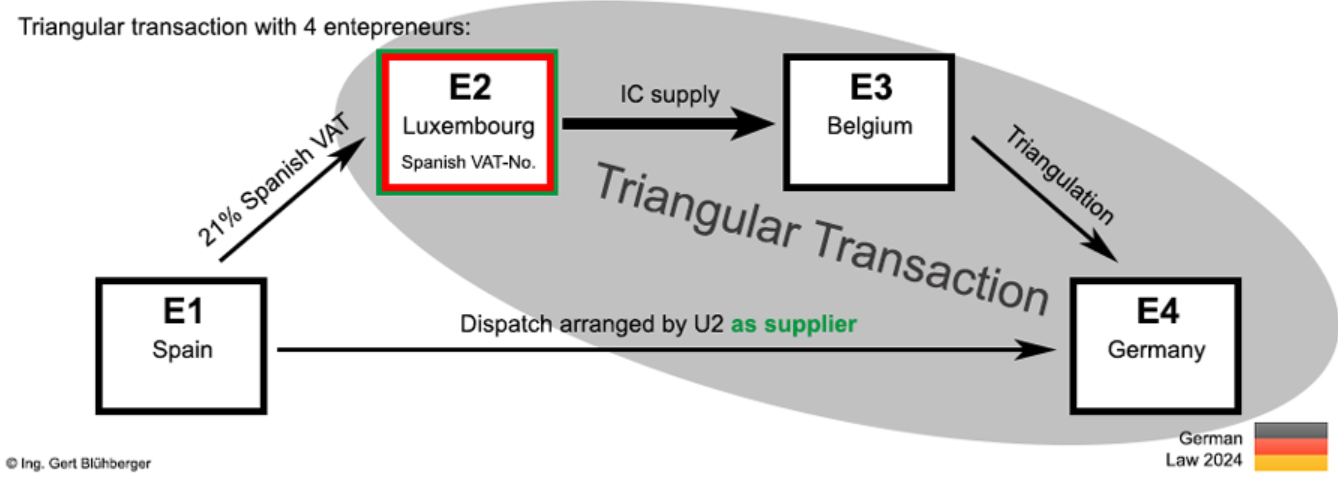

- Definition and Purpose: VAT triangulation is a simplification mechanism for cross-border EU transactions involving three VAT-registered parties in different countries, aimed at reducing administrative burdens and optimizing compliance.

- Key Requirements: To qualify, transactions must involve three distinct parties registered in separate EU member states, with goods moving directly from one member state to another without any party being registered in the same state.

- Benefits and Reporting: This simplification reduces the need for multiple VAT registrations, ensuring VAT is only due in the final destination country, thereby minimizing compliance complexity and costs for businesses involved in triangulation transactions.

Source VATit

Click on the logo to visit the website

Latest Posts in "European Union"

- GC VAT Case T-363/25 (UNIX) – Order – VAT deductions can not be denied solely due to invoice trustworthiness if the underlying transactions occurred

- ECJ VAT Cases decided in 2025

- General Court T-773/25 (Finanzamt für Großbetriebe) – Questions – Ex Nunc Implications of Late Invoices in Triangular Transactions

- A Guide to cross-border B2B distribution and tolling transactions in Europe: the staggering cost of VAT

- VAT Treatment of Social Media Influencers in the EU: Directive Rules, ECJ Guidance & National Practices