I. Executive Summary

The case of Titanium Ltd v. Finanzamt Österreich (Case C-931/19) before the Court of Justice of the European Union (CJEU) centered on the crucial interpretation of “fixed establishment” for Value Added Tax (VAT) purposes within the EU, specifically regarding property letting. Titanium Ltd, a company established in Jersey (outside the EU), owned and let a property in Vienna, Austria. The core dispute was whether this property constituted a “fixed establishment” in Austria, thereby making Titanium Ltd directly liable for Austrian VAT on rental income.

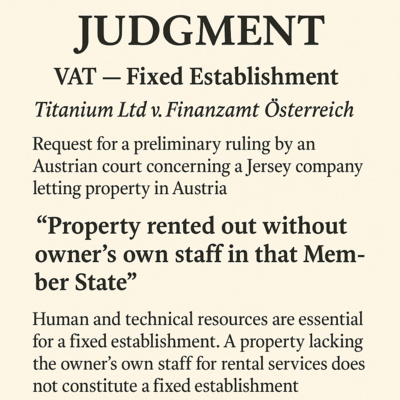

The CJEU definitively ruled that a property let in a Member State, where the owner does not have their own staff to perform services relating to the letting, does not constitute a fixed establishment. This decision reinforces the long-standing principle in EU VAT law that a “fixed establishment” requires the permanent presence of both human and technical resources that can act independently to supply or receive services. Despite Titanium Ltd retaining significant decision-making powers, the outsourcing of all operational tasks to an independent Austrian real estate management company and the absence of Titanium’s own staff in Austria meant the property itself did not meet the “fixed establishment” criteria. This ruling has significant implications for cross-border property letting and the application of reverse charge mechanisms.

II. Case Summary and Key Facts

- Parties: Titanium Ltd (registered in Jersey) vs. Finanzamt Österreich (Austrian Tax Authority).

- Subject Matter: Levying of VAT on rental income from a property in Vienna, Austria, for the tax years 2009 and 2010.

- Titanium’s Operations: Titanium Ltd’s “registered office and management are located in Jersey.” Its sole activities in Austria during the relevant period involved letting its Vienna property.

- Property Management Arrangement: Titanium “appointed an Austrian real estate management company to act as intermediary between the service providers and suppliers, to invoice rental payments and operating costs, to maintain business records and to prepare the VAT declaration data.” This agent operated from their own premises.

- Titanium’s Retained Control: Crucially, Titanium Ltd “retained the decision-making power to enter into and terminate leases, to determine the economic and legal conditions of the tenancy agreements, to make investments and repairs and to organise their financing, to choose third parties intended to provide other upstream services and, finally, to select, appoint and oversee the real estate management company itself.”

- The Dispute:Titanium’s Argument: It was not liable for VAT as it did not have a permanent establishment in Austria.

- Austrian Tax Authority’s Argument: The rented property itself constituted a permanent establishment, making Titanium liable for VAT. The Austrian tax authority viewed that “a trader who owns immovable property in Austria that he lets, subject to tax, must be treated as a national trader and that the person to whom the services are supplied is not liable to pay the tax on that transaction. Accordingly, there is always a permanent establishment where immovable property is let.”

- Referring Court’s Question: The Bundesfinanzgericht (Federal Finance Court, Austria) sought a preliminary ruling on whether the concept of “fixed establishment” “is to be interpreted as meaning that the existence of human and technical resources is always necessary and therefore that the service provider’s own staff must be present at the establishment, or can – in the specific case of the letting, subject to tax, of a property situated in national territory… – that property, even without human resources, be regarded as a ‘fixed establishment’?”

III. Legal Framework

The case involved the interpretation of several key EU VAT directives and regulations:

- Directive 2006/112/EC (VAT Directive):Place of Supply of Services (Original – pre-Jan 1, 2010):Article 43: General rule – “the place where the supplier has established his business or has a fixed establishment from which the service is supplied.”

- Article 45: Specific rule for immovable property – “The place of supply of services connected with immovable property… shall be the place where the property is located.”

- Place of Supply of Services (As amended by Directive 2008/8/EC – from Jan 1, 2010):Article 44: Services to a taxable person – “the place where that person has established his business. However, if those services are provided to a fixed establishment… the place of supply… is the place where that fixed establishment is located.”

- Article 45: Services to a non-taxable person – “the place where the supplier has established his business. However, if those services are provided from a fixed establishment… the place of supply… shall be the place where that fixed establishment is located.”

- Article 47: Specific rule for immovable property – “The place of supply of services connected with immovable property… shall be the place where the immovable property is located.”

- VAT Liability (Reverse Charge Mechanism):Article 193: General rule – VAT payable by the taxable person supplying goods/services.

- Article 194: “Member States may provide that the person liable for payment of VAT is the person to whom the goods or services are supplied” if the supplier is not established in that Member State.

- Article 196 (original and as amended): VAT payable by the recipient if services (e.g., under Article 44) are supplied by a taxable person not established in that Member State.

- Implementing Regulation (EU) No 282/2011:Recital 14: States its purpose is “To ensure the uniform application of rules relating to the place of taxable transactions, concepts such as the place where a taxable person has established his business, fixed establishment… should be clarified. While taking into account the case-law of the Court of Justice, the use of criteria which are as clear and objective as possible should facilitate the practical application of these concepts.”

- Article 11: Defines “fixed establishment” as “any establishment… characterised by a sufficient degree of permanence and a suitable structure in terms of human and technical resources to enable it to receive and use the services supplied to it for its own needs” (for Article 44 application) or “to provide the services which it supplies” (for Article 45 and others). It also explicitly states, “The fact of having a VAT identification number shall not in itself be sufficient to consider that a taxable person has a fixed establishment.”

- Applicability: Became applicable from July 1, 2011, after the tax years in question (2009-2010). However, its role in clarifying existing case-law was crucial.

- Austrian Law (Umsatzsteuergesetz 1994 – UStG): Paragraph 19(1) transposes EU directives, outlining VAT liability and reverse charge conditions, particularly where the service provider has no permanent establishment (Betriebsstätte) in national territory.

IV. Court’s Reasoning and Ruling

A. Admissibility of the Question

- Austrian Government’s Argument: The Austrian Government argued the question was inadmissible, asserting that the case fell under Article 45/47 (immovable property rule) and Article 194 (Member States’ choice for reverse charge), rendering the “fixed establishment” concept irrelevant.

- CJEU’s Stance on Admissibility: The Court reiterated its “settled case-law” that national courts are solely responsible for determining the need and relevance of preliminary ruling questions. Such questions “enjoy a presumption of relevance” unless “it is quite obvious that the interpretation of EU law that is sought is unrelated to the actual facts of the main action or its object, where the problem is hypothetical, or where the Court does not have before it the factual or legal material necessary to give a useful answer.”

- Decision: The CJEU found the question admissible. The referring court clarified that the question concerned the general interpretation of “fixed establishment” because both Article 194 and Article 196 (which the Austrian court was considering applying) hinged on whether a taxable person was “established in the Member State.” Therefore, the existence of a fixed establishment was directly relevant to determining VAT liability.

B. Substance: Interpretation of “Fixed Establishment”

- Established Case-Law: The Court explicitly referenced its previous rulings (e.g., ARO Lease, Planzer Luxembourg), stating: “The concept of ‘fixed establishment’… implies a minimum degree of stability derived from the permanent presence of both the human and technical resources necessary for the provision of given services. It thus requires a sufficient degree of permanence and a structure adequate, in terms of human and technical resources, to supply the services in question on an independent basis.” Crucially, it reaffirmed that “a structure without its own staff cannot fall within the scope of the concept of a ‘fixed establishment’.”

- Role of Implementing Regulation 282/2011: Despite its non-applicability ratione temporis to the specific tax years, the Court noted that “recital 14 to that implementing regulation states that it seeks to clarify certain concepts, including the concept of ‘fixed establishment’, taking into account the case-law of the Court.” This underscored that Article 11 of the regulation, with its explicit requirement for “human and technical resources,” simply codified and clarified the existing legal interpretation established by the Court.

- Application to Titanium: The Court found that “the applicant in the main proceedings does not have any staff of its own in Austria and that the persons responsible for certain management tasks were contractually appointed by that company, which reserved for itself all important decisions concerning the letting of the property in question.” Because “A property which does not have any human resource enabling it to act independently clearly does not satisfy the criteria established by the case-law to be characterised as a fixed establishment.”

- Final Ruling: The Court (Tenth Chamber) ruled: “A property which is let in a Member State, in the circumstance where the owner of that property does not have his or her own staff to perform services relating to the letting does not constitute a fixed establishment within the meaning of Article 43 of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax and of Articles 44 and 45 of Directive 2006/112, as amended by Council Directive 2008/8/EC of 12 February 2008.“

V. Key Themes and Important Ideas/Facts

- Strict Interpretation of “Fixed Establishment”: The CJEU maintains a stringent definition of “fixed establishment” requiring the permanent presence of both human and technical resources capable of acting independently. The mere ownership of immovable property, even if let subject to tax, is insufficient without the direct involvement of the owner’s own staff.

- Human Resources as a Prerequisite: The presence of the supplier’s “own staff” is a non-negotiable element. Outsourcing operational tasks, even while retaining strategic control, does not fulfill this requirement. This directly counters the Austrian tax authority’s view that a rented property always constitutes a permanent establishment for VAT purposes.

- Clarificatory Nature of Implementing Regulations: Implementing Regulation (EU) No 282/2011, particularly Article 11, played a crucial role. Even though it was not applicable ratione temporis, its stated purpose (Recital 14) to “clarify” existing Court case-law meant it reinforced the established interpretation of “fixed establishment.” This highlights that such regulations can serve to codify and make explicit existing judicial principles.

- Implications for Reverse Charge Mechanism: The determination of a “fixed establishment” is critical for applying the reverse charge mechanism (Articles 194, 196). If a non-established supplier has no fixed establishment in a Member State, VAT liability often shifts to the recipient, simplifying compliance for the non-established supplier. The ruling implies that in scenarios like Titanium’s, the reverse charge mechanism would likely apply if the recipient is a taxable person.

- Distinction Between Strategic Control and Operational Presence: The case clarifies that retaining high-level decision-making power (e.g., setting lease terms, approving investments) is not equivalent to having the necessary “human and technical resources” for a fixed establishment if the actual operational tasks are entirely outsourced to an independent third party without the supplier’s own staff on site.

- Judicial Autonomy and Presumption of Relevance: The Court reaffirmed its authority and the presumption of relevance for questions referred by national courts under Article 267 TFEU, emphasizing that it is for the national court to determine the necessity and relevance of preliminary rulings. This ensures a consistent application of EU law despite national legal specificities.

See also

- ECJ C-931/19 (Titanium) – Judgment – No fixed establishment if the owner of the property does not have his own staff

- Roadtrip through ECJ Cases – Focus on ”Fixed Establishments” (Art. 44 & 45)

- Briefing Document: EU VAT principles on ”Fixed Establishment” based on ECJ/CJEU transactions

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

Latest Posts in "European Union"

- Advocate General’s Opinion Clarifies VAT Treatment of Transfer Pricing Adjustments in Stellantis Portugal Case

- Agenda of the ECJ/General Court VAT cases -1 Judgment, 1 Hearing till Feb 25, 2026

- The «Prefilling» headache

- The Fiscalis Programme 2021–2027: Interim Evaluation and Key Insights

- EU ViDA E-Invoicing: Key Changes and Luxembourg Implications for Cross-Border B2B Transactions