Detailed Briefing: VAT Classification of Leased Business Assets – The Mailat Case

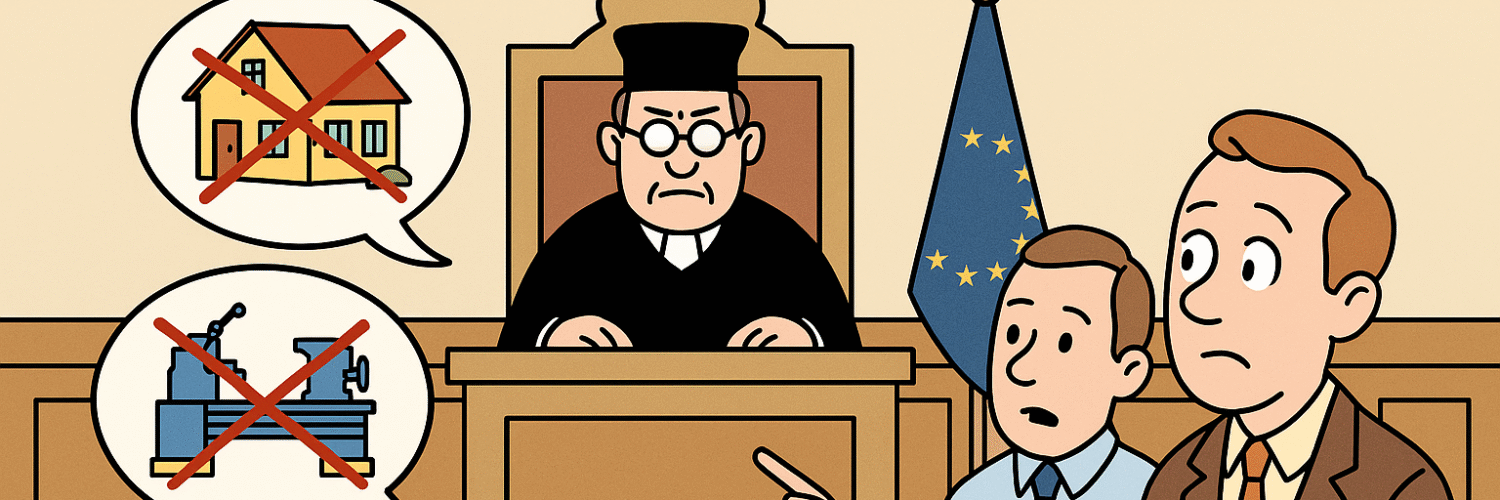

This briefing examines the key legal principles and implications arising from the European Court of Justice (ECJ) ruling in Case C‑17/18, involving Virgil Mailat, Delia Elena Mailat, and Apcom Select SA. The case clarifies the distinction between a “transfer of a totality of assets” and the “letting of immovable property” for Value Added Tax (VAT) purposes, particularly when both movable and immovable assets are involved in a business transaction.

I. Case Summary and Background

The Mailat case originated from criminal proceedings in Romania against Mr. and Mrs. Mailat, managers of Apcom Select SA, for tax avoidance. Apcom Select SA had deducted input VAT on renovation works and fixed assets related to their restaurant business. Subsequently, they leased the restaurant building and all necessary movable property to another company under a VAT exemption regime, but failed to adjust the previously deducted VAT. The core legal questions posed to the ECJ by the Romanian court were:

- Whether the transaction constituted a “transfer of a totality of assets or part thereof” under Articles 19 and 29 of the VAT Directive.

- If not, whether it qualified as a “letting of immovable property” under Article 135(1)(l) of the VAT Directive, or a complex supply of taxable services.

The correct classification was crucial because a “transfer of a totality of assets” would typically not trigger a VAT adjustment, while an exempt “letting of immovable property” would necessitate an adjustment of previously deducted input VAT under Romanian law (Article 149 of Law No 571/2003).

II. Key Legal Provisions and Concepts

The case revolved around the interpretation of several articles within Council Directive 2006/112/EC (the VAT Directive) and related national legislation:

- Article 19 VAT Directive: “Transfer of a totality of assets or part thereof”This provision allows Member States to consider that “no supply of goods has taken place” when a totality of assets or part thereof is transferred, treating the recipient as the successor.

- Purpose: Its aim is “to facilitate transfers of undertakings by making such transfers simpler and by preventing the cash resources of the recipient from being overburdened by a disproportionate charge to tax which, in any event, would ultimately be recovered through deduction of the input VAT paid.”

- Interpretation: The ECJ consistently interprets this as covering the “transfer of a business or an independent part of an undertaking, including tangible elements and, as the case may be, intangible elements which, together, constitute an undertaking or a part of an undertaking capable of carrying on an independent economic activity.” It “does not cover the simple transfer of assets, such as the sale of a stock of products.”

- Crucial Element: For such a transfer, “all of the elements transferred must, together, be sufficient to allow an independent economic activity to be carried on.” The nature of the economic activity dictates the necessary elements.

- Article 29 VAT Directive: Extends the principles of Article 19 to the supply of services.

- Article 135(1)(l) VAT Directive: “Exemption for lettings of immovable property”Mandates Member States to exempt the “leasing or letting of immovable property” from VAT.

- Interpretation: This exemption is to be “interpreted strictly since these exemptions constitute exceptions to the general principle that VAT is to be levied on all services supplied for consideration by a taxable person.” The “letting of immovable property” is defined as “an arrangement whereby the lessor assigns to the lessee, in return for rent and for an agreed period, the right to occupy his property and to exclude any other person from it.”

- Article 149 of Romanian Tax Code (Legea nr. 571/2003): VAT AdjustmentRequires the adjustment of deductible input VAT on capital goods when they are subsequently used “in order to carry out transactions that do not give rise to a deduction of VAT” (e.g., exempt transactions).

III. Court’s Analysis and Rulings

A. First Question: Is the transaction a “transfer of a totality of assets or part thereof”?

The Court ruled that the transaction did not constitute a “transfer of a totality of assets or part thereof” within the meaning of Article 19 of the VAT Directive.

- Emphasis on Ownership/Disposal: The ECJ highlighted that “all the items necessary to pursue the economic activity at issue in the main proceedings were merely let and no related property rights were transferred.” The Court found that “making all of these items available does not constitute a transfer of a totality of assets or part thereof.” A critical factor was the lessee’s inability “to liquidate the activity concerned, in so far as, not having taken ownership of a large part of the items necessary to pursue that activity, it was not entitled to dispose of them.”

- Continuation of Activity is Secondary: While acknowledging that the lessee continued the restaurant activity under the same name, took over employees, and maintained suppliers, the Court clarified that these factors, though “objective evidence,” were not sufficient. The crucial element for a “transfer of a totality of assets” is the transfer of elements allowing the transferee to independently operate and, crucially, dispose of the business or part of the undertaking. The fact that “the transferee continued to pursue the activity under the same name as the transferor is also irrelevant for the purpose of determining whether the transaction at issue in the main proceedings comes within the scope of the first paragraph of Article 19 of the VAT Directive.”

- Distinction from Prior Case Law (Schriever): The Court distinguished the Mailat case from Schriever (C‑444/10), where the transfer of ownership of stock and equipment, combined with a lease of premises, was deemed a totality of assets. In Mailat, there was no transfer of ownership of essential movable assets, only a lease of both immovable and movable property.

B. Second Question: Is the transaction “letting of immovable property” or a complex supply of services?

The Court ruled that the transaction constituted a single supply in which the “letting of the immovable property is the principal supply,” falling under the VAT exemption of Article 135(1)(l).

- Single vs. Multiple Supplies Principle: The Court reiterated that “several formally distinct services, which could be supplied separately and thus give rise, in turn, to taxation or exemption, must be considered to be a single transaction when they are not independent.” A “single supply” exists where elements are “so closely linked that they form, objectively, a single, indivisible economic supply, which it would be artificial to split.”

- Principal and Ancillary Supplies: A supply is “ancillary to a principal supply if it does not constitute for customers an end in itself but a means of better enjoying the principal service supplied.”

- Application to Mailat: The Court found the “letting of the movable property included in the lease contract does not appear to be dissociable from the letting of the immovable property.” It noted that “some of the movable property, such as the equipment and kitchen appliances, are incorporated in that immovable property and must… be considered to be an integral part of that property.” The movable property “cannot be regarded as having its own purpose either, but must be treated as a means of better enjoying the principal service supplied, that is, the letting of the immovable property.”

- Conclusion: “The letting of the immovable property must be regarded as constituting the principal service supplied to which the other services, that is, the letting of capital equipment and inventory items, are merely ancillary.”

IV. Implications for VAT Adjustment

The ECJ’s rulings had direct consequences for the Mailats and Apcom Select SA:

- Since the transaction was determined not to be a “transfer of a totality of assets” (which would have allowed for no VAT adjustment) but rather a single supply primarily classified as an exempt “letting of immovable property,” the original deduction of input VAT on the restaurant’s works and assets became subject to adjustment.

- Under Romanian law (Article 149 of the Tax Code), Apcom Select SA was obligated to adjust the previously deducted VAT because the capital goods (the building and its fixed assets) were subsequently used for a transaction that did not give rise to a VAT deduction (i.e., an exempt letting).

- Their failure to make this adjustment at the time of concluding the lease contract formed the basis of the tax avoidance prosecution.

V. Key Takeaways

- Ownership is Paramount for “Transfer of a Totality of Assets”: The ECJ places significant emphasis on the transfer of ownership and the right to dispose of assets when classifying a transaction as a “transfer of a totality of assets or part thereof” under Article 19/29. Merely letting assets, even if the business activity continues, is insufficient.

- Strict Interpretation of VAT Exemptions: Exemptions from VAT, such as the letting of immovable property, are interpreted strictly as they are exceptions to the general principle of VAT taxation.

- Single vs. Multiple Supplies Doctrine: When multiple elements are supplied together, the ECJ will assess whether they form a “single supply” or “multiple supplies.” This often depends on whether one element is principal and others are ancillary, providing a means to better enjoy the principal service. The physical integration of assets (e.g., kitchen appliances in a building) can be a strong indicator of an ancillary relationship.

- Consequences of Misclassification: Misclassifying a transaction can lead to severe tax implications, including the obligation to adjust previously deducted input VAT and potential prosecution for tax avoidance. Businesses engaging in transactions involving both immovable and movable property, especially through leasing arrangements, must carefully assess the principal and ancillary elements to ensure correct VAT treatment.

See also

- ECJ C-17/18 (Mailat – Apcom Select) – Judgment – TOGC, a lease of immovable property and related equipment and consumables constitute a single rental service – VATupdate

- Roadtrip through ECJ Cases – Focus on ”Transfer of Going Concern” (Art.19 EU VAT Directive) – VATupdate

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify