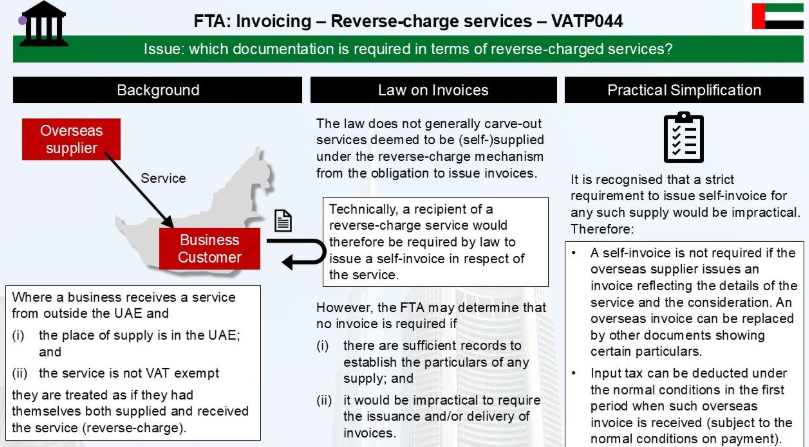

- Curious Requirement: The UAE VAT Law previously suggested that businesses must issue a self-invoice for any received reverse-charge supplies, which could impose a significant administrative burden without clear benefits for those fully entitled to recover input tax.

- Administrative Exception: The Federal Tax Authority (FTA) has intervened by exercising its powers to eliminate this self-invoicing requirement in most cases, easing compliance for businesses affected by this provision.

- Positive Impact: This general administrative exception is seen as a welcome development, as it simplifies the VAT process for businesses and reduces unnecessary paperwork while maintaining the integrity of the VAT system.

Source Fabian Barth

Other sources

- VAT Obligations for Imported Services: Taxable persons in the UAE must account for VAT on services imported from outside the country if the place of supply is within the UAE, unless these services would be exempt if supplied domestically.

- Self-Invoicing and Exceptions: Registrants are required to issue tax invoices to themselves for concerned services unless an administrative exception is granted by the Federal Tax Authority (FTA), allowing reliance on invoices from overseas suppliers.

- Input Tax Recovery: Registrants can recover input tax on concerned services used for taxable supplies, provided they retain relevant supporting documents, such as supplier invoices, and meet specific conditions outlined in the VAT legislation

Source Federal Tax Authority

Latest Posts in "Saudi Arabia"

- ZATCA’s 2025 Guide: VAT Rules for E-Market Platforms and Deemed Supplier Obligations in KSA

- Saudi Arabia Revises Customs Tariffs, Increases Duties, and Updates HS Codes Effective 2025

- Saudi Arabia Extends ZATCA Tax Penalty Waiver Initiative Until June 2026

- Saudi Arabia Updates VAT Rules for Online Marketplaces, Amends Excise Tax on Sweetened Beverages

- Saudi Arabia Clarifies VAT Deemed Supplier Rules for Electronic Marketplaces