- Revenue is transitioning VAT registered businesses from the Fixed Direct Debit Scheme to a Variable Direct Debit facility.

- Annual VAT filers on the Fixed Direct Debit Scheme will need to file returns bi-monthly.

- The Fixed Direct Debit Scheme will be phased out from mid-2025.

- Revenue is notifying businesses and their agents about the cessation of the Fixed Direct Debit Scheme.

- No immediate action is required from taxpayers or their agents.

- Taxpayers should continue with monthly Fixed Direct Debit payments.

- Revenue will provide further instructions as taxpayers approach their annual filing period end.

Source: charteredaccountants.ie

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "Ireland"

- Ireland Issues EU VAT SME Scheme Guidance for Small Businesses

- Ireland’s ViDA Roadmap: Phased Rollout of E-Invoicing & Real-Time VAT Reporting

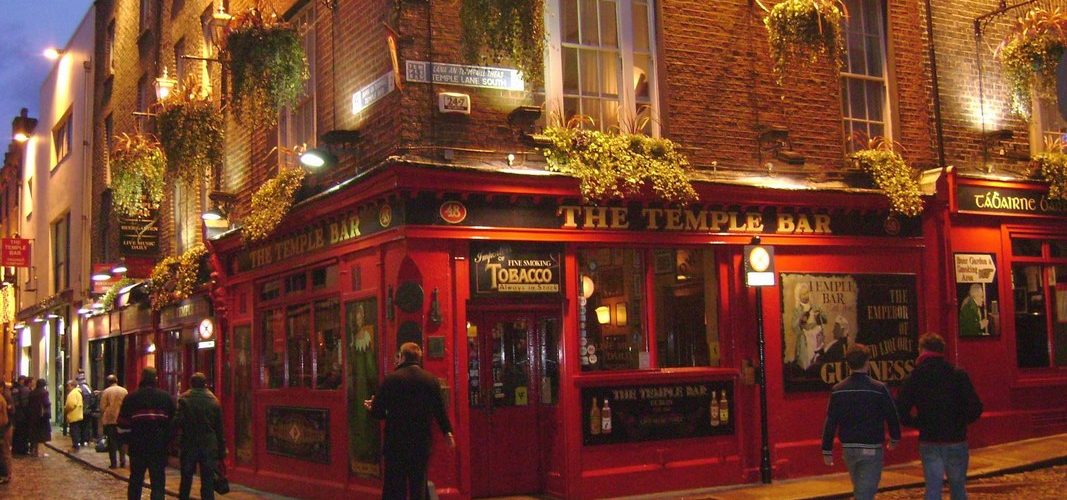

- Government Delays Hospitality VAT Cut to July 2026 Due to High Cost

- Ireland Releases E-Invoicing Roadmap for EU VAT Digital Age Requirements by 2030

- Ireland Announces Phased VAT Digital Rollout for EU ViDA Compliance by 2030