attribution:

- Logical Impossibility: The Court deemed it “illogical” to ascribe the single intra-Community movement to both supplies. The intermediary (K in the EMAG case) acquires the goods in the Member State of arrival (Austria in EMAG’s case). It would be inconsistent for this same taxable person to then make a subsequent supply of those goods from the original Member State of departure (Italy/Netherlands), as the goods have physically moved and their acquisition by the intermediary has been legally situated at the destination. “The intermediary acquiring the goods can transfer the right to dispose of the goods as owner to the second person acquiring the goods only if it has previously been transferred to him by the first vendor and, therefore, the second supply can take place only after the first supply has been effected.”

- Purpose of Transitional Arrangements: Attributing the movement to only one supply effectively achieves the goal of transferring tax revenue to the Member State of final consumption through the correlative exemption and acquisition mechanism. Attributing it to both would “not have the effect of transferring the tax revenue to the Member State where final consumption of the goods supplied takes place, since that transfer has already occurred at the end of the first transaction.” It would also negate the purpose of input VAT deduction rules for the intermediary regarding the second supply.

- Administrative Efficiency: Attributing the movement to both supplies would “multiply the number of cases requiring… exchange of information” between Member States’ tax authorities, making the “treatment of the transactions concerned by the competent tax authorities more cumbersome.”

Determination of Place of Supply (Question 1):

- Only the supply to which the intra-Community transport is ascribed has its place determined by Article 8(1)(a) (place where transport begins). This supply will be the exempt intra-Community supply.

- The place of the other supply (which does not involve the intra-Community dispatch/transport for VAT purposes) is determined by Article 8(1)(b) (where the goods are when the supply takes place).

- Specific Scenarios:

- Scenario 1: First supply causes movement: If the first supply (e.g., from original supplier to intermediary) is the one to which the intra-Community transport is attributed, then its place of supply is deemed to be where the transport begins (Member State of departure). The second supply (from the intermediary to the final acquirer) “is deemed to occur in the place of the intra-Community acquisition preceding it, that is, in the Member State of arrival.”

- Scenario 2: Second supply causes movement: If the second supply (e.g., from intermediary to final acquirer) is the one to which the intra-Community transport is attributed, then its place of supply is deemed to be where the transport begins (Member State of departure). The first supply (from original supplier to intermediary), which necessarily occurred before the goods were dispatched or transported, “is deemed to occur in the Member State of the departure of that dispatch or transport.”

IV. Implications for EMAG’s Case and Practice

The Court’s ruling affirmed the principle that only one supply in a chain transaction can be linked to the intra-Community movement for VAT purposes. For EMAG’s case, this meant that K’s supply to EMAG could only be considered an “intra-Community supply” (and thus exempt in the departure state) if the intra-Community movement was ascribed to K’s transaction with EMAG.

- If the movement was ascribed to K’s acquisition from its Italian/Dutch suppliers, then K made an intra-Community acquisition in Austria (taxed in Austria), and its subsequent supply to EMAG would be an internal supply in Austria. In this scenario, K would be liable for Austrian VAT, and EMAG would be entitled to deduct it.

- If the movement was ascribed to K’s supply to EMAG, then K’s supply would be an exempt intra-Community supply in the Member State of departure (Italy/Netherlands). EMAG would then be deemed to make an intra-Community acquisition in Austria, making EMAG liable for Austrian VAT on its acquisition, and K should not have charged Austrian VAT.

This judgment is critical for businesses engaged in “triangular” or “chain” transactions. They must carefully identify which supply in the chain is responsible for the intra-Community movement to correctly apply VAT rules (exemption, acquisition, place of supply). This principle ensures that VAT is ultimately collected in the Member State of final consumption, upholding the “destination principle” of VAT. The uniform application of these rules across Member States is also facilitated by the preliminary ruling mechanism, ensuring consistency where national legislation (like Austria’s UStG 1994) might need alignment with EU principles.

See also

- Roadtrip through ECJ Cases – Focus on the Exemption for Intra-Community supplies of goods (Art. 138) – VATupdate

- Briefing Document & Podcast: VAT concept ”Chain Transactions” explained based on ECJ/CJEU cases – VATupdate

- C-245/04 (EMAG Handel Eder OHG) – Place of supply in case of chain supplies

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- European Commission Reviews EU Member States’ Use of VAT Rate Derogations

- Comments on ECJ C-535/24 (Svilosa) – VAT Deduction on Recovery Actions Not Considered Taxable Service

- CJEU Case C-726/23: Arcomet Towercranes Decision Clarifies Intra-Group VAT and Transfer Pricing Rules

- EU and Morocco reach agreement to extend preferential tariff treatment to Western Sahara

- Comments on ECJ C-436/24 (Lyko) – Loyalty programs and VAT: AG’s opinion in Lyko case brings new perspectives