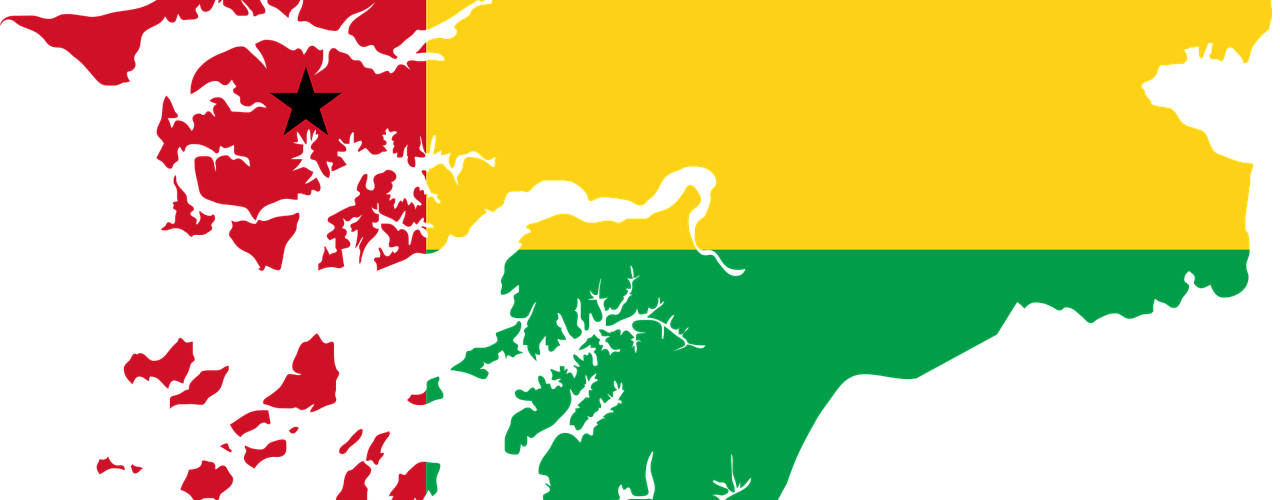

- Guinea-Bissau introduced the VAT regime in 2022

- Ministry of Finance adopted implementing Decree in October 2024

- Implementation of VAT regime started on January 1, 2025

- Shift from IGV to VAT aimed at modernization and harmonization

- Phased roll-out of VAT mandate for economic operators

- Different turnover thresholds for mandatory VAT registration

- VAT Rates: Standard Rate (19%), Reduced Rate (10%), Zero Rate (0%)

- Impact of VAT regime on taxable persons

- Foreign e-commerce suppliers and digital providers should monitor tax news

Source: 1stopvat.com

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "Guinea-Bissau"

- Guinea-Bissau’s VAT Implementation: Key Features & Business Impact

- Guinea-Bissau Implements VAT, Effective January 2025

- Guinea-Bissau Introduces New VAT Regime, Thresholds, and Simplified Option for Taxpayers

- Guinea-Bissau’s VAT Reform: Enhancing Taxation Framework for Economic Growth and Compliance

- Introduction of VAT in 2025: Compliance Obligations and Rates for Taxpayers in Circular Announcement